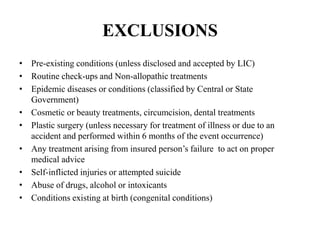

- The document presents details on LIC Jeevan Arogya, a health insurance plan that provides coverage for hospitalization expenses and surgeries for the policyholder, spouse, children, parents, and parents-in-law.

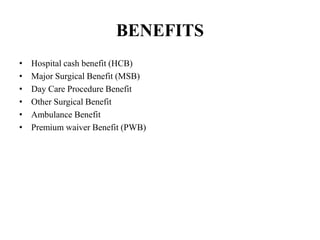

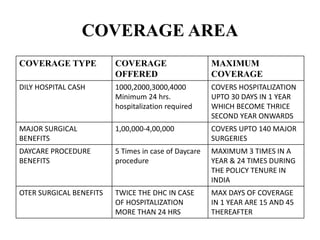

- Key features include coverage for one family on a single policy, coverage for hospitalization costs and surgeries up to certain limits, no-claim bonus, and quick cash payout for certain pre-approved surgeries.

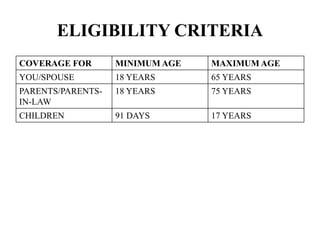

- Eligible individuals are ages 18-65 for self/spouse, 18-75 for parents/parents-in-law, and 91 days to 17 years for children. The plan covers hospitalization and daycare procedures in India.