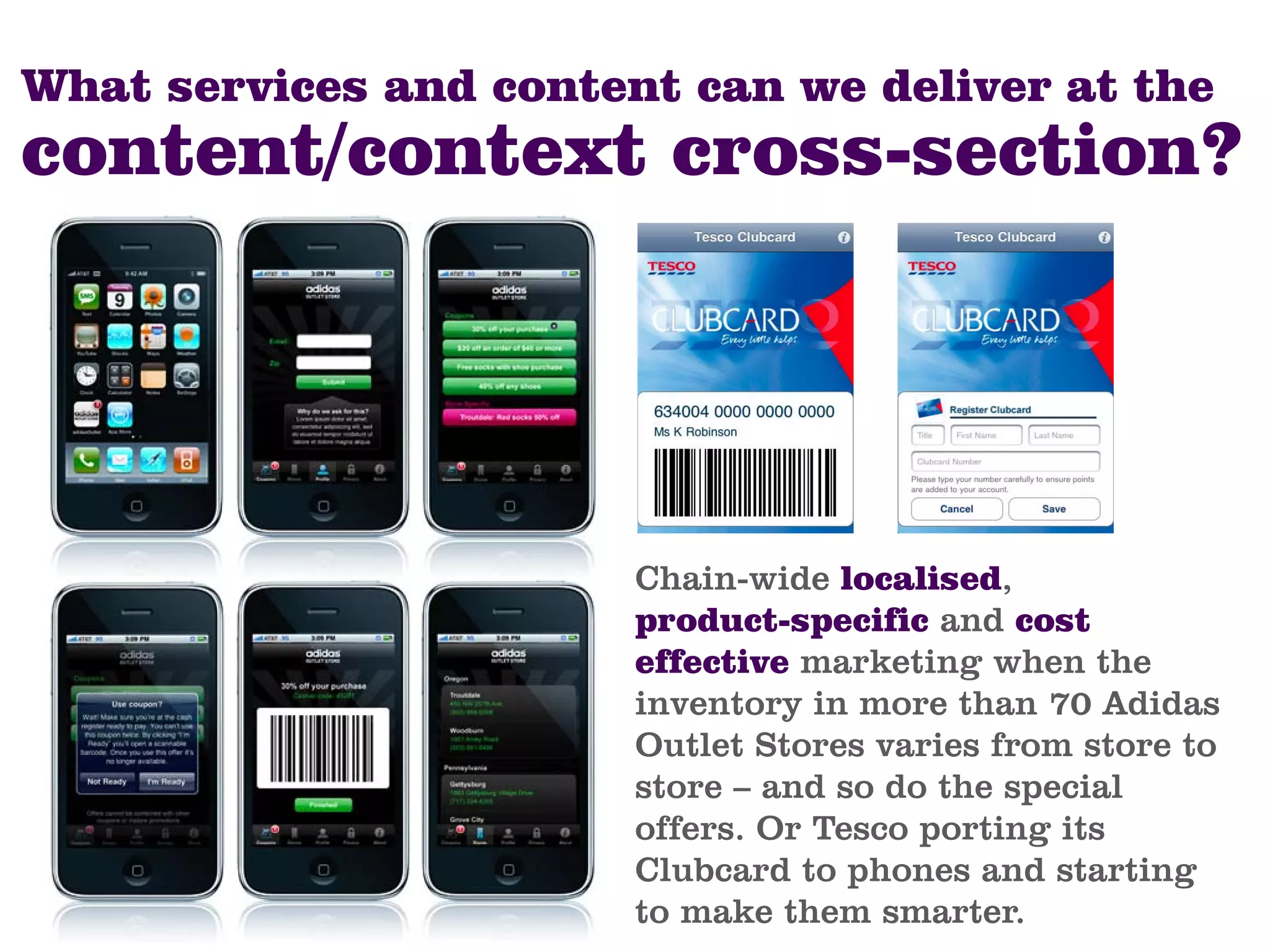

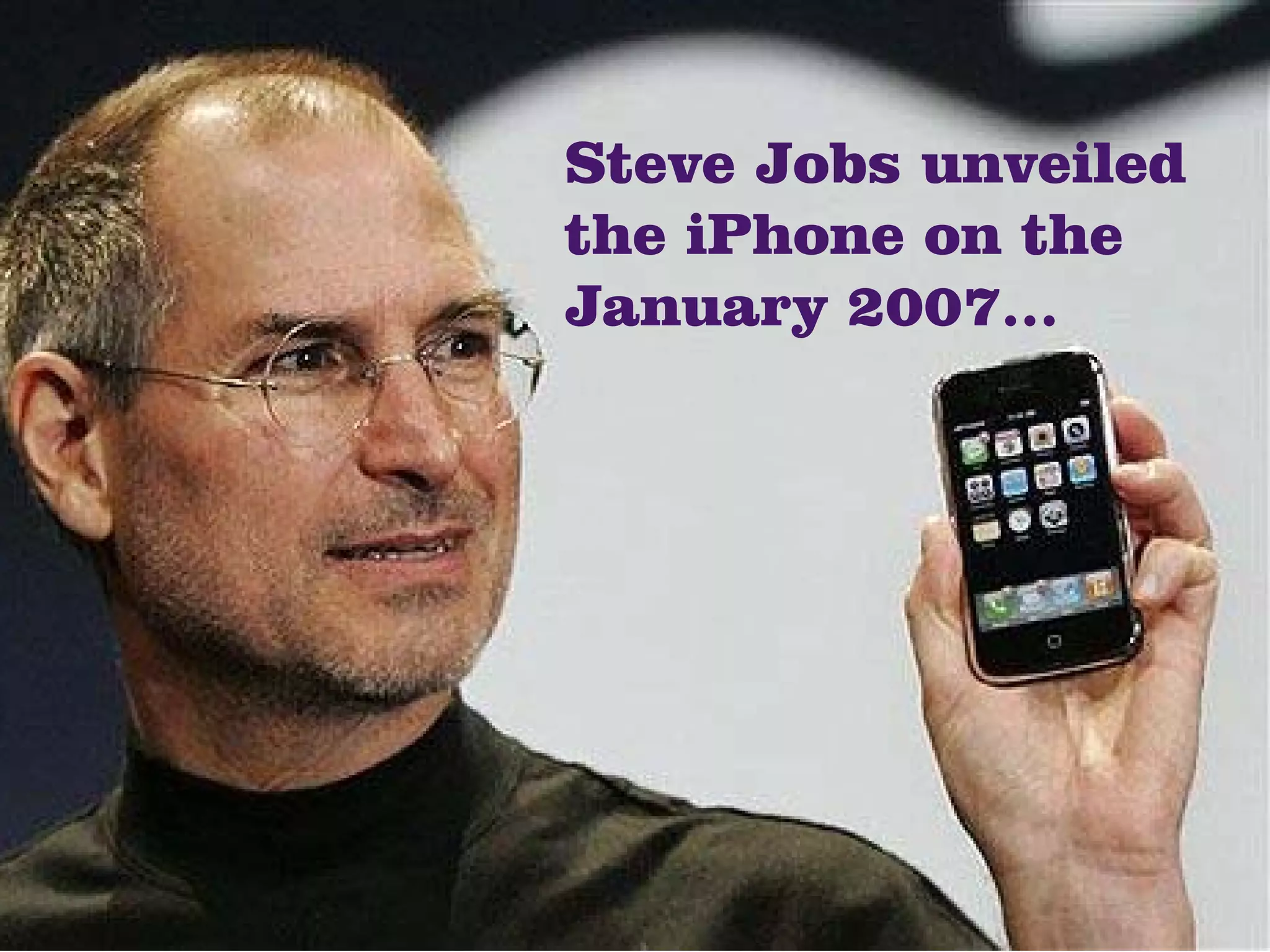

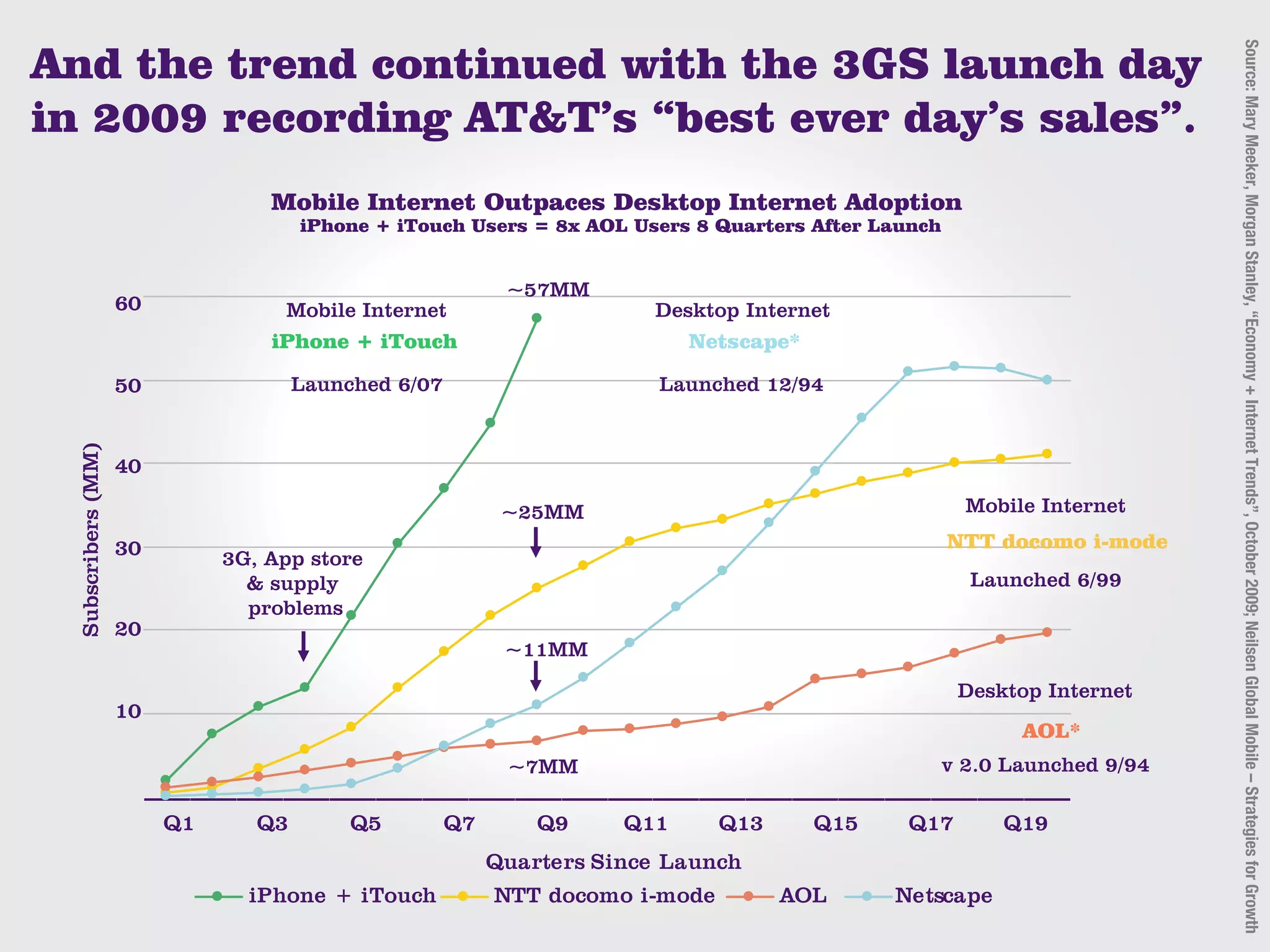

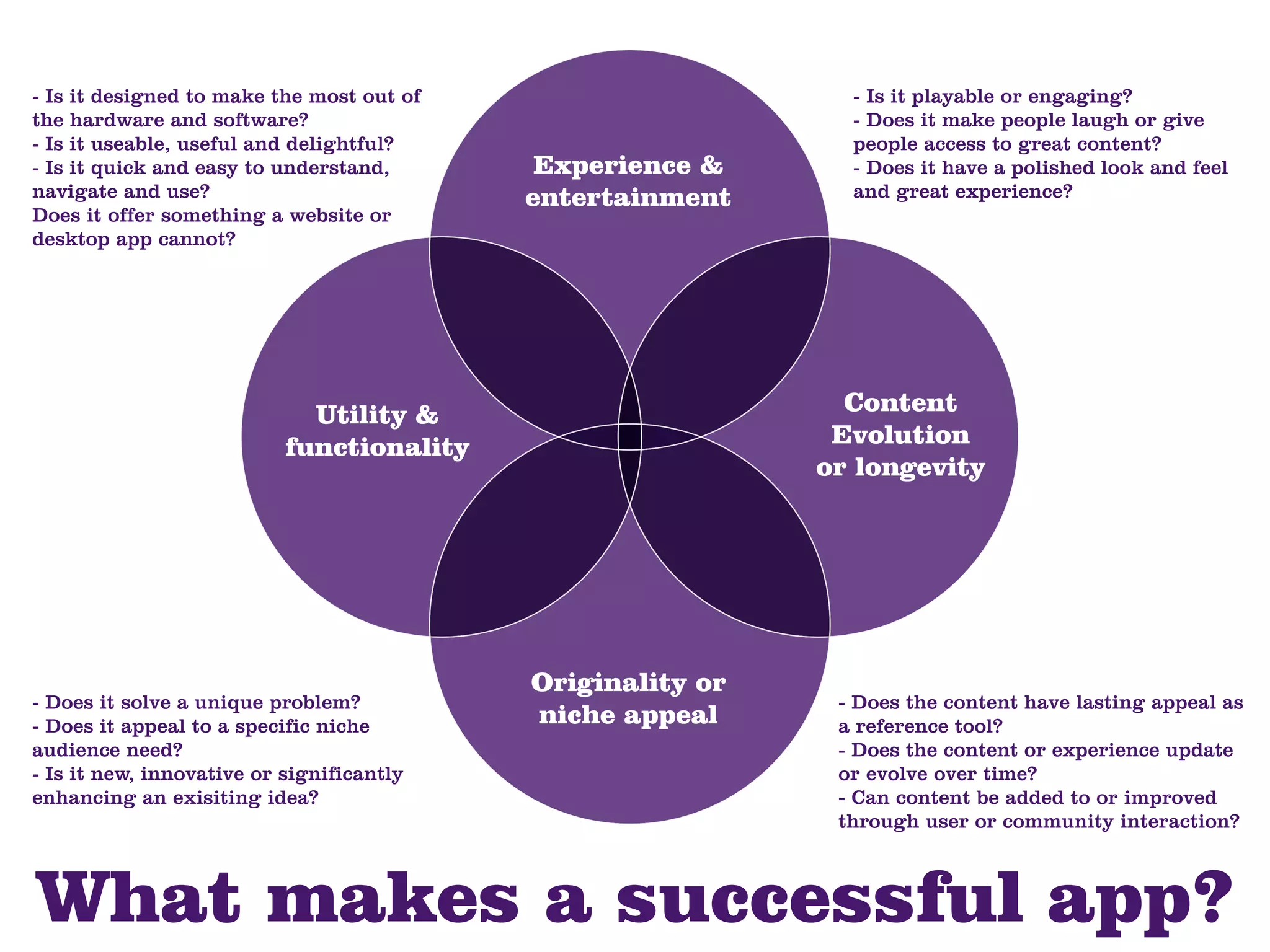

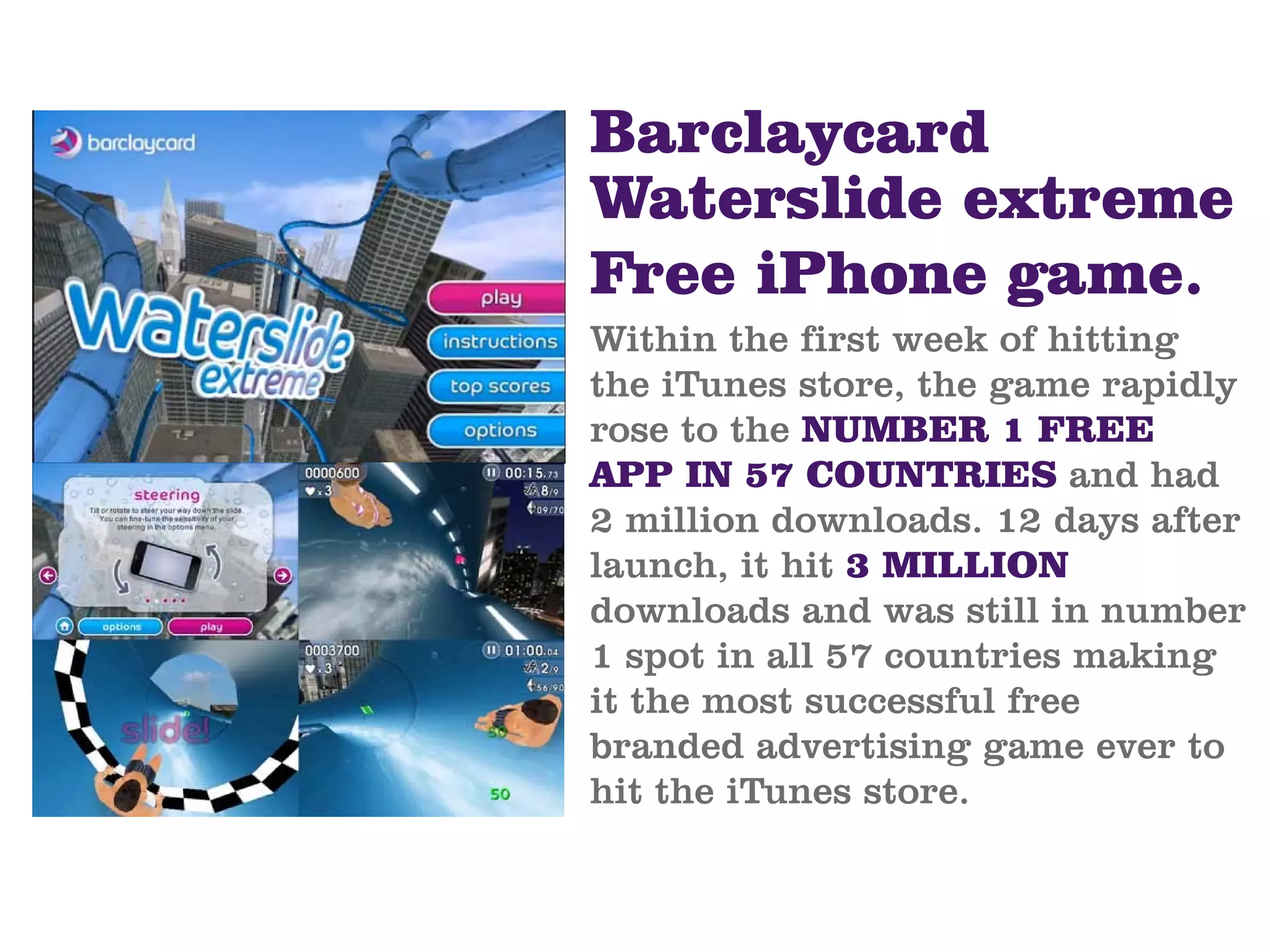

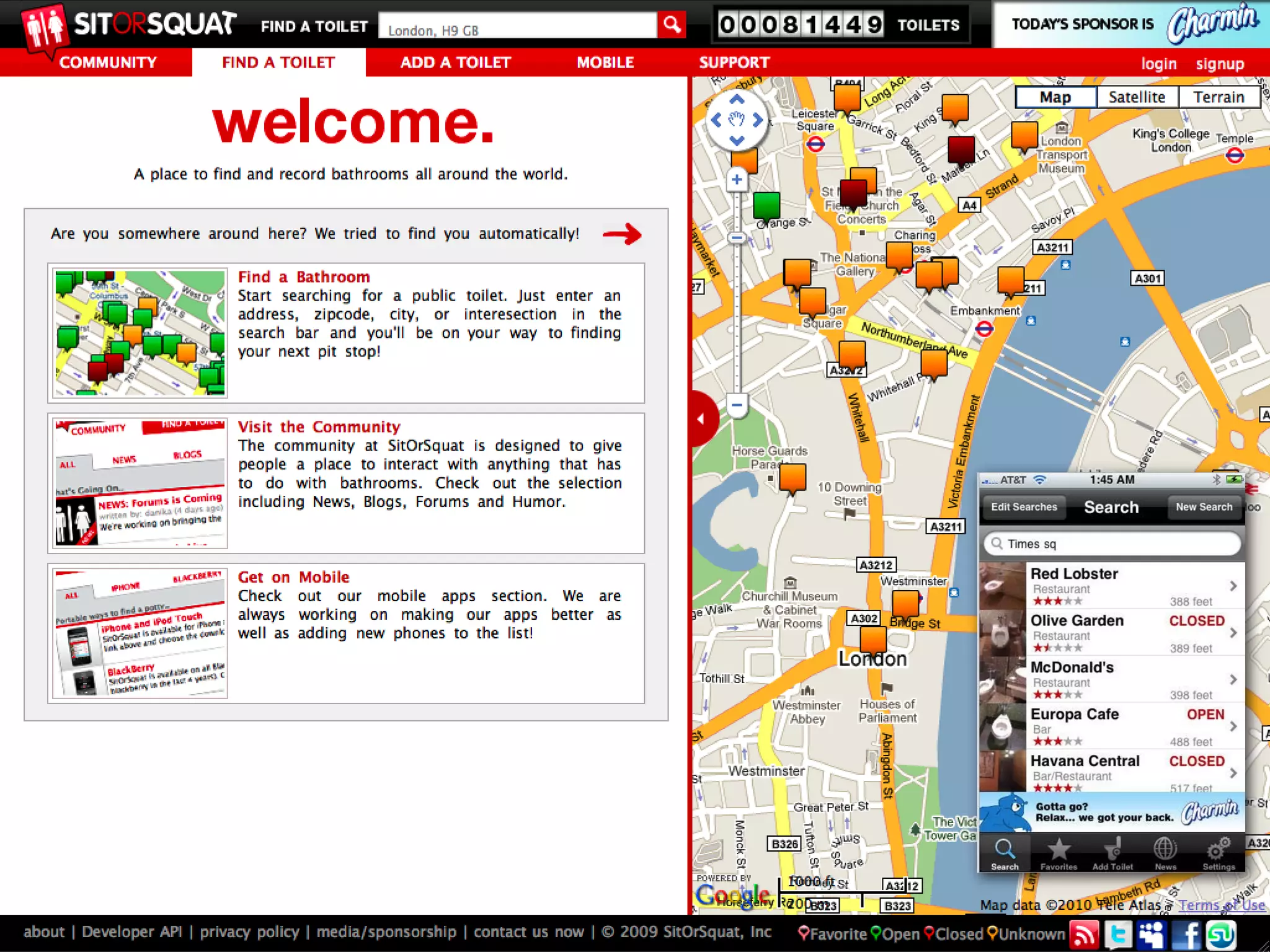

The document discusses the rise of iPhone apps and their impact on the mobile market since the iPhone's launch in 2007. It examines consumer adoption, app economy statistics, and factors contributing to app success, including design and user retention. Additionally, it highlights marketing opportunities and the evolving landscape of mobile applications as they integrate with social networks and local services.

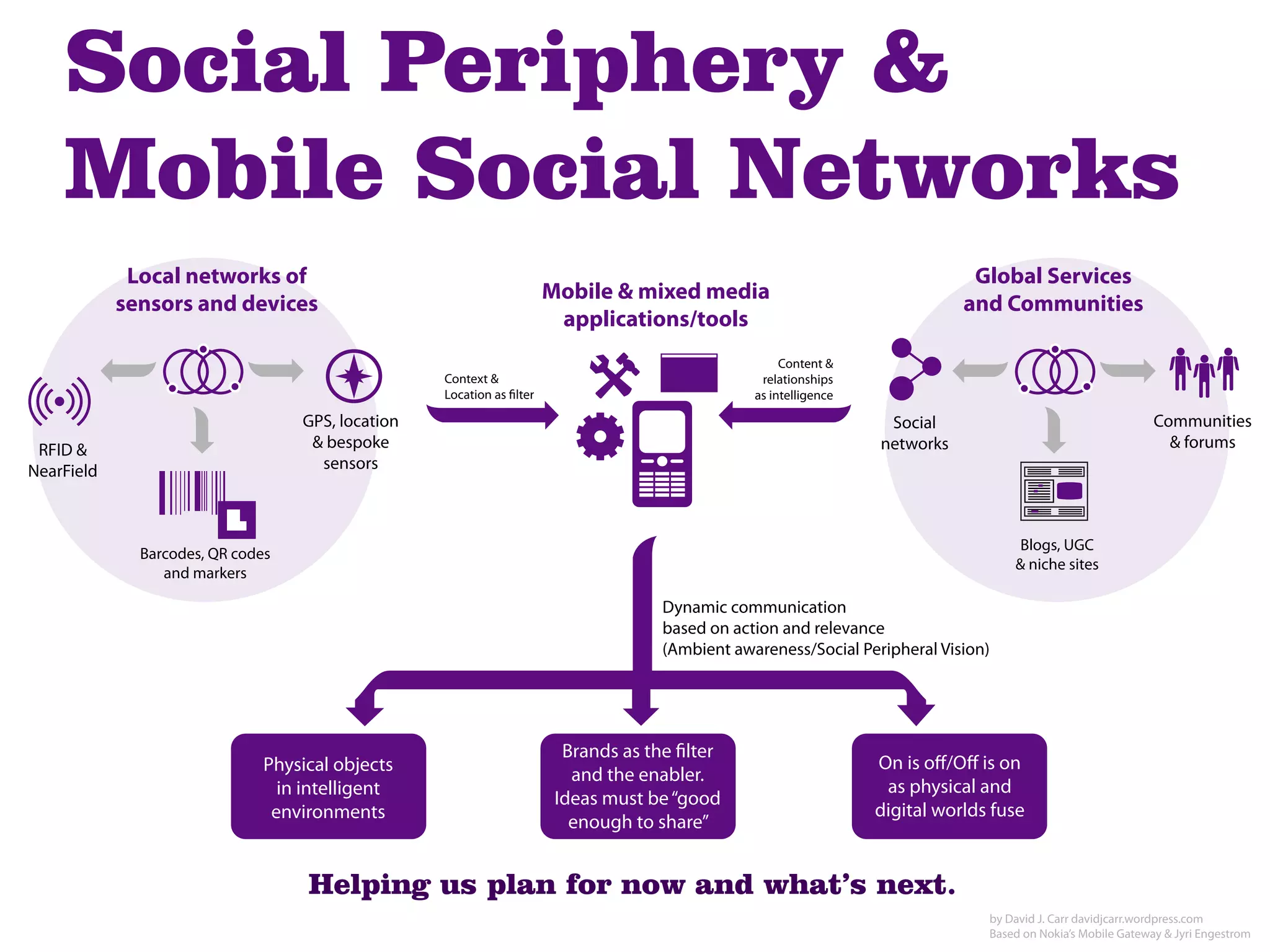

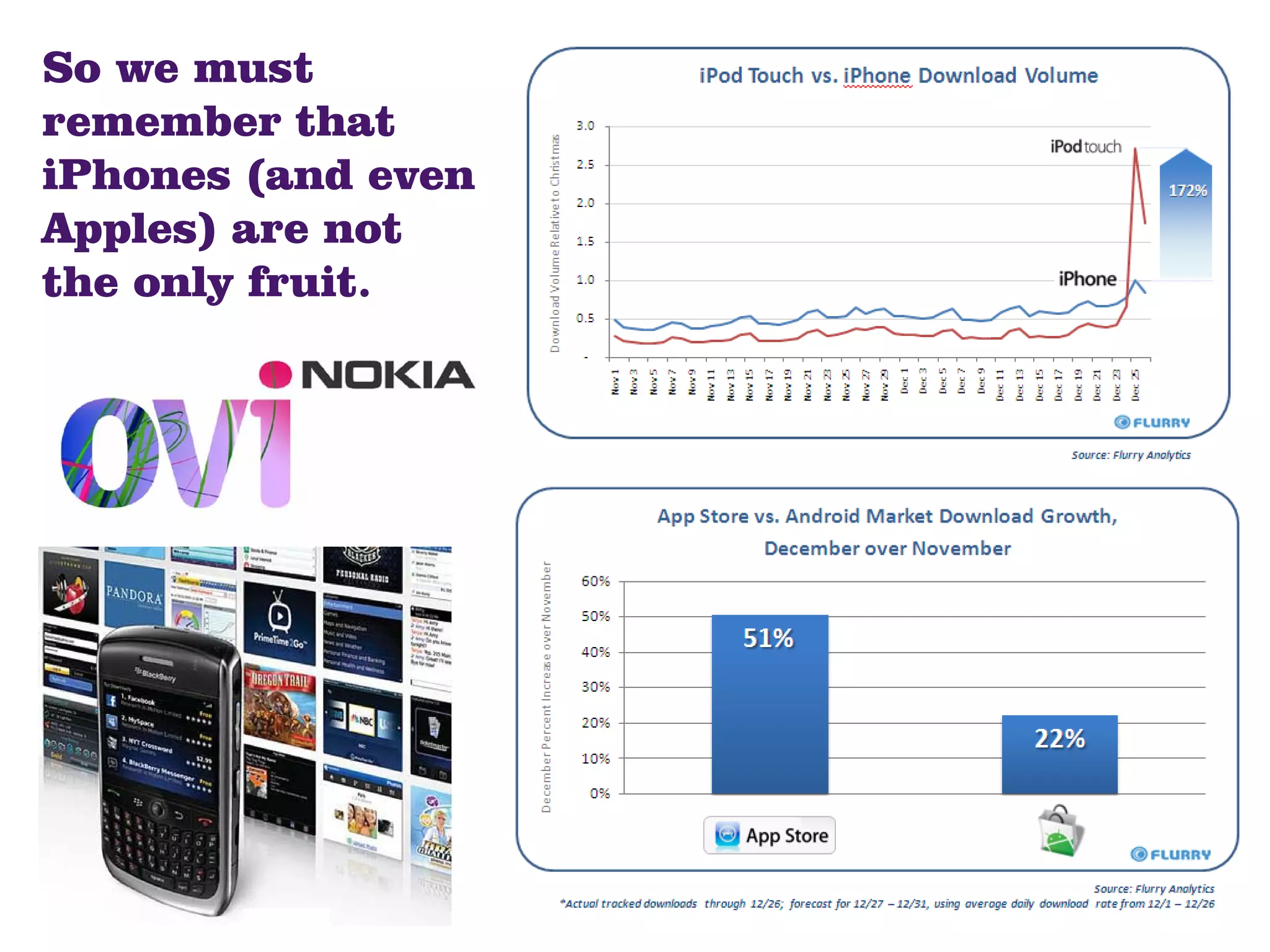

![“The majority of the real-time search boom will be

in its convergence with another rapidly growing

industry, mobile computing.

[Offering people] real-time recommendations

based on your current location using an

application that aggregates information from

real-time searches as well as social sites like

Yelp and Urban Spoon...... local advertisements

and “limited time” discounts on your mobile.”*

Social Periphery

*Rob Diana](https://image.slidesharecdn.com/iphoneapps-100311100456-phpapp02/75/iPhone-Apps-What-how-why-34-2048.jpg)