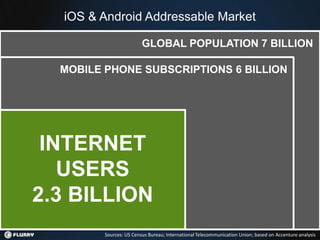

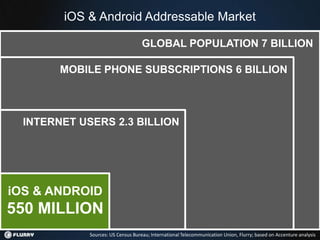

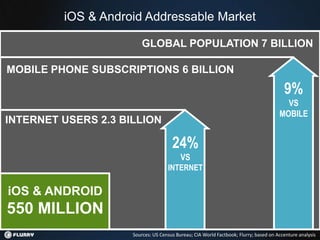

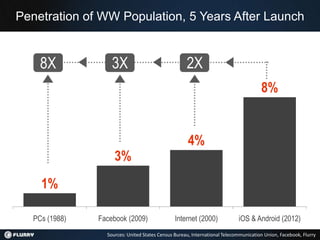

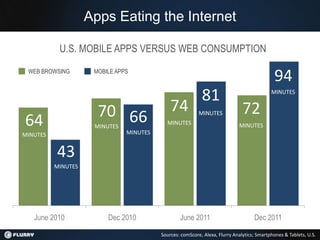

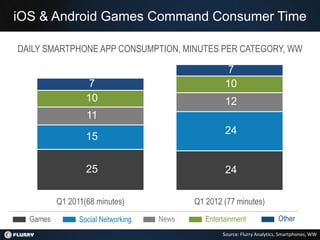

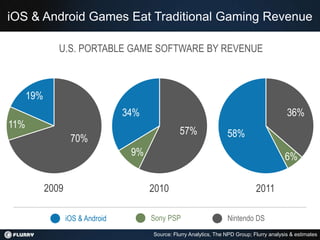

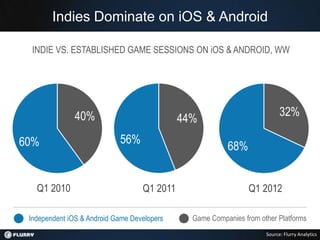

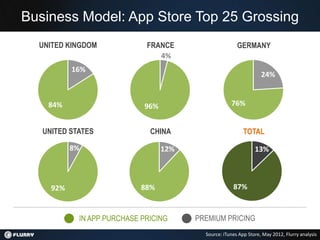

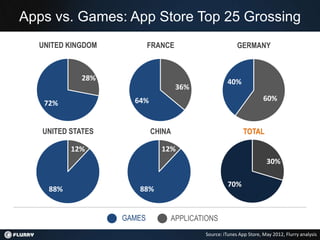

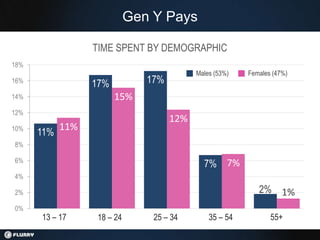

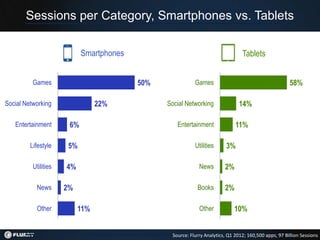

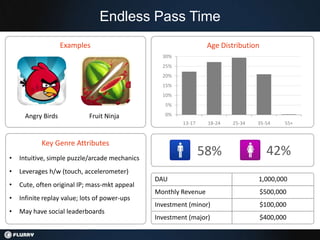

This document discusses mobile app usage statistics from Flurry Analytics. It provides data on the large and growing number of mobile app developers, devices, and users accessing apps each month. Charts show that iOS and Android now reach over 550 million users, representing 24% of internet users and 9% of the global population. Games are shown to be highly engaging mobile apps that are eating into other forms of media consumption like web browsing and portable gaming devices.