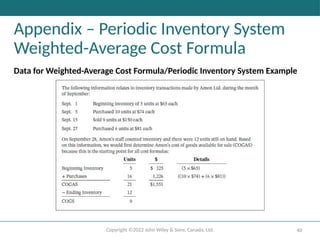

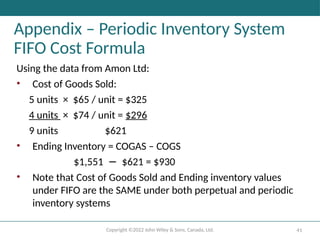

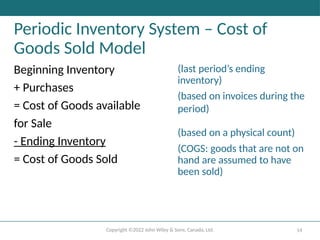

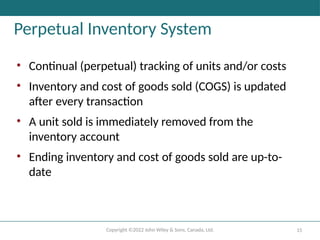

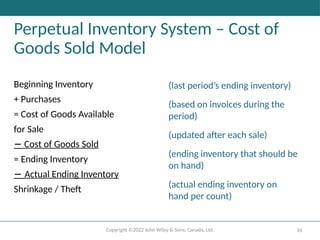

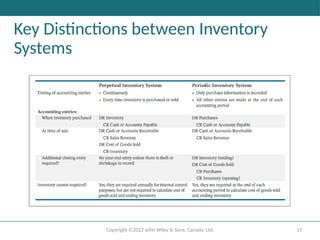

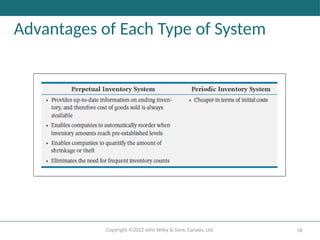

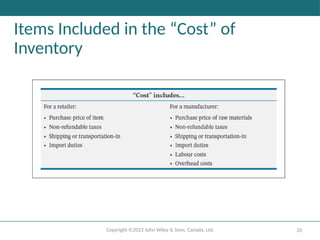

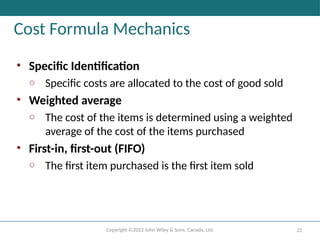

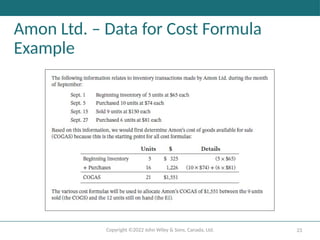

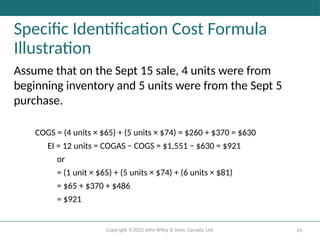

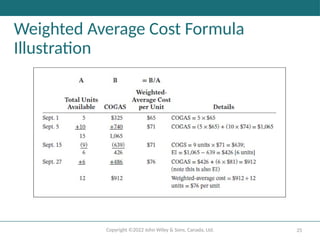

Chapter 7 of 'Understanding Financial Accounting' discusses the significance of inventory for companies, its classifications, and the systems used for inventory management. It outlines learning objectives including the importance of cost formulas, inventory valuation, and management responsibilities for internal controls. The document elaborates on periodic and perpetual inventory systems and emphasizes the impact of inventory valuation errors on financial statements.

![Copyright ©2022 John Wiley & Sons, Canada, Ltd. 31

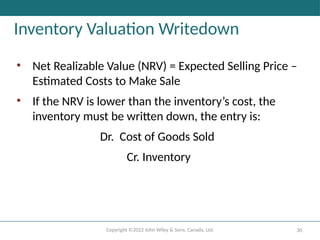

Application of the Lower of Cost and

NRV

Note that the historical costs of Products B and C are less than the net realizable value, so

no adjustment is required. However, the historical cost of Product A is higher than its net

realizable value. Therefore, we need to make an entry as follows:

DR Cost of Goods Sold [4,550 − 4,050] 500

CR Inventory 500

This entry has the effect of immediately reducing net income by the amount of the

inventory writedown even though the inventory has yet to be sold. In other words, the loss

in the value of the inventory is included in the cost of goods sold in the period in which it is

realized rather than when the product is subsequently sold.](https://image.slidesharecdn.com/ppt07-250109035850-a7f60870/85/understanding-financial-accounting-by-absxc-31-320.jpg)