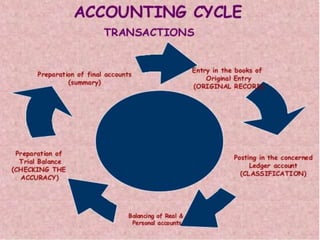

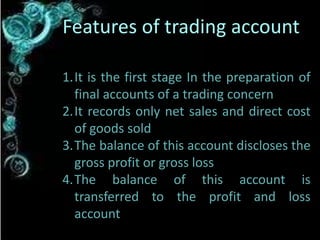

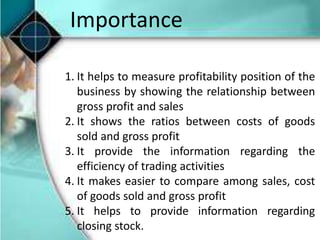

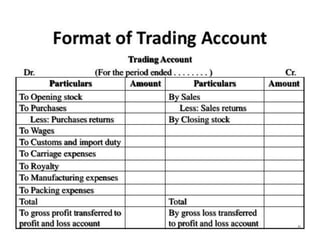

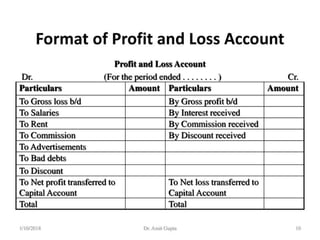

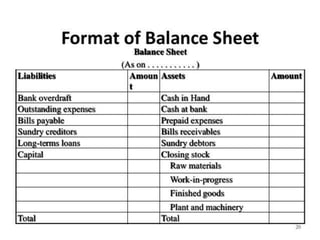

The document discusses the preparation of final accounts, which includes three financial statements: (i) the trading account, which shows gross profit/loss; (ii) the profit and loss account, which shows net profit/loss; and (iii) the balance sheet, which shows the financial position. It provides details on what each statement shows and their importance. The trading account is the first stage and shows gross profit/loss. The profit and loss account indicates net profit/loss after deducting all expenses. The balance sheet presents the sources and uses of funds on a particular date. Final accounts are important to understand business results, financial position, and for tasks like getting loans.