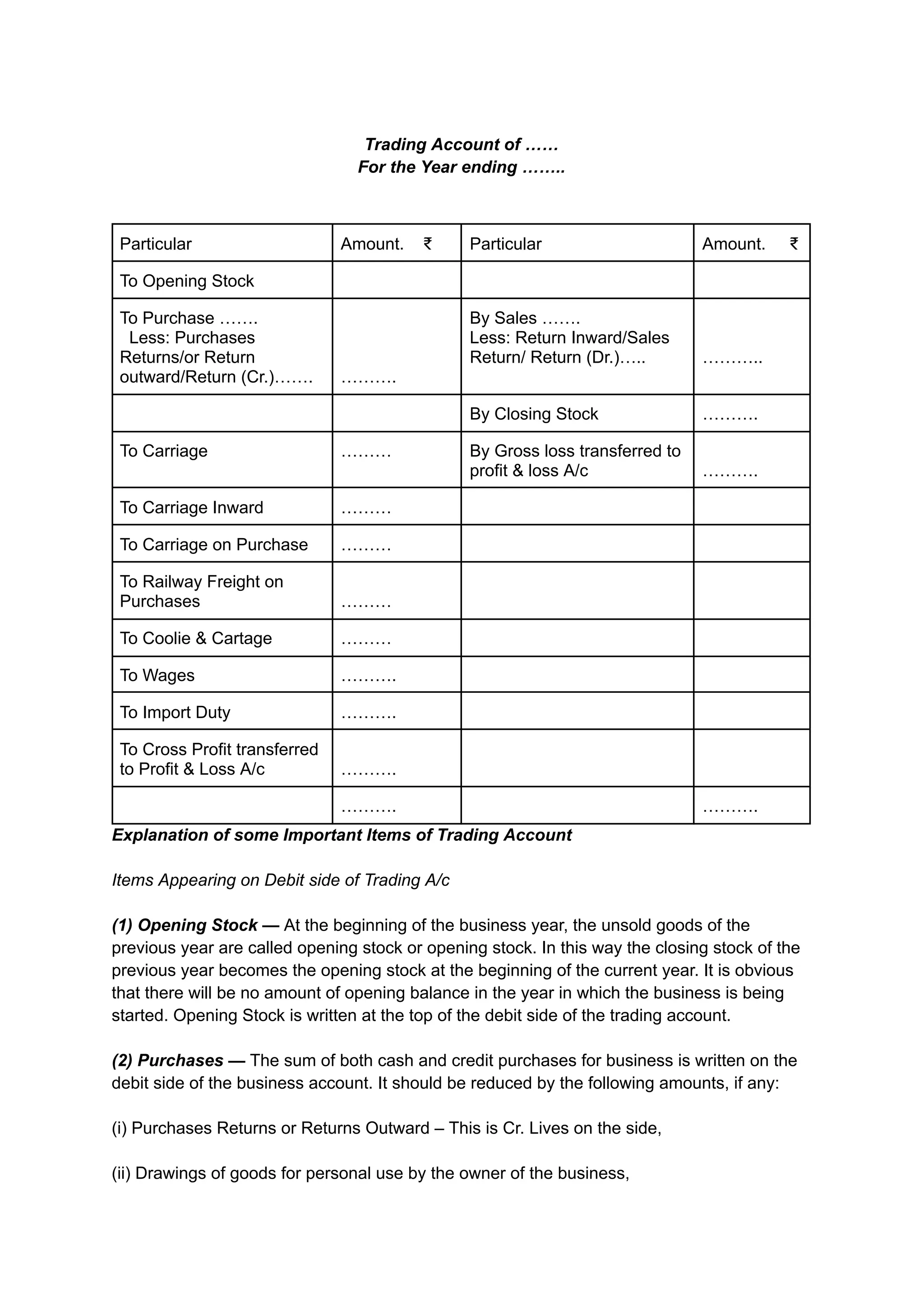

A trading account is an accounting record that summarizes the gross profit or loss of a business over a specific period, typically including elements such as opening stock, purchases, sales, and closing stock. It serves as the first step in preparing final accounts by focusing solely on transactions related to goods, leading to the calculation of gross profit or loss. Its preparation helps assess business performance and efficiency, as well as evaluate the relationship between purchases, expenses, and profit.