This document provides information on several international institutions:

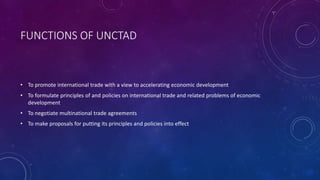

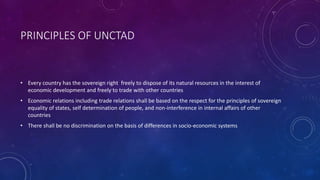

- UNCTAD deals with development issues and trade, established in 1964 with 194 member states, aims to promote equitable global development.

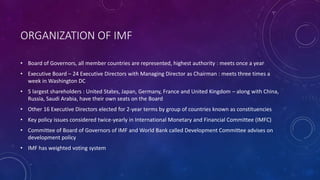

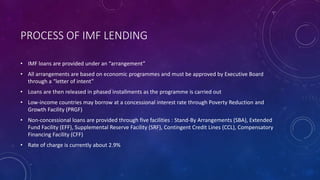

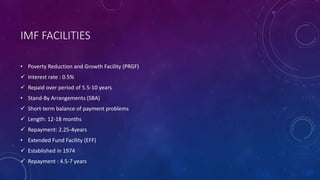

- IMF was established in 1945 with goals of monetary cooperation and financial stability, has 187 member countries and provides loans and policy advice.

- IBRD offers loans to middle-income countries for development projects and is part of the World Bank Group.

- WTO established in 1995 as the successor to GATT, has 167 members and oversees global trade rules and agreements through negotiation and dispute resolution.