More Related Content

PPT

Intrrnl env, resources competancies PDF

Chapter 3 the internal organization- resources capabilities core competencies... PPT

PPT

Assessing Strengths and Weaknesses PPT

PPTX

PPT

Internal Analysys Of Strategic Management PPTX

Chp 3_Examining Internal organisation.pptx Similar to Class4_444444444444444444444The Internal Organization.ppt

PPT

DOCX

BUS 499, Week 3 The Internal Organization Resources, Capabilitie PDF

Session 5 - Strategic Management.pptx.pdf PPT

DOCX

Pagedundee.ac.ukDr. Andrew G. RossLecture Internal.docx PPTX

L 9 value chain analysis, eva, mva etc PPTX

Hitt_ppt_12e_ch03_SM.pptx PPT

Analysing Strategic Capability Tools.ppt PPTX

Student Career Development Centre Plan 2018 E (1).pptx PPTX

MF strategic marketing slides competitive advantage MF PPTX

MODULE-3-THE-INTERNAL-ORGANIZATION.pptx PPTX

How to use Internal Analysis In Strategic Management.pptx PPTX

DOC

Strategic management chapter 5 and 6 note for bba vii PPTX

PPTX

PPTX

Competing for Advantage.pptx PPT

PPTX

PDF

Ch04_Roth3e_Enhanced_PPT.pdf Recently uploaded

PPTX

Advanced SEO: Ranking in a Competitive Digital World PPTX

What is a Source Context in semantic seo? PPTX

MANUFACTURING LOYALTY: AN EXPLORATION INTO DIGITAL FAN ENGAGEMENT AND COMPARA... PDF

2026 Digital Marketing Roadmap for Higher Education PDF

How Modern Brands Actually Scale in a Market Shaped by AI PDF

YouTube SEO Playbook: Ranking, Discovery, and Search Optimization PDF

The 2026 Sports Marketing Blueprint: Orchestrating Fan Engagement in India PDF

Why Voice of Customer Is the Missing Layer in Positioning and Competitive Str... PPTX

Google Business Video Verification in 2026: The 3-Minute Walkthrough That Get... PDF

Multicultural Strategy Playbook.pptx.pdf PDF

How Verified Alipay Accounts Boost Online Business and Credibility PDF

How DigiTechzo Is Redefining Sales-Focused Digital Marketing in India DOCX

12 Way to Buy Verified Cash App Accounts Smartly PDF

🥳 BUKTI KEMENANGAN HARI INI MINGGU 01 FEBRUARI 2026 🥰 PDF

From stadiums to Screens Digital Marketing and the Future of Fan Engagement ... PDF

Ananya hi solutions digital marketing hy PPTX

Google Local Services Ads Not Showing? 5 Fixes for Zero Impressions (LSA) PDF

22 Ways to Increase Ecommerce Sales .... PDF

Google SERPs In 2026: Changes, Features & How To Boost Your Organic Traffic PDF

SEO Strategy in 2026_ Proven Methods to Boost Visibility, Traffic, and Conver... Class4_444444444444444444444The Internal Organization.ppt

- 1.

©2011 Cengage Learning.All Rights Reserved. May not be scanned,

copied or duplicated, or posted to a publicly accessible website, in

whole or in part.

1 | 1

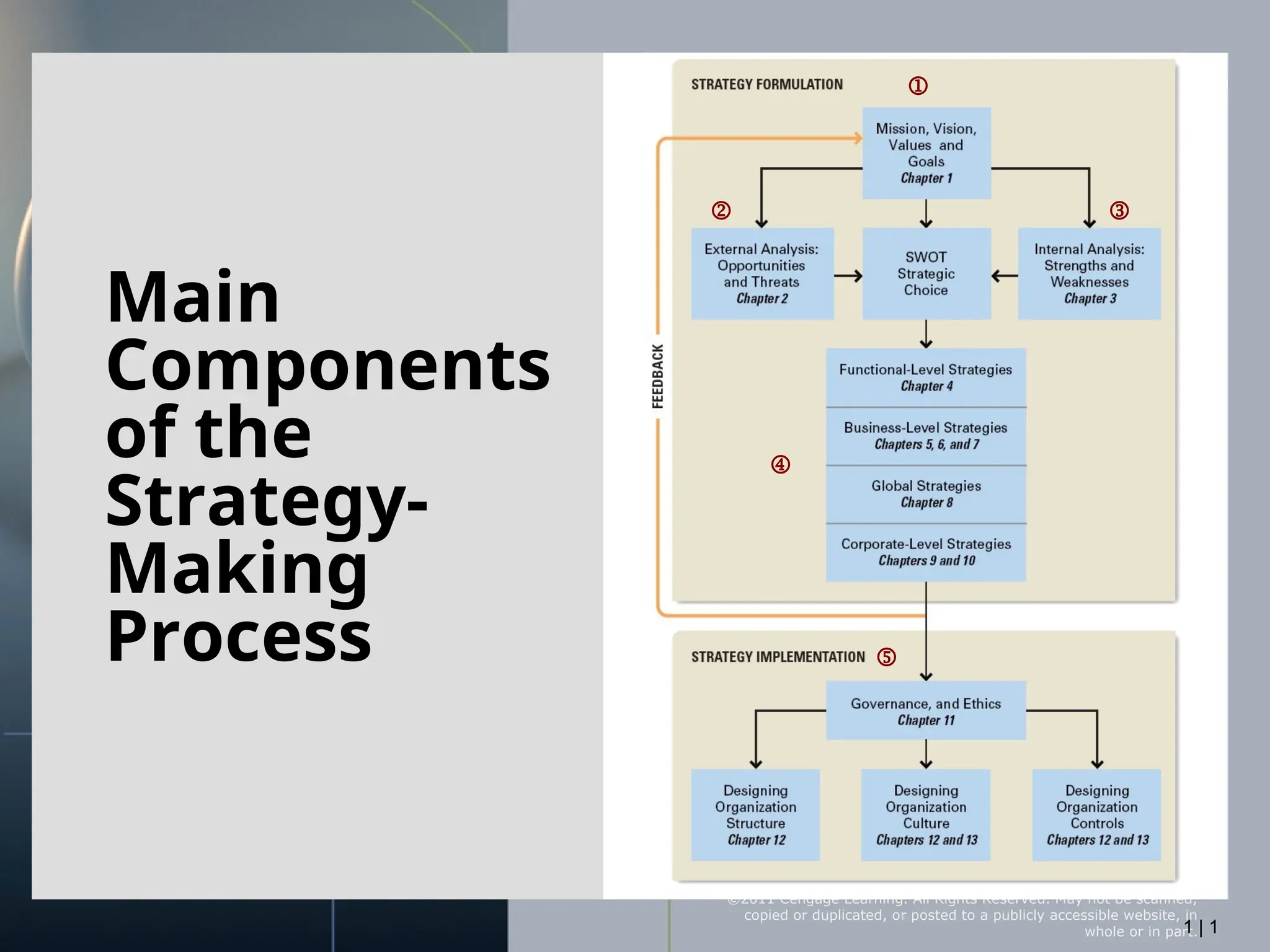

Main

Components

of the

Strategy-

Making

Process

- 2.

©2011 Cengage Learning.All Rights Reserved. May not be scanned,

copied or duplicated, or posted to a publicly accessible website, in

whole or in part.

Strategic Management Inputs

The Internal Organization:

Resources, Capabilities, Core

Competencies

and Competitive Advantages

- 3.

©2011 Cengage Learning.All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

Innovation in Action: Apple

• Record sales in midst of 2008 global recession

– Attributed to capabilities in innovation across all product

lines

• Laptops

• iPhone

• iPod (Shuffle)

• iPad

– Marketing capabilities

• Advertising

• Point of sale promotion

• Apple stores

• Potential negatives going forward

– Steve Jobs (health issues)

– Top management talent lured away by other firms

- 4.

©2011 Cengage Learning.All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

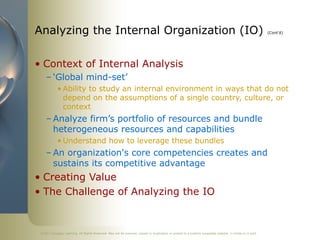

Analyzing the Internal Organization (IO) (Cont’d)

• Context of Internal Analysis

– ‘Global mind-set’

• Ability to study an internal environment in ways that do not

depend on the assumptions of a single country, culture, or

context

– Analyze firm’s portfolio of resources and bundle

heterogeneous resources and capabilities

• Understand how to leverage these bundles

– An organization's core competencies creates and

sustains its competitive advantage

• Creating Value

• The Challenge of Analyzing the IO

- 5.

©2011 Cengage Learning.All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

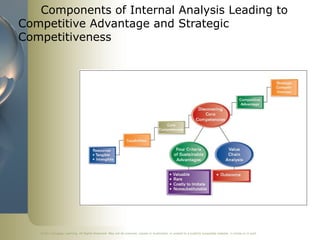

Components of Internal Analysis Leading to

Competitive Advantage and Strategic

Competitiveness

- 6.

©2011 Cengage Learning.All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

Analyzing the Internal Organization (IO) (Cont’d)

• Context of Internal Analysis

• Creating Value

–Develop core competencies that lead to

competitive advantage

–Value: measured by a product's

performance characteristics and by its

attributes for which customers are willing

to pay

- 7.

©2011 Cengage Learning.All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

Analyzing the Internal Organization (IO) (Cont’d)

• The Challenge of Analyzing the IO

–Strategic decisions are non-routine, have ethical

implications and influence the organization’s above-

average returns

•Involves identifying, developing, deploying and

protecting firms’ resources, capabilities and core

competencies

–Managers face uncertainty on many fronts --

•Proprietary technologies

•Changes in economic and political trends, societal values

and shifts in customer demands

•Environment – increases complexity

–Intraorganizational conflict

•Due to decisions about core competencies and how to

nurture them

- 8.

©2011 Cengage Learning.All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

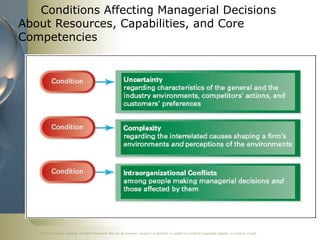

Conditions Affecting Managerial Decisions

About Resources, Capabilities, and Core

Competencies

- 9.

©2011 Cengage Learning.All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

Resources, Capabilities and Core

Competencies

• Competitive Advantage (CA) foundation includes

– Resources

• Bundled to create organizational capabilities

• Tangible and intangible.

– Capabilities

• Source of a firm’s core competencies and basis for CA

• Purposely integrated to achieve a specific task/set of tasks

– Core Competencies

• Capabilities that serve as a source of CA for a firm over its

rivals

• Distinguish a company from its competitors – the personality

- 10.

©2011 Cengage Learning.All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

Resources, Capabilities and Core

Competencies

• Tangible Resources

– Assets that can be seen, touched and quantified

– Examples include equipment, facilities, distribution

centers, formal reporting structures

– Four specific types

• Intangible Resources

– Assets rooted deeply in the firm’s history, accumulated

over time

– In comparison to ‘tangible’ resources, usually can’t be

seen or touched

– Examples include knowledge, trusts, organizational

routines, capabilities, innovation, brand name, reputation

– Three specific types

- 11.

©2011 Cengage Learning.All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

Building Core Competencies:

Criteria and Value Chain Analysis

• Two tools firms use to identify and build on their

core competencies

– Four specific criteria of Sustainable CA

– Value Chain Analysis

- 12.

©2011 Cengage Learning.All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

Building Core Competencies:

Criteria and Value Chain Analysis

• Four specific criteria of sustainable competitive

advantage – capabilities that are:

– Valuable

– Rare

– Costly-to-imitate

– Nonsubstitutable capabilities

• Competitive consequences:

– Focus on capabilities that yield competitive parity and

either temporary or sustainable competitive advantage

• Performance implications include:

– Parity = average returns

– Temporary advantage = avg. to above avg. returns

– Sustainable advantage = above average returns

- 13.

©2011 Cengage Learning.All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

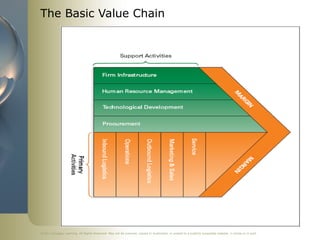

Building Core Competencies:

Criteria and Value Chain Analysis

• Value Chain Analysis

– Primary activities

• Involved with product’s physical creation, sales and

distribution to buyers, and service after the sale

– Service, marketing/sales, outbound/inbound logistics and operations

– Support activities

• Provide assistance necessary for the primary activities to take

place

• Includes firm infrastructure, HRM, technologies development

and procurement

- 14.

©2011 Cengage Learning.All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

The Basic Value Chain

- 15.

©2011 Cengage Learning.All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

The Concept of a Company Value Chain

• The Value Chain

– Identifies the primary internal activities that

create customer value and the related

support activities.

– Permits a deep look at the firm’s cost

structure and ability to offer low prices.

– Reveals the emphasis that a firm places on

activities that enhance differentiation and

support higher prices.

- 16.

©2011 Cengage Learning.All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

Comparing the Value Chains of Rival Firms

• Value Chain Analysis

– Facilitates a comparison, activity-by-activity, of how

effectively and efficiently a company delivers value

to its customers, relative to its competitors.

• The Value Chain Analysis Process:

– Segregate the firm’s operations into different types

of primary and secondary activities to identify the

major components of its internal cost structure.

– Use activity-based costing to evaluate the activities.

– Do the same for significant competitors.

- 17.

©2011 Cengage Learning.All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

- 18.

©2011 Cengage Learning.All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

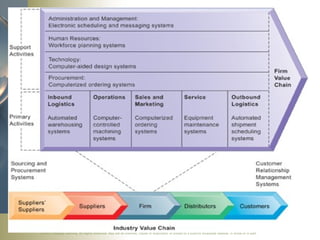

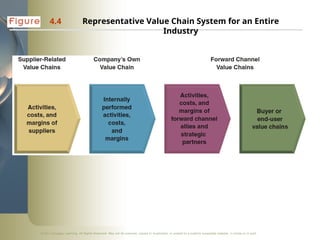

4.4 Representative Value Chain System for an Entire

Industry

- 19.

©2011 Cengage Learning.All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

Value Chain System for an Entire Industry

• Industry Value Chain:

– The firm’s internal value chain

– The value chains of industry suppliers

– The value chains of channel intermediaries

• Effects of the Industry Value Chain:

– Costs and margins of suppliers and channel

partners can affect prices to end consumers.

– Activities of channel partners can affect industry

sales volumes and customer satisfaction.

- 20.

©2011 Cengage Learning.All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

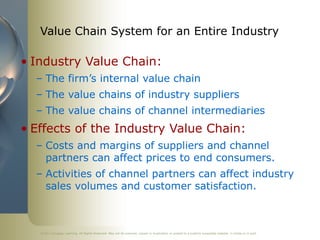

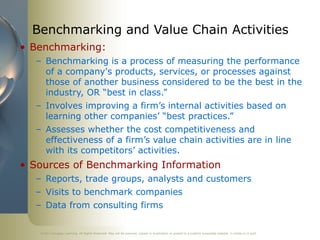

Benchmarking and Value Chain Activities

• Benchmarking:

– Benchmarking is a process of measuring the performance

of a company's products, services, or processes against

those of another business considered to be the best in the

industry, OR “best in class.”

– Involves improving a firm’s internal activities based on

learning other companies’ “best practices.”

– Assesses whether the cost competitiveness and

effectiveness of a firm’s value chain activities are in line

with its competitors’ activities.

• Sources of Benchmarking Information

– Reports, trade groups, analysts and customers

– Visits to benchmark companies

– Data from consulting firms

- 21.

©2011 Cengage Learning.All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

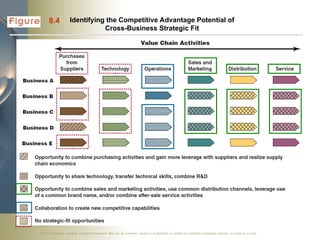

8.4 Identifying the Competitive Advantage Potential of

Cross-Business Strategic Fit

- 22.

©2011 Cengage Learning.All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

Outsourcing

• Definition: Purchase of a value-creating activity

from an external supplier

– Effective execution includes an increase in flexibility,

risk mitigation and capital investment reduction

– Trend continues at a rapid pace

– Firms must outsource activities where they cannot

create value or are at a substantial disadvantage

compared to competitors

• Can cause concerns

– Usually revolves around innovative ability and loss of

jobs

- 23.

©2011 Cengage Learning.All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

Internal Organization Assessment and

Strategic Decisions

• Firms must identify their strengths and weaknesses

• Appropriate resources and capabilities needed to

develop desired strategy and create value for

customers/other stakeholders

• Tools (i.e., outsourcing) can help a firm focus on

core competencies as the source for CA

• Core competencies have potential to become core

rigidities

– Competencies emphasized when no longer competitively

relevant can become a weakness

• External environmental conditions and events

impact a firm’s core competencies