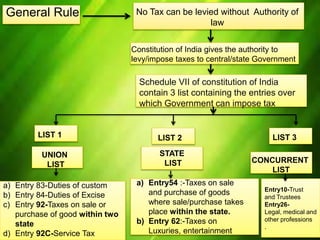

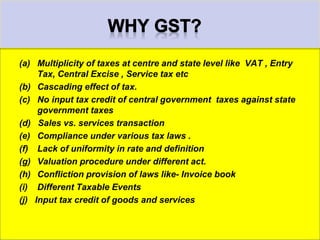

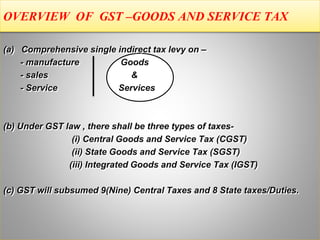

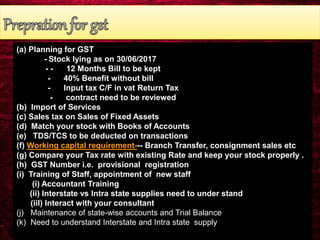

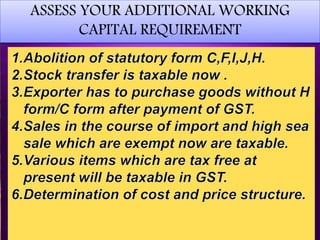

This document provides an overview of the Goods and Services Tax (GST) implemented in India. It discusses key aspects of GST including:

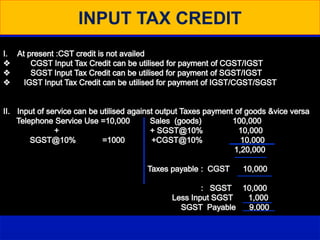

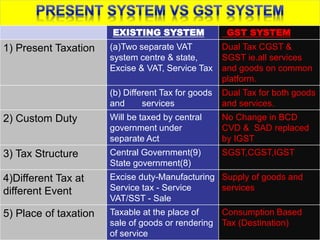

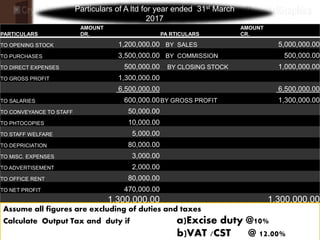

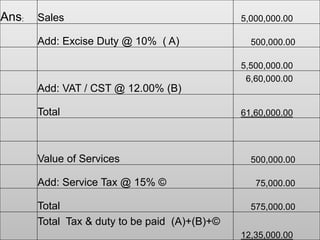

- GST unifies multiple indirect taxes into a single tax applied to the manufacture and sale of goods and the provision of services.

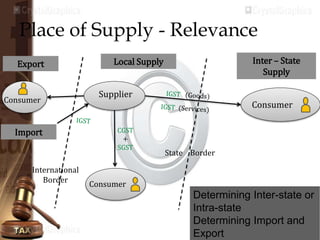

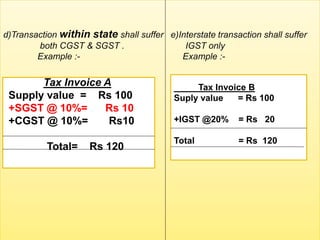

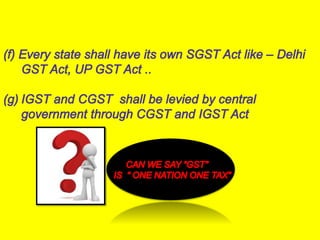

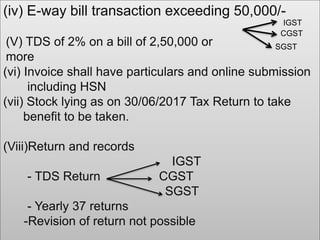

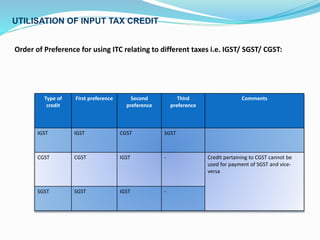

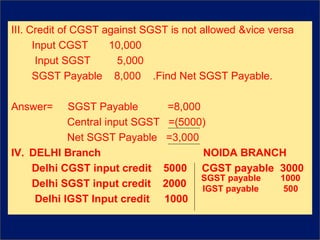

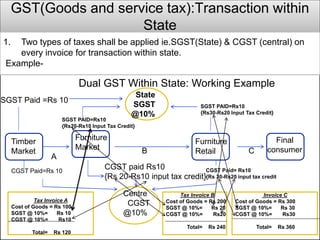

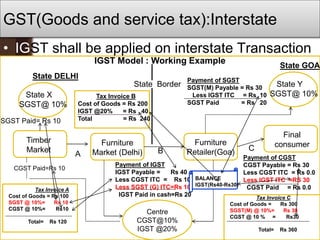

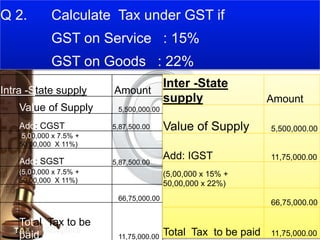

- It consists of three types of taxes - Central GST, State GST, and Integrated GST for inter-state transactions.

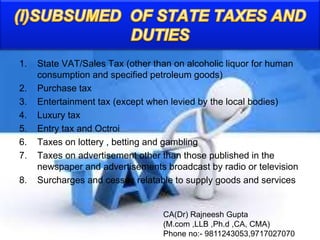

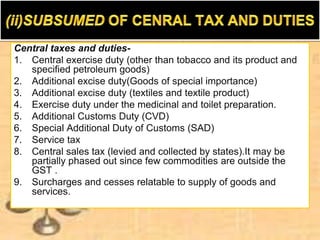

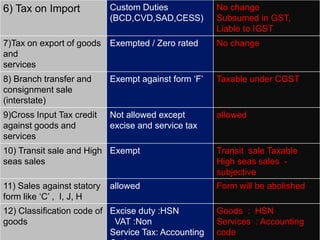

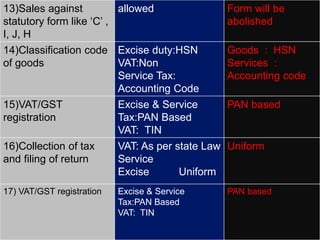

- GST subsumes many central and state taxes such as excise duty, VAT, service tax, etc.

- Under GST, taxes will be levied at both the central and state level for intra-state transactions, while inter-state transactions will be taxed under