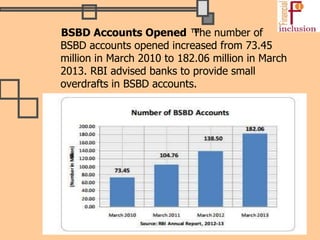

Financial inclusion refers to providing affordable financial services to low-income individuals, contrasting with financial exclusion faced by 2.5 billion working-age adults globally. Initiatives by the Reserve Bank of India (RBI) since 2004, including no-frills accounts and technology usage, aim to enhance financial access, with progress indicated by the CRISIL inclusix score rising from 35.4 to 40.1. The Pradhan Mantri Jan Dhan Yojana, launched in 2014, has further advanced banking accessibility, resulting in millions of new accounts and significant deposit amounts.