Here are some of the major products and services offered by banks:

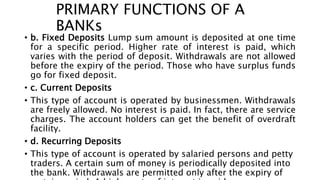

- Deposit accounts: Savings accounts, current/checking accounts, fixed/term deposits, recurring deposits etc. These are the core deposit taking functions of banks.

- Lending products: Overdrafts, cash credits, loans for various purposes like home, vehicle, personal, business, agriculture etc. Banks lend the deposits they collect.

- Payment and remittance services: ATM cards, debit cards, credit cards, netbanking, mobile banking, IMPS, NEFT, RTGS funds transfer services. These facilitate cashless payments and funds transfer.

- Third party services: Demat/trading account, insurance, mutual funds,