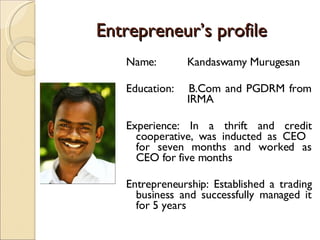

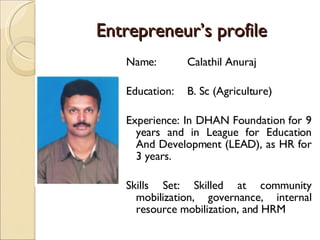

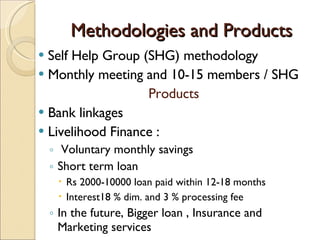

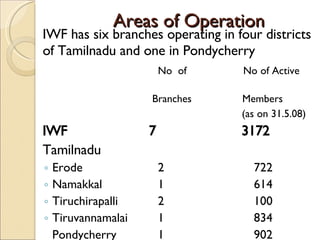

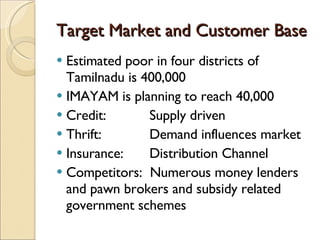

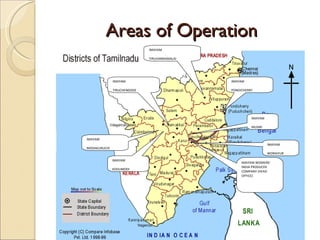

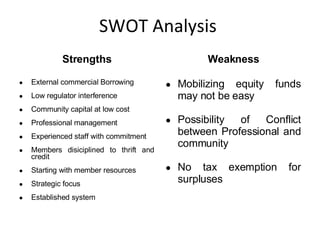

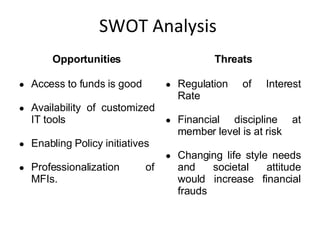

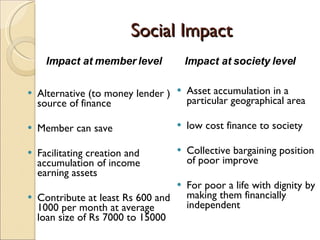

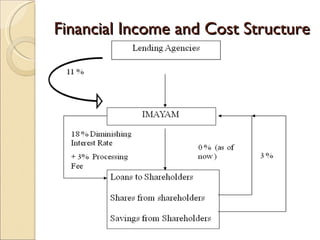

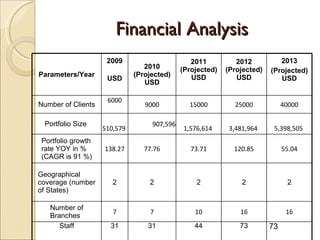

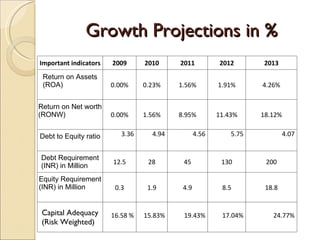

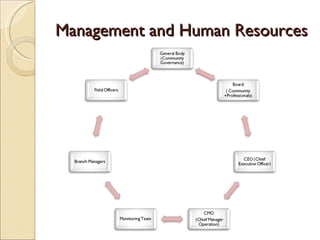

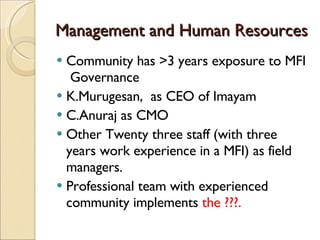

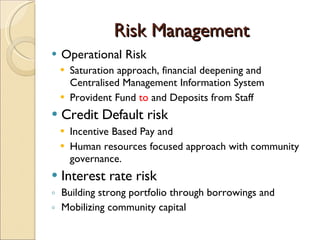

Imayam Women's Federation (IWF) is a community-owned organization that promotes increasing the bargaining power of poor women through self-help groups and providing financial services like loans, savings programs, and insurance. IWF currently has over 3,000 active members across 6 branches in Tamil Nadu and Pondicherry. The organization is led by experienced managers Kandaswamy Murugesan and Calathil Anuraj and aims to reach 40,000 customers by strengthening its community governance model and mobilizing more funds. Financial projections estimate rapid portfolio and customer base growth over the next 5 years, with a return on assets of over 4% by 2013.