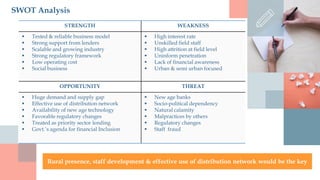

This document provides an investment memorandum for IGT Financial Services, a proposed social sector organization seeking equity investment. It outlines IGT's mission to improve quality of life for underprivileged communities. The organization will provide microfinance, microinsurance, and other services through a rural-focused NBFC-MFI model. Projections show the business growing to serve over 5 million customers within 5 years and generating annual revenue of over $90 million. The memorandum requests $2.3 million in seed funding and outlines plans for future funding rounds and exit opportunities.