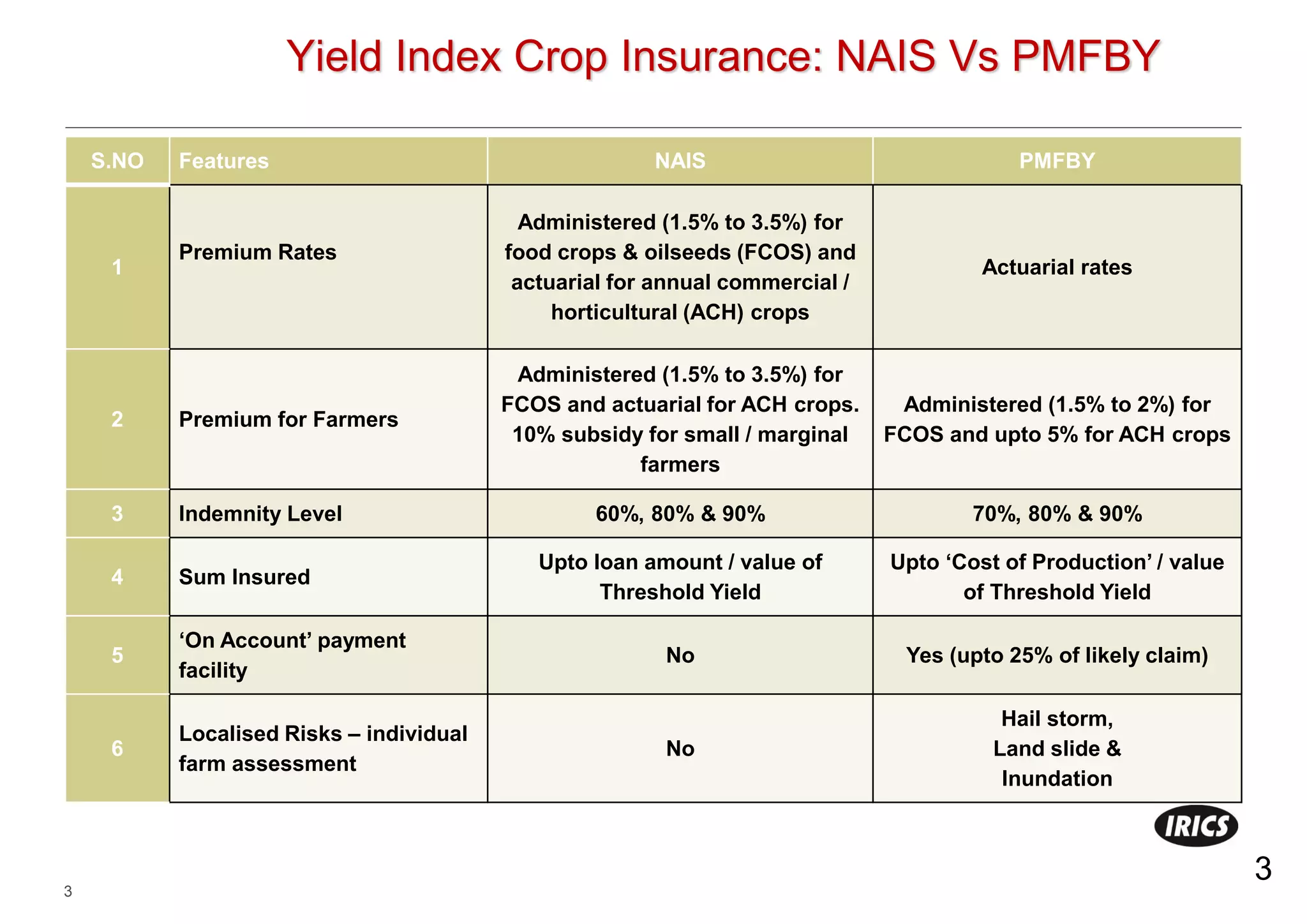

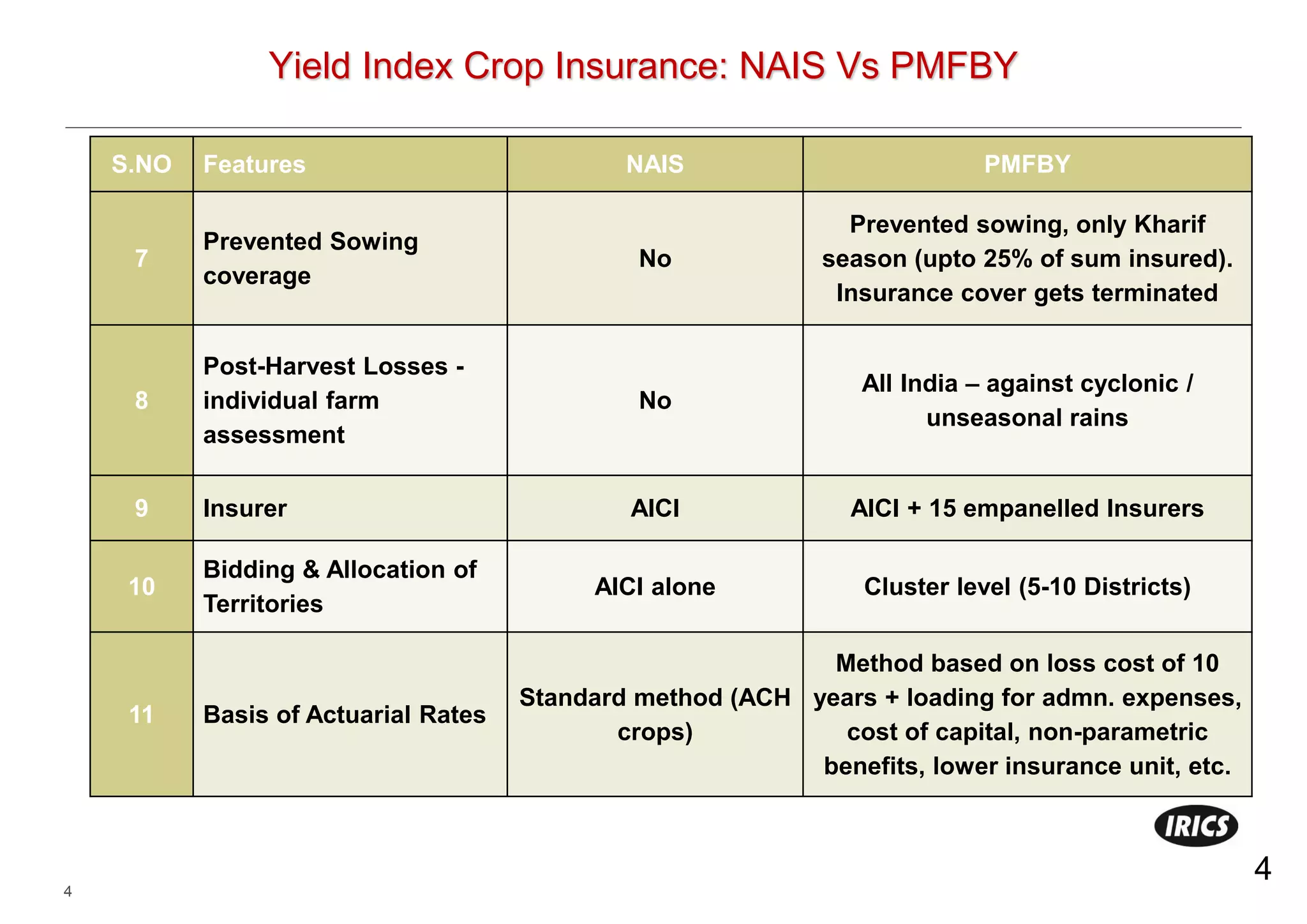

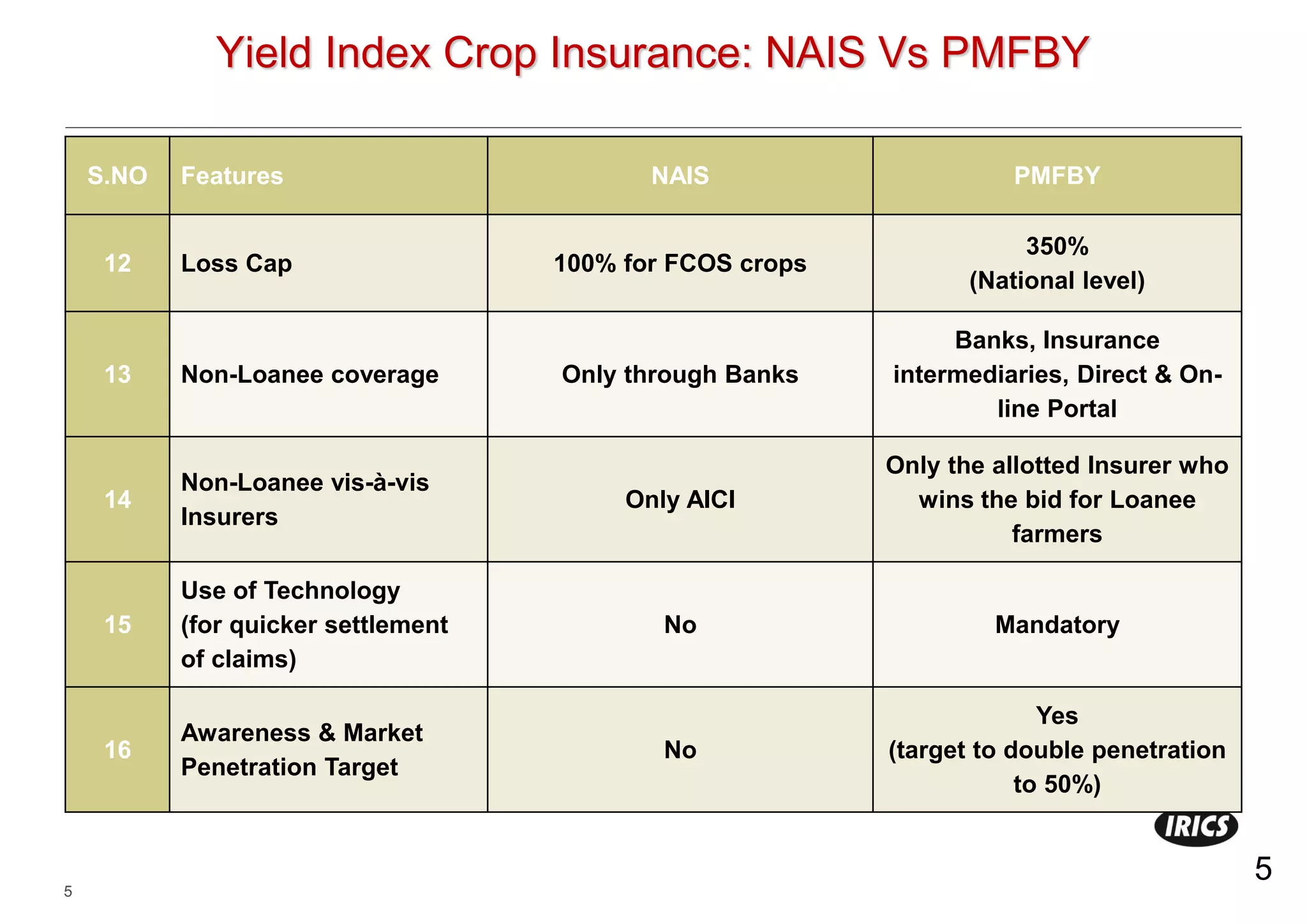

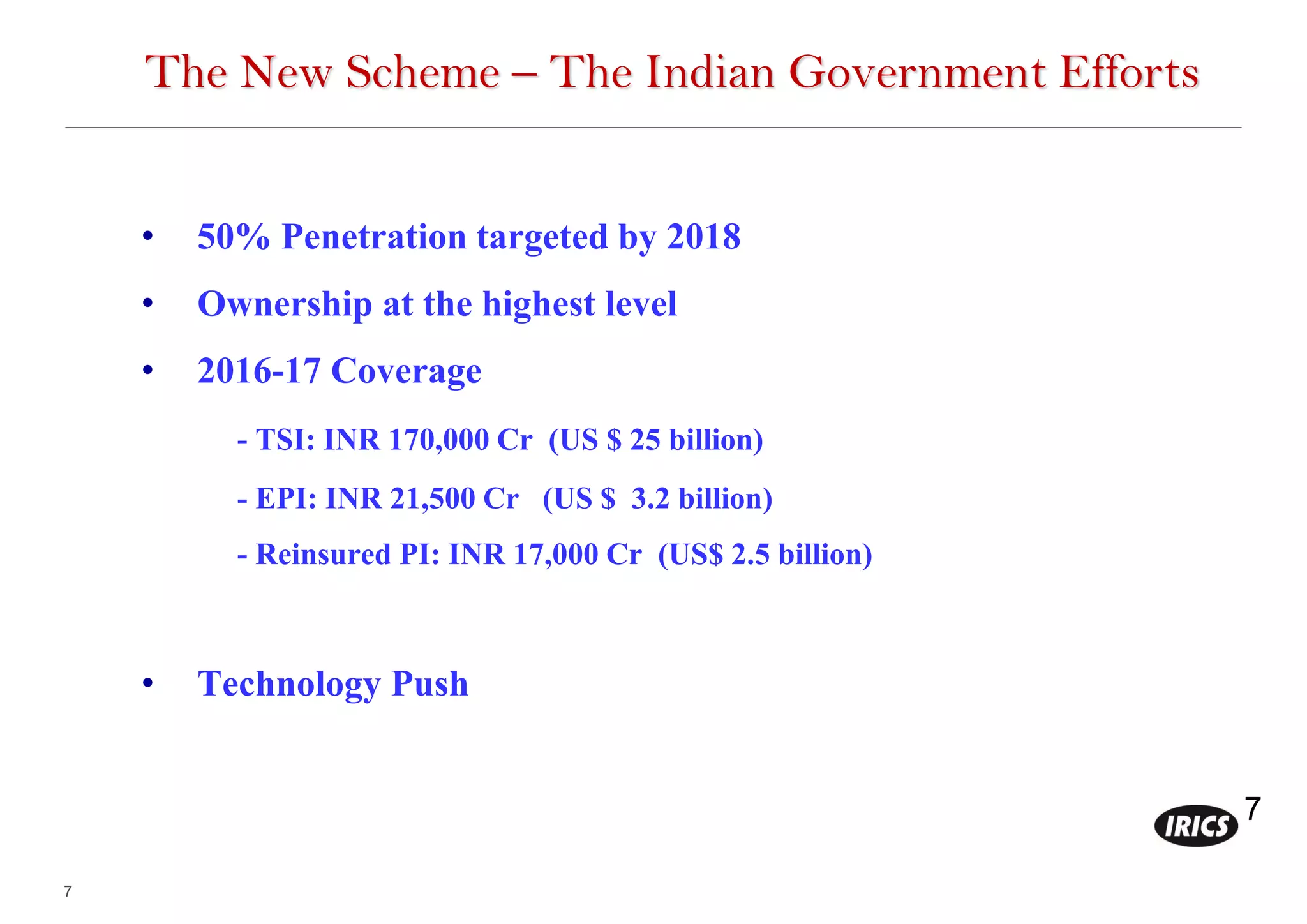

The document outlines the key features of the Pradhan Mantri Fasal Bima Yojana (PMFBY) crop insurance scheme in India, including its components, value proposition, and comparisons to the previous National Agricultural Insurance Scheme (NAIS). PMFBY aims to provide higher farmer participation, quicker settlement of claims, and increased use of technology through measures like yield index insurance, weather index insurance, unified package insurance, and a dedicated online portal. The government targets 50% penetration of PMFBY by 2018 through efforts to promote awareness, rationalize premium rates, and leverage digital tools and apps to streamline crop cutting experiments and