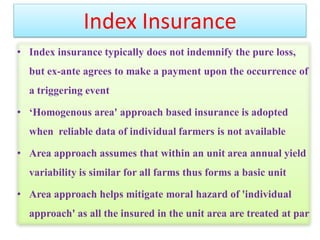

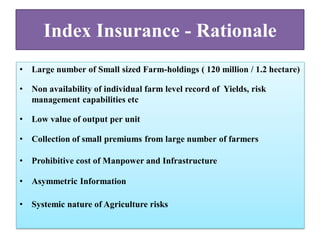

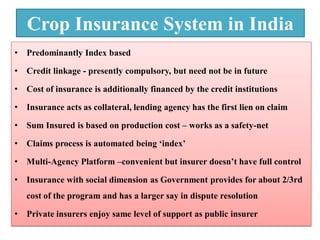

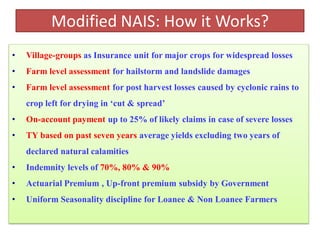

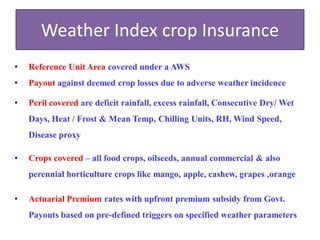

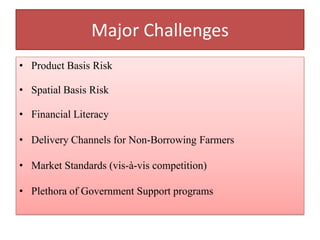

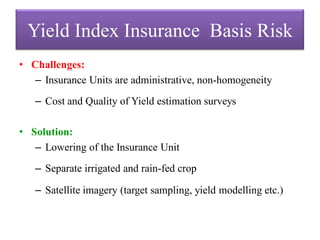

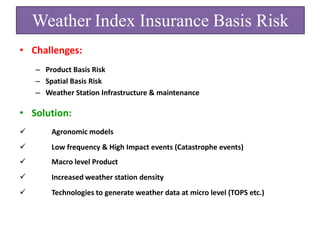

The document discusses the challenges and structure of crop insurance in India, emphasizing the prevalence of small farm holdings and the reliance on index insurance due to the lack of individual farm data. It outlines the workings of index insurance, recent innovations, and the associated risks such as basis risk and financial literacy. Key features include automated claims processes tied to weather events and the involvement of both public and private insurers, with government support playing a crucial role in funding and resolving disputes.