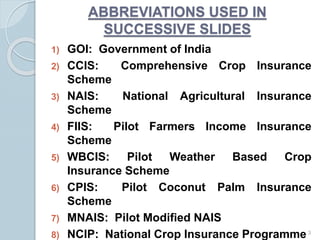

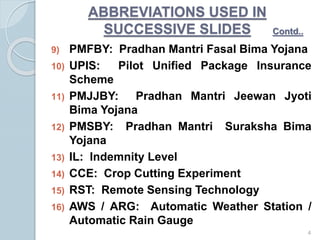

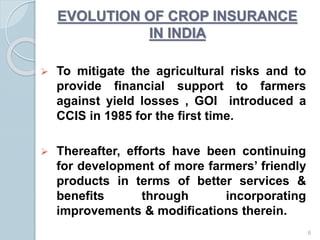

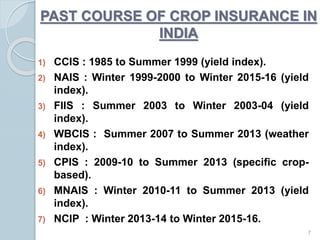

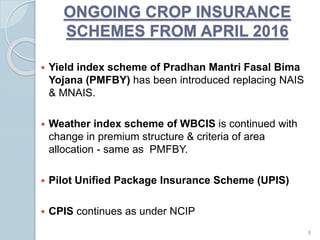

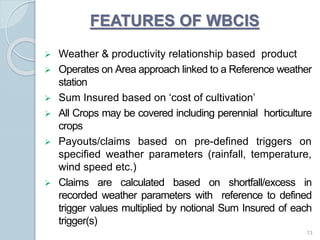

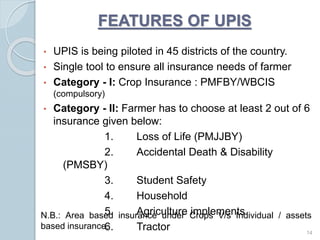

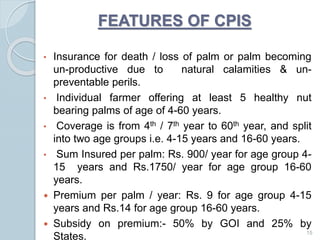

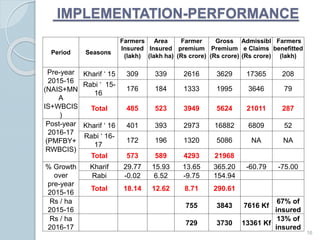

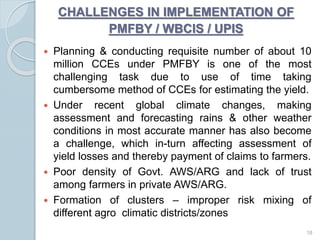

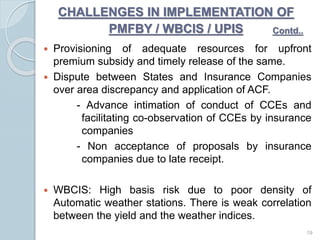

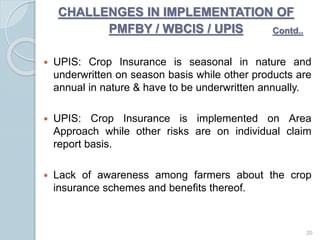

This document summarizes the key aspects of crop insurance in India presented by Dr. Ashish Kumar Bhutani, Joint Secretary of the Department of Agriculture, Cooperation & Farmers Welfare in the Government of India. It provides an overview of the evolution of crop insurance schemes in India from 1985 to the current Pradhan Mantri Fasal Bima Yojana (PMFBY) launched in 2016. It highlights features of PMFBY including reduced farmer premiums, expanded crop and risk coverage, and use of technology to assess losses. It also discusses the Weather Based Crop Insurance Scheme, Unified Package Insurance Scheme, and Coconut Palm Insurance Scheme.