Embed presentation

Downloaded 67 times

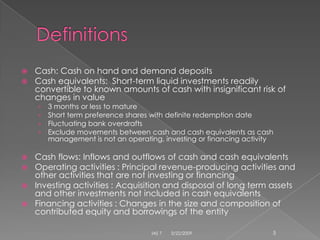

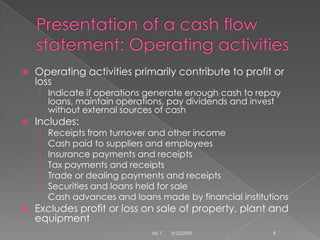

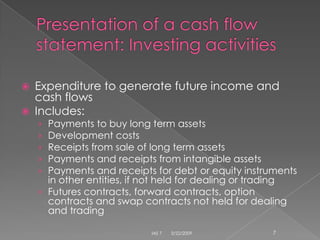

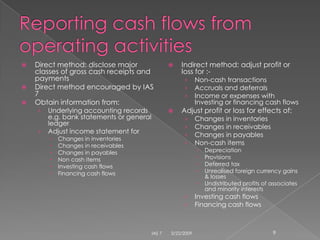

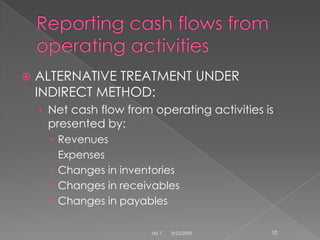

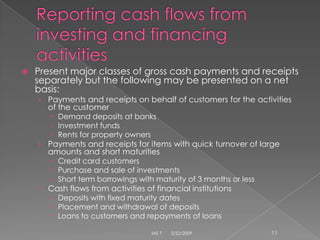

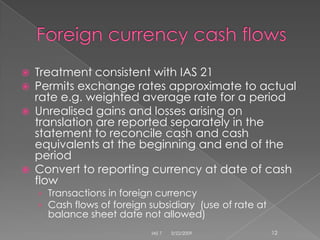

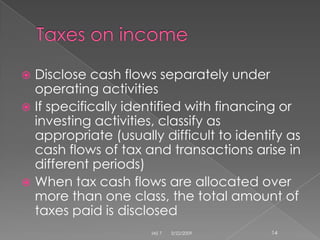

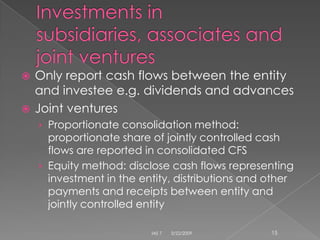

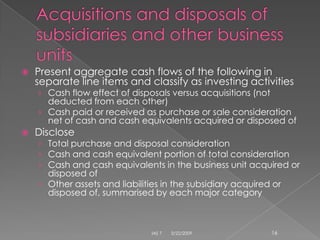

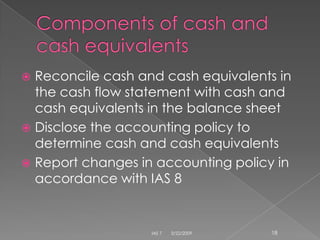

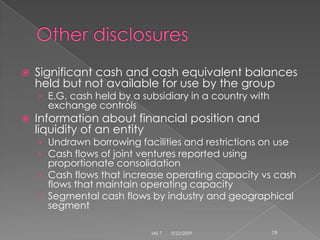

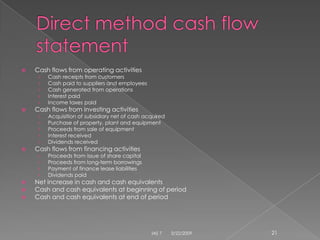

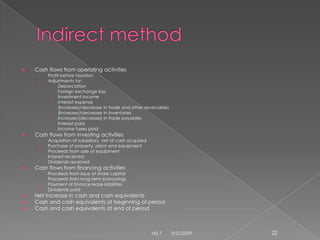

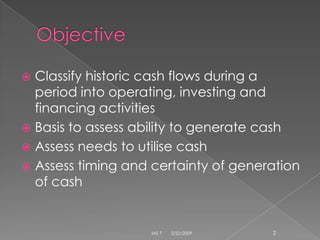

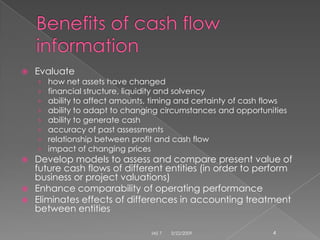

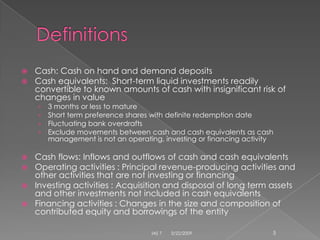

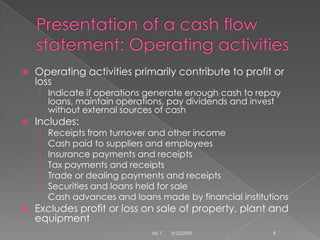

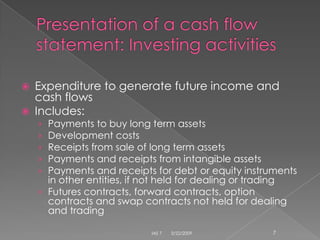

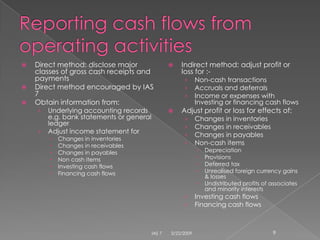

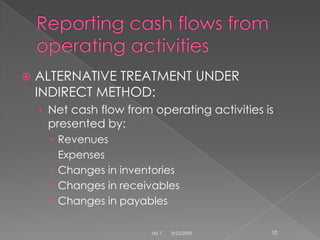

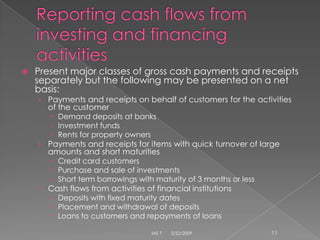

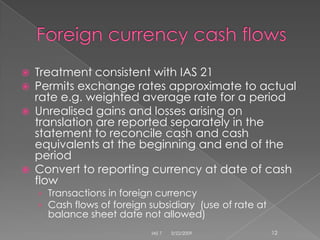

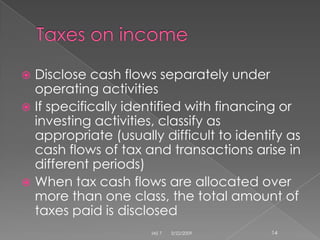

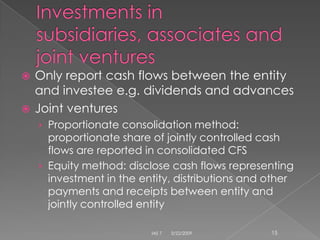

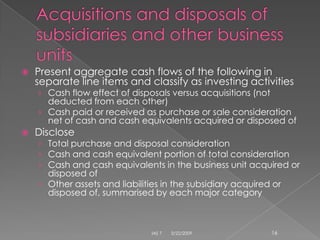

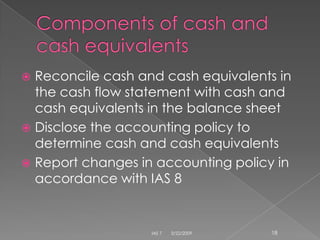

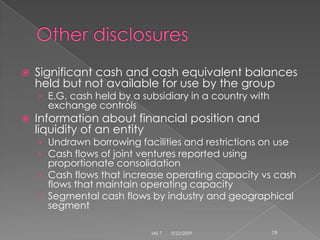

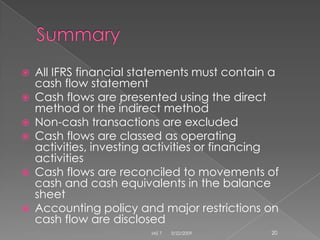

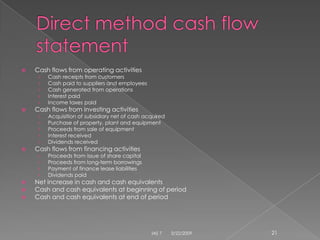

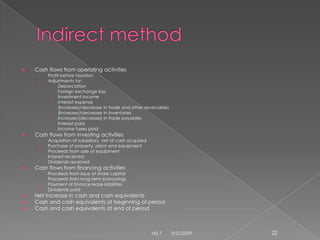

IAS 7 provides guidance on cash flow statements. It requires entities to present a statement of cash flows which classifies cash flows during a period into operating, investing and financing activities. It aims to provide information about the ability of an entity to generate cash, its needs to utilize cash, and the timing and certainty of cash flows. The standard describes the content of the statement of cash flows, including requirements for presentation and disclosures.