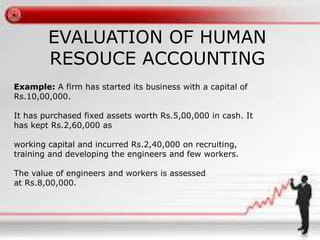

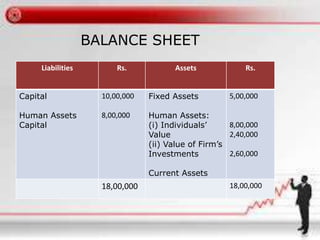

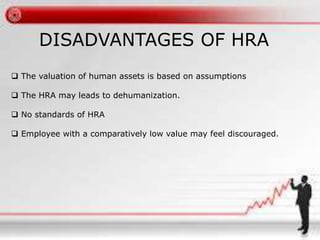

This document discusses human resource accounting (HRA). It provides definitions of HRA, lists group members, objectives, and methods of HRA including historical cost, replacement cost, opportunity cost, return on efforts employed, and reward valuation. It also discusses costs of human resources like acquisition, training, welfare, and other costs. An example is provided to evaluate HRA and show how human assets can be included in a balance sheet. Advantages include helping with employment and utilization of resources, while disadvantages include assumptions used for valuation and potential for dehumanization.