The document discusses various aspects of human resource accounting (HRA), including:

1. The objectives of HRA are to improve management decision making regarding human resources as assets, attracting and retaining qualified employees, and analyzing investments in human capital.

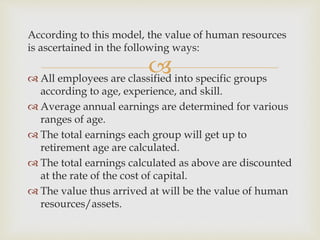

2. Several approaches to valuing human resources are described, including historical cost, replacement cost, and opportunity cost models. Specific models like the Lev and Schwartz model and Eric Flamholtz model are also covered.

3. The limitations of HRA are that there is no set methodology, how to record values in financial statements is unclear, and tax laws do not recognize people as assets.