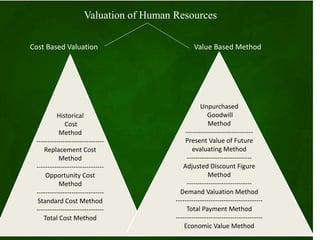

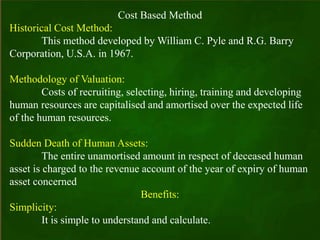

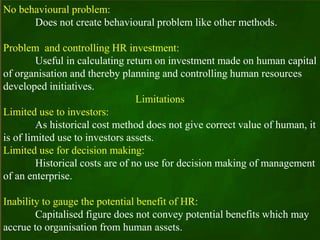

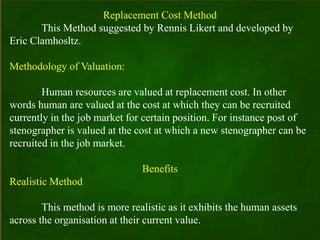

This document provides an overview of human resource accounting. It discusses various methods for valuing human resources as assets, including historical cost, replacement cost, opportunity cost, standard cost, and total cost methods. It also covers value-based methods such as unpurchased goodwill, present value of future earnings, adjusted discount figure wage, reward valuation, net benefit, total payment, and economic value methods. The objectives, advantages, and limitations of human resource accounting are also summarized.