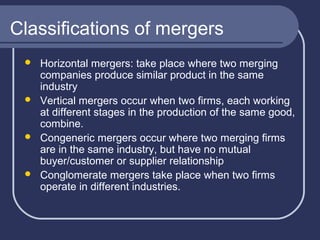

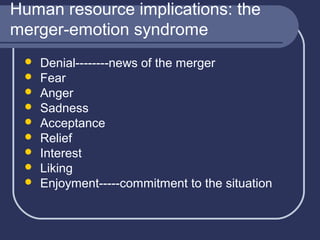

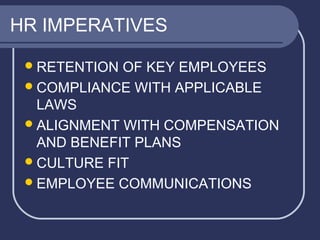

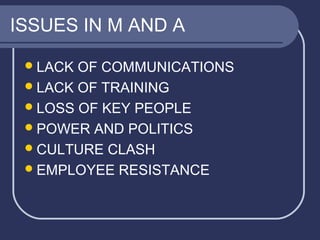

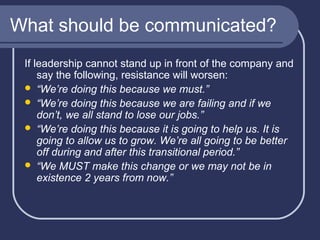

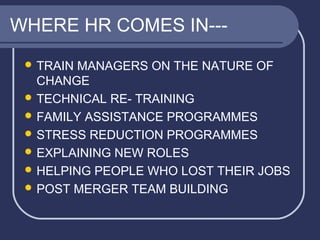

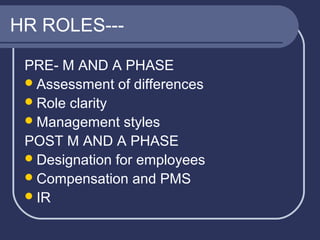

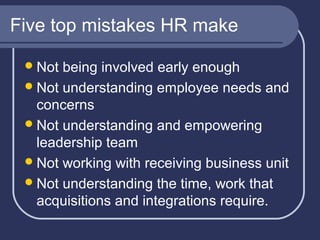

This presentation provides an overview of mergers and acquisitions (M&A). It defines mergers as a combination of two firms on an equal basis, while acquisitions involve one firm purchasing a controlling stake in another. Mergers can be horizontal, vertical, congeneric, or conglomerate. Cultural and organizational fit are important factors in M&A success or failure. Human resources play a key role by managing communications, training, retention of key employees, and addressing cultural clashes post-merger. Common mistakes include lack of early HR involvement, understanding employee needs, empowering leadership, and appreciating the time required for integration.