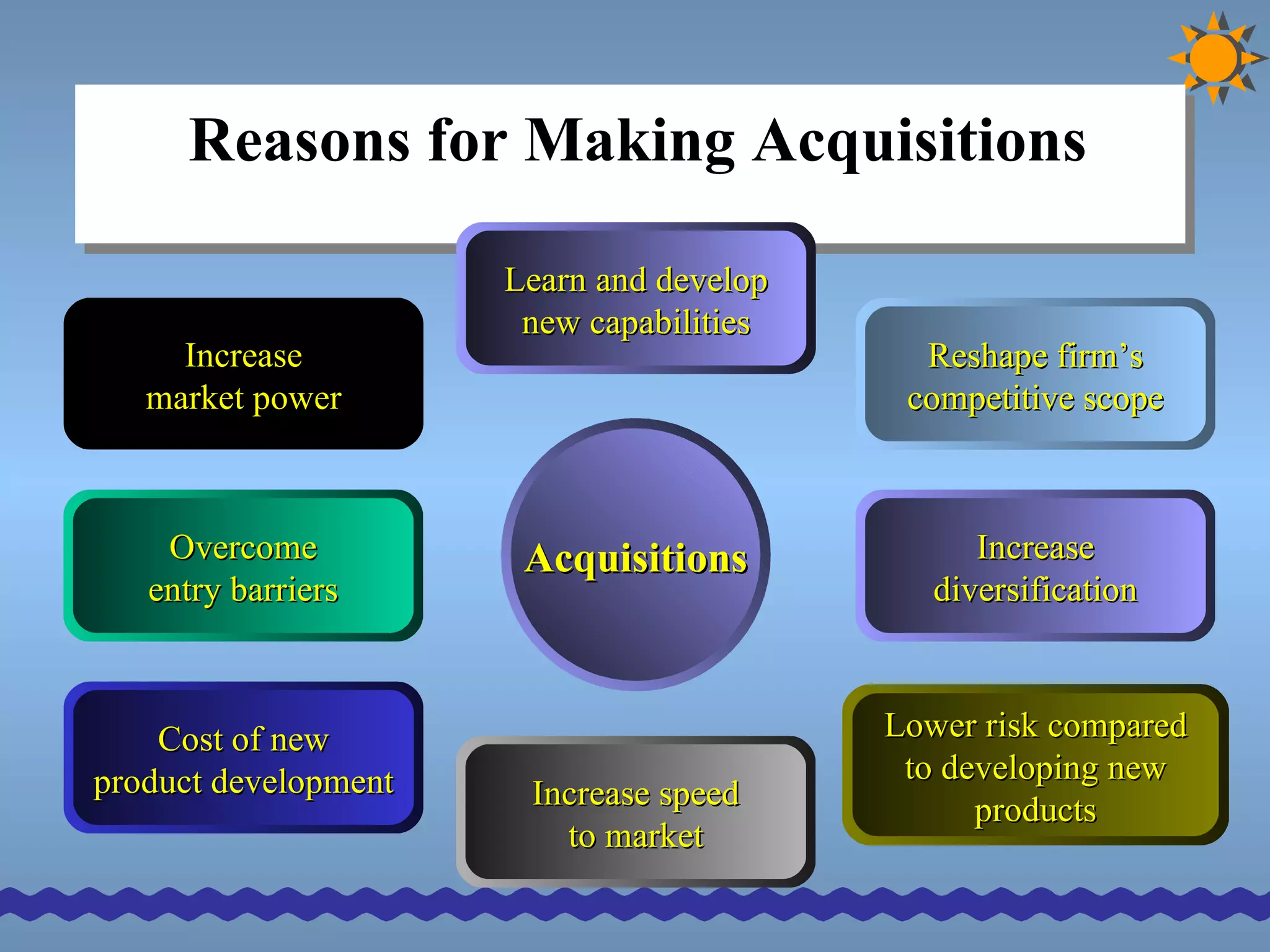

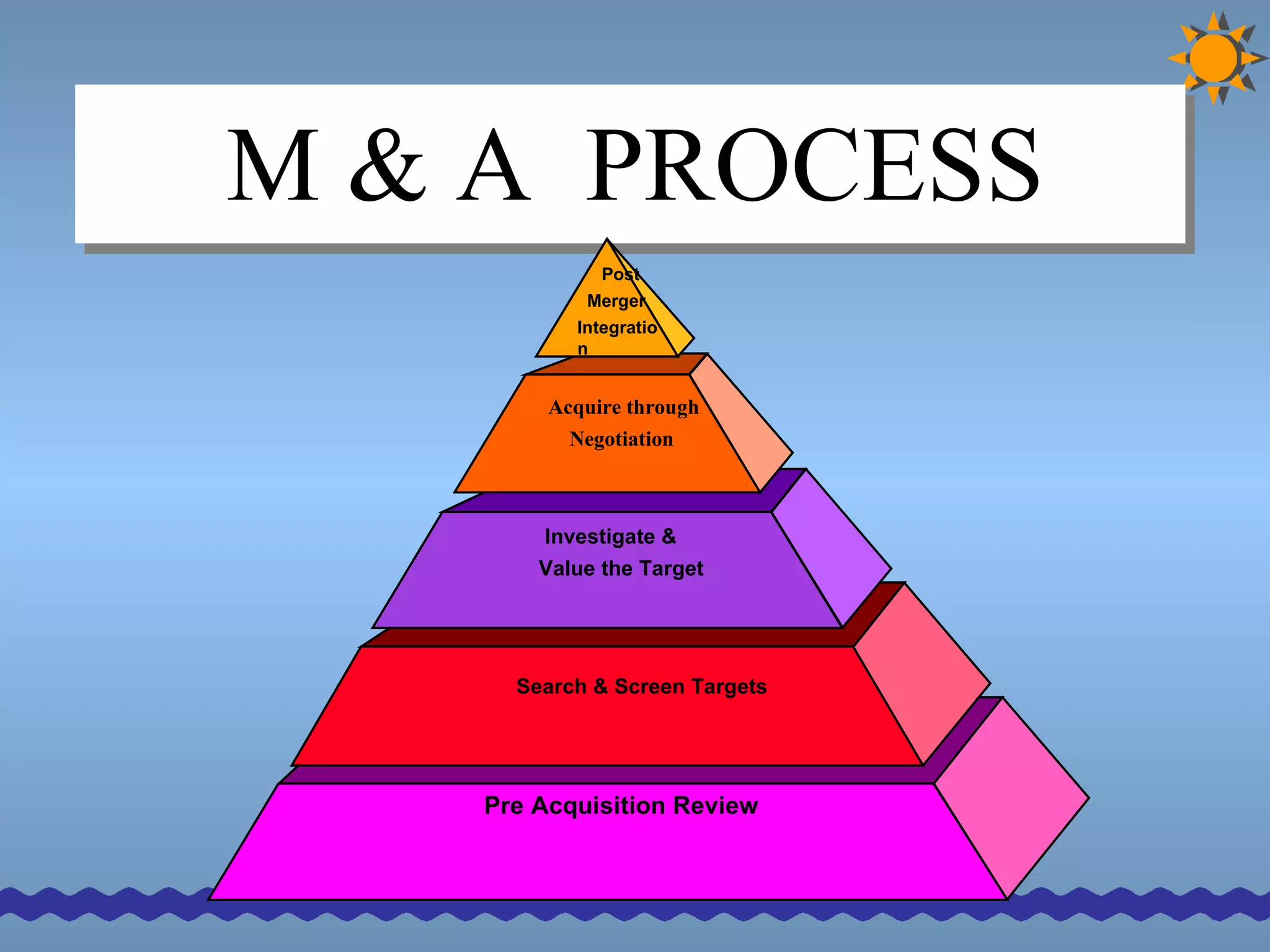

Mergers and acquisitions can occur for several strategic and financial reasons. There are three main types of mergers: horizontal, vertical, and conglomerate. A merger happens when two companies combine, while an acquisition occurs when one company purchases another. Successful mergers and acquisitions require thorough planning and integration of the combining organizations.