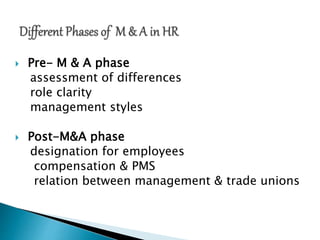

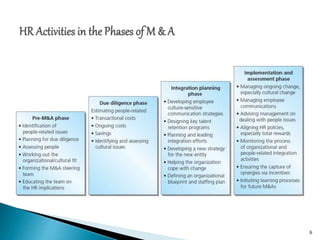

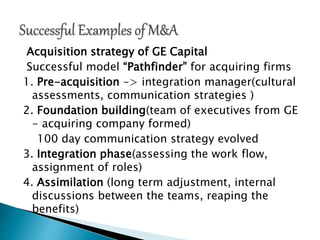

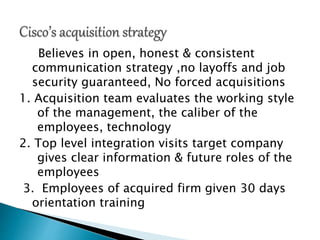

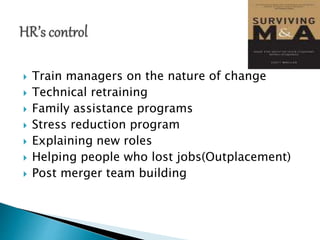

The document discusses several key factors for successful mergers and acquisitions including managing cultural differences between companies, retaining key employees, ensuring compliance with laws, aligning compensation plans, assessing cultural fit, and clear communication. It provides details on GE Capital's acquisition strategy which includes appointing integration managers, forming executive teams from both companies, developing a 100 day communication strategy, assessing workflows during integration, and providing long-term adjustment and discussions. The strategy focuses on open communication, job security, and orientation training for acquired employees.