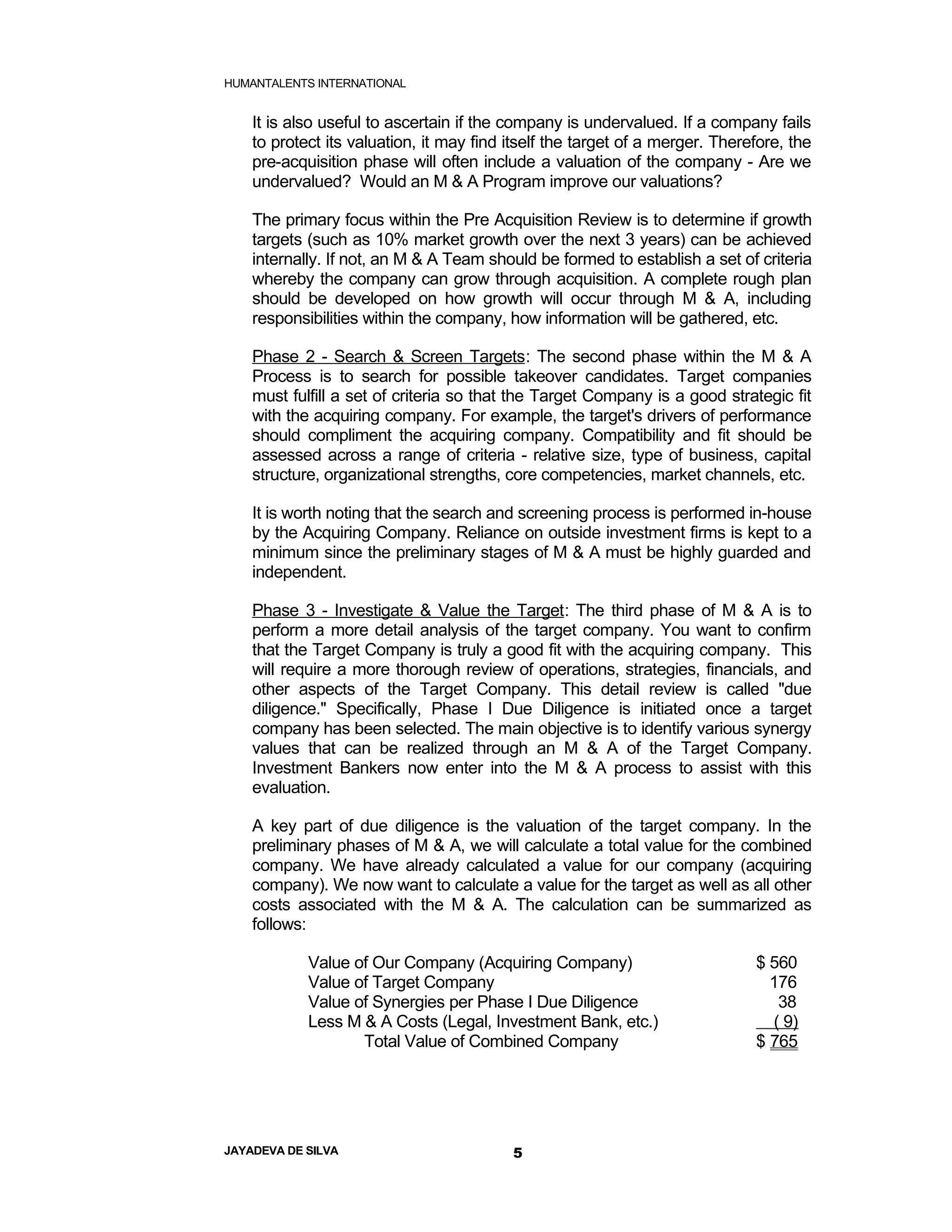

This document provides an overview of mergers and acquisitions (M&A) and common HR challenges. It discusses the basic concepts of M&A, including definitions of mergers and acquisitions. It also outlines reasons for M&A such as gaining synergies through reduced costs and expanded market access. Additionally, it describes the overall M&A process in five phases from pre-acquisition review to post-acquisition integration. HR challenges can arise during M&A from changes in company culture, leadership, and redundancy of roles which must be carefully managed.