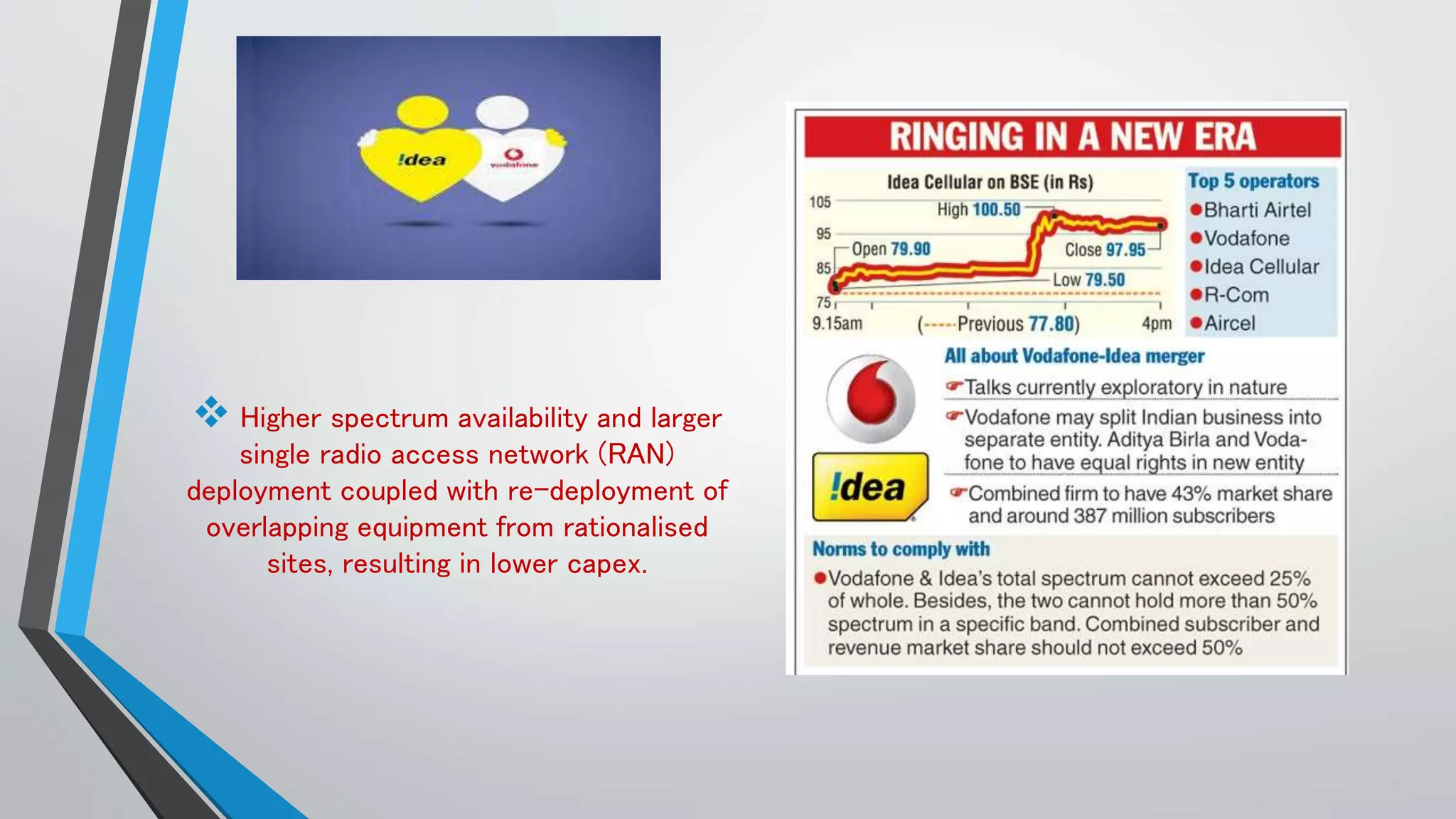

The document discusses mergers and acquisitions in the telecom industry. It provides details about the merger between Vodafone India and Idea, two major telecom companies in India. Vodafone is a large multinational telecom company headquartered in London, with mobile operations in 26 countries. Idea is the third largest wireless operator in India, headquartered in Mumbai. The document then discusses some of the top mergers and acquisitions that have occurred in the telecom industry.

![About idea

• Idea Cellular Limited

• IndustryTelecommunicationsFounded1995;

22 years ago

• Headquarters Mumbai .

• IndiaKey people:KumarMangalamBirla

(Chairman)

• Products Mobile telephony, wireless

broadbandRevenue ₹354

billion (US$5.5 billion) (2016)Net income

•Idea cellular is the 3rd largest

wireless operator in india.

•Listed in national stock

exchange(nse) and bombay stock

exchange (bse) in india.

•Part of Adithiya Brila Group,

•an Indian mobile network

operator based

in Mumbai, Maharashtra.

•Idea is a pan-India integrated

GSM operator offering 2G, 3G and

4G mobile services.

• Idea has 193.96 million

subscribers as of 31 July 2017.[3]](https://image.slidesharecdn.com/topmergersacquisitionsintelecomindustry-171213154119/75/Top-mergers-acquisitions-in-telecom-industry-33-2048.jpg)