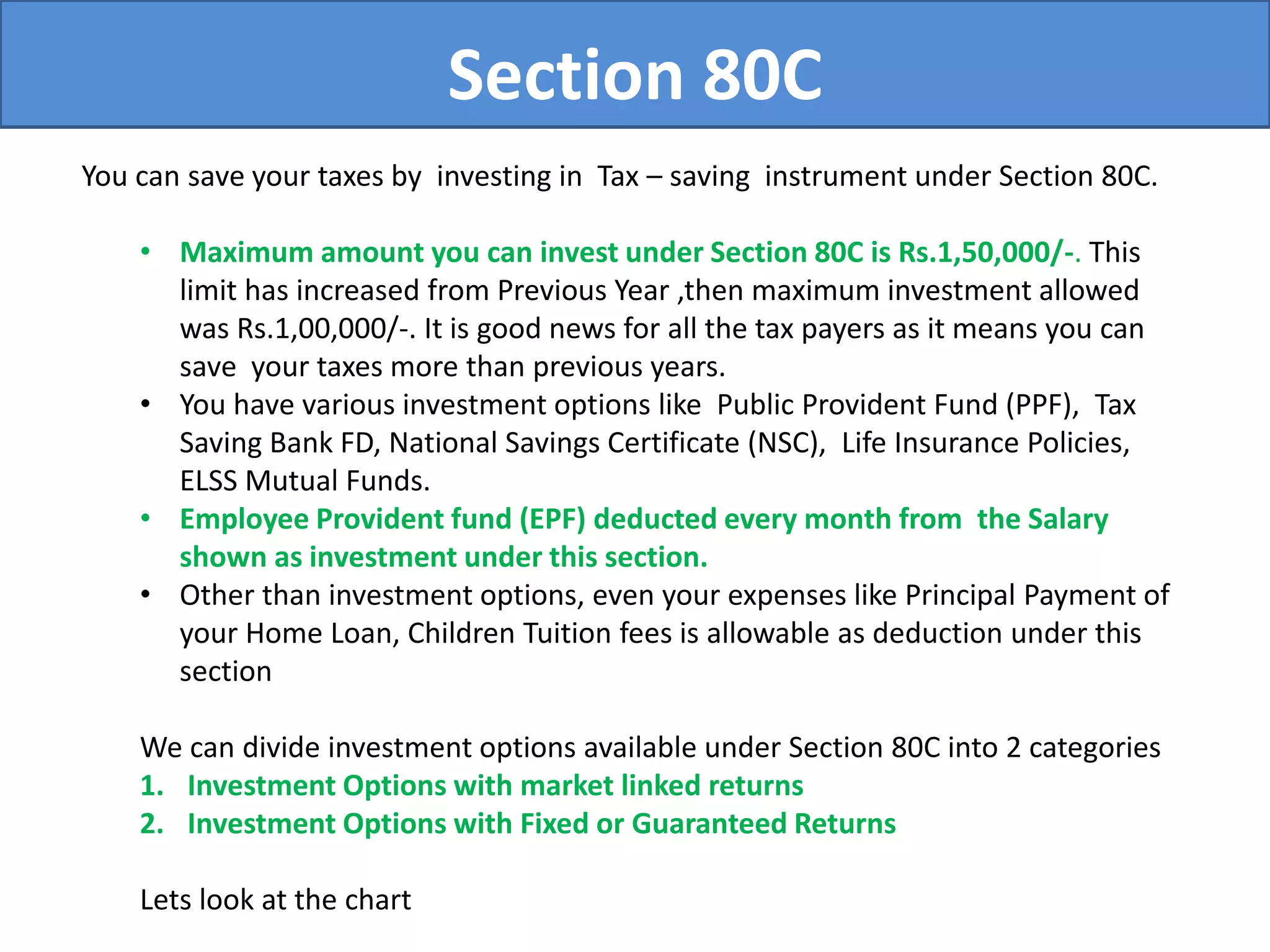

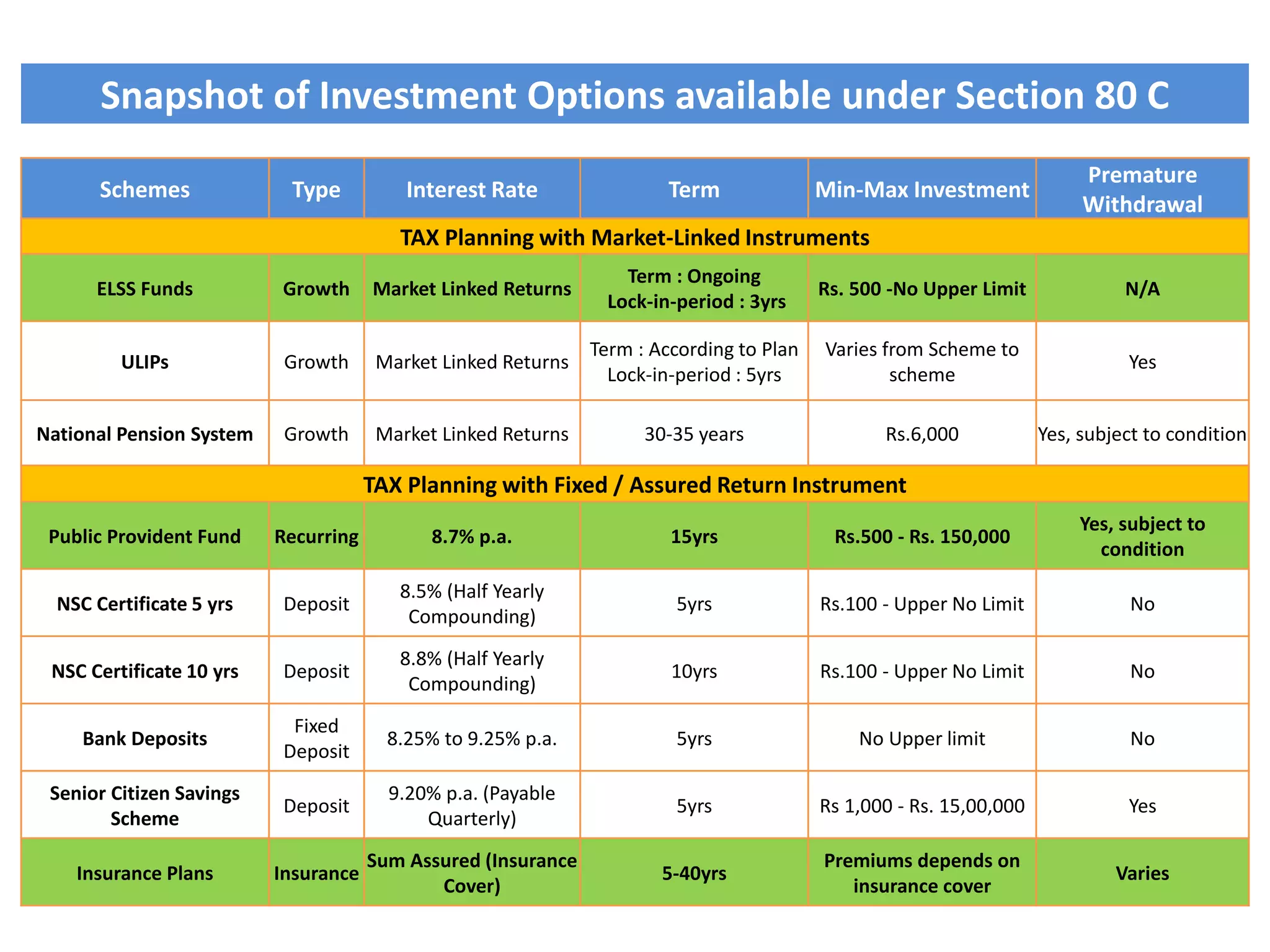

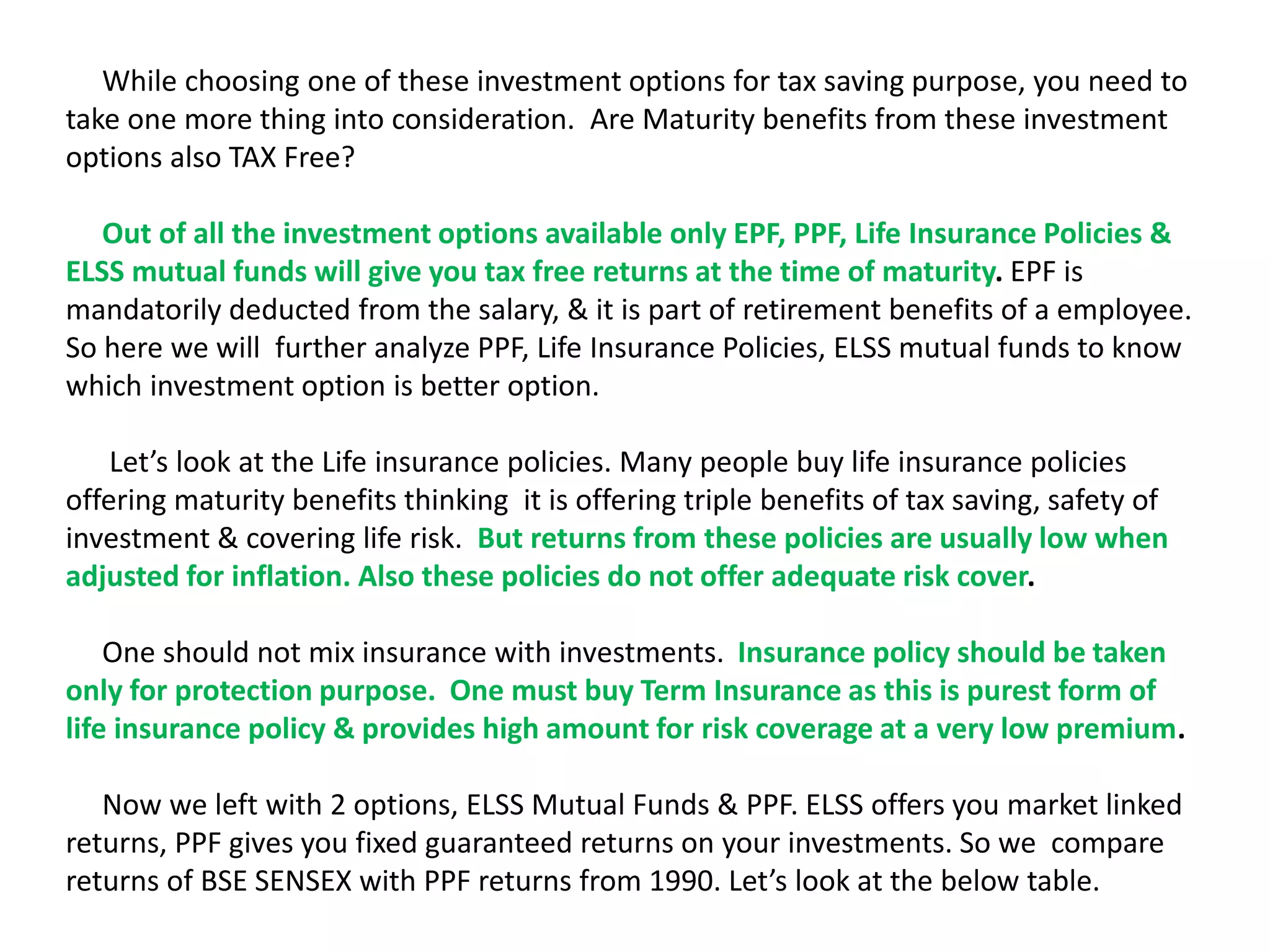

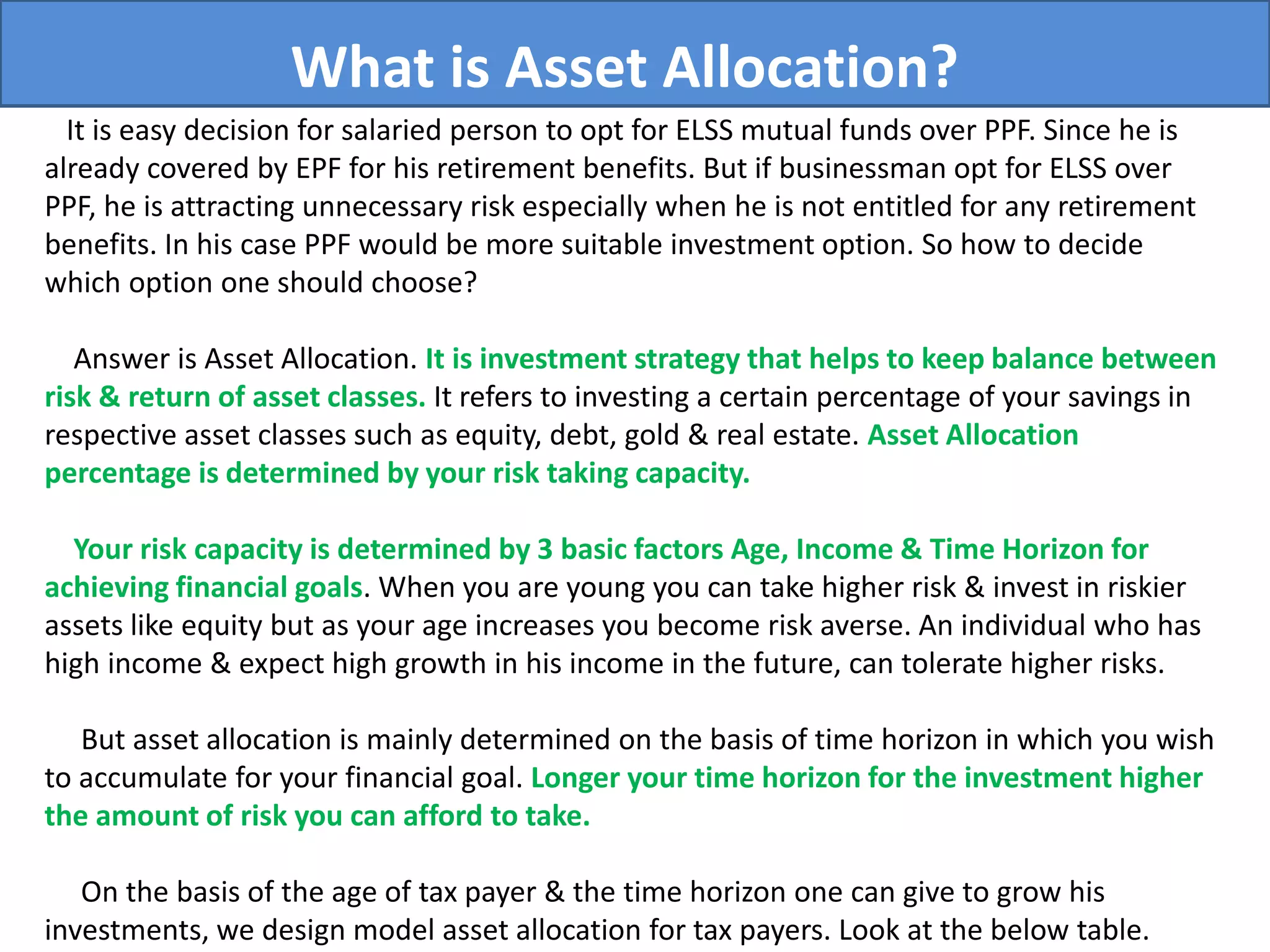

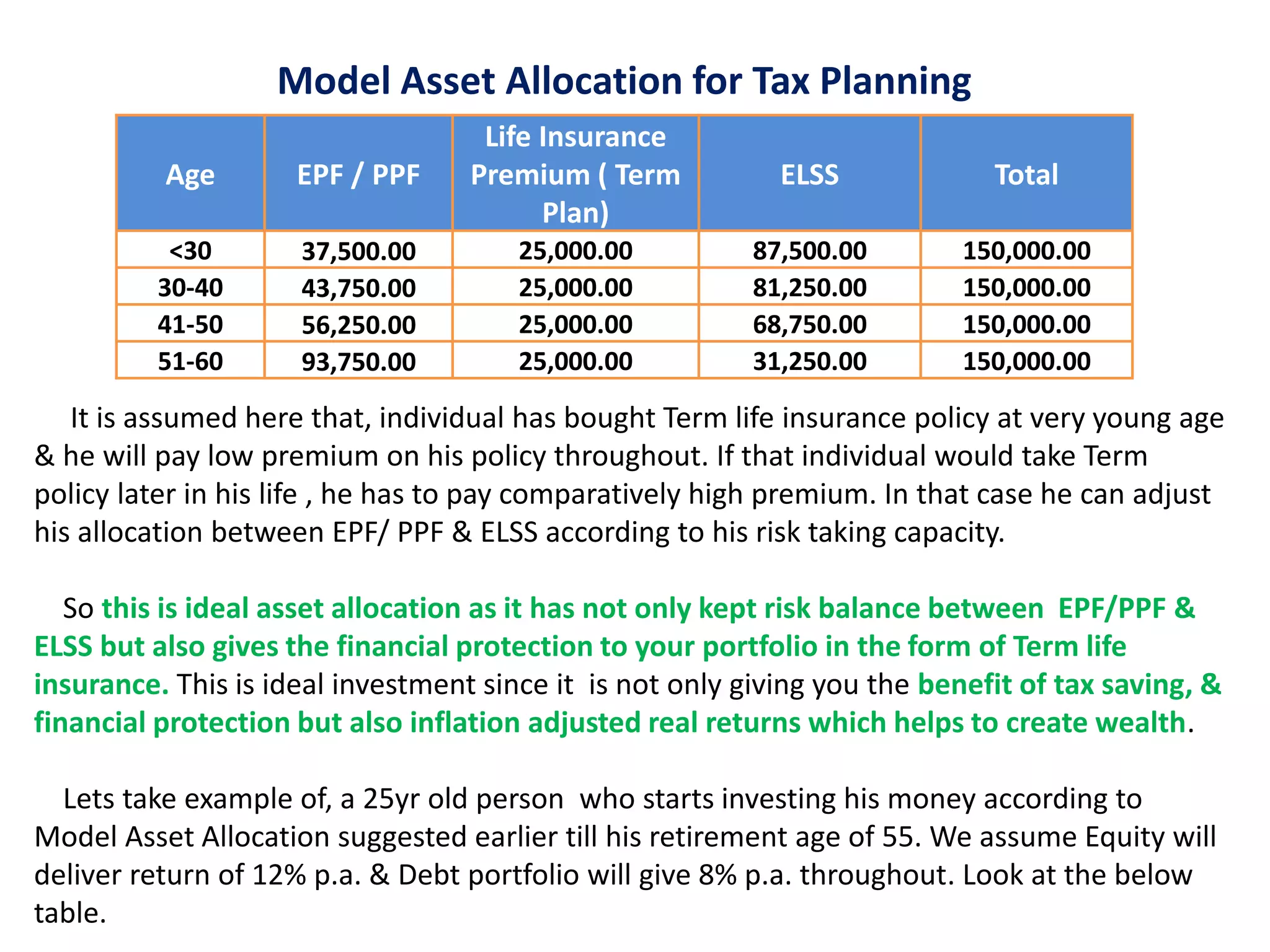

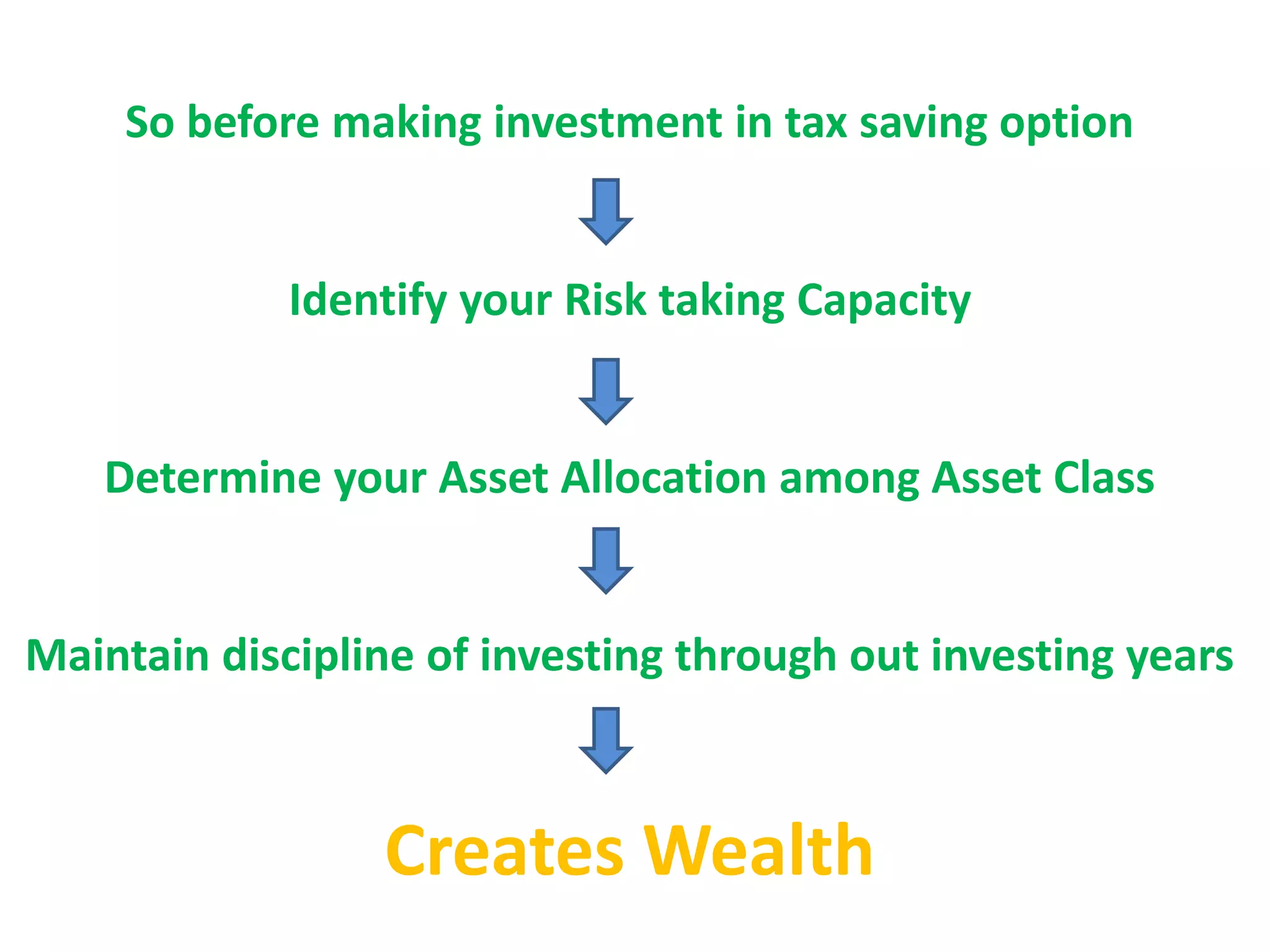

The document discusses tax planning strategies for FY 2017-18, emphasizing the importance of understanding income tax slabs and the potential tax-saving instruments under Section 80C, such as PPF, ELSS mutual funds, and life insurance. It explains the differences between market-linked and fixed-return investment options, advocating for asset allocation based on individual risk tolerance and life stage. The document concludes that disciplined investing and proper asset allocation can lead to wealth creation while optimizing tax benefits.