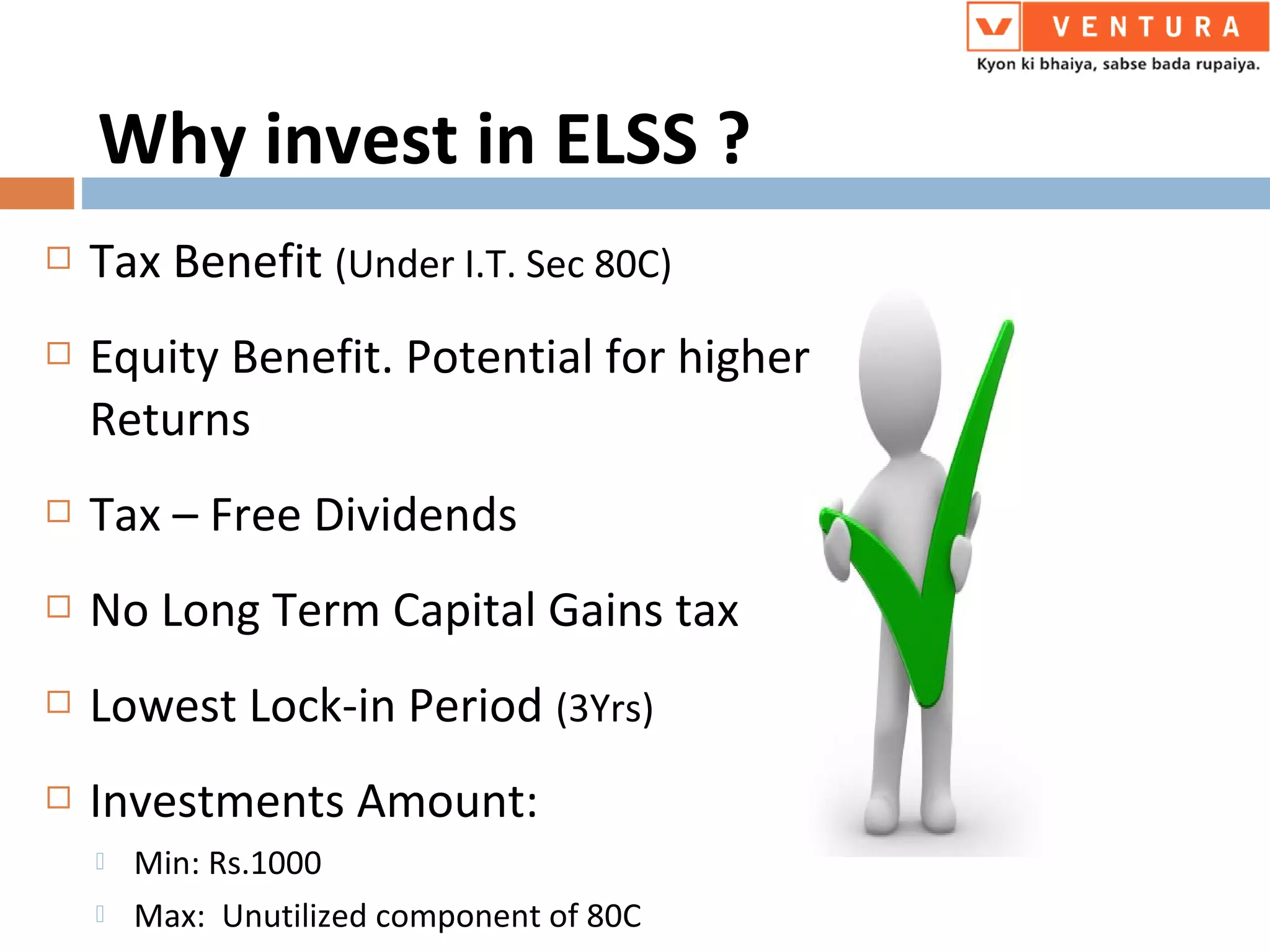

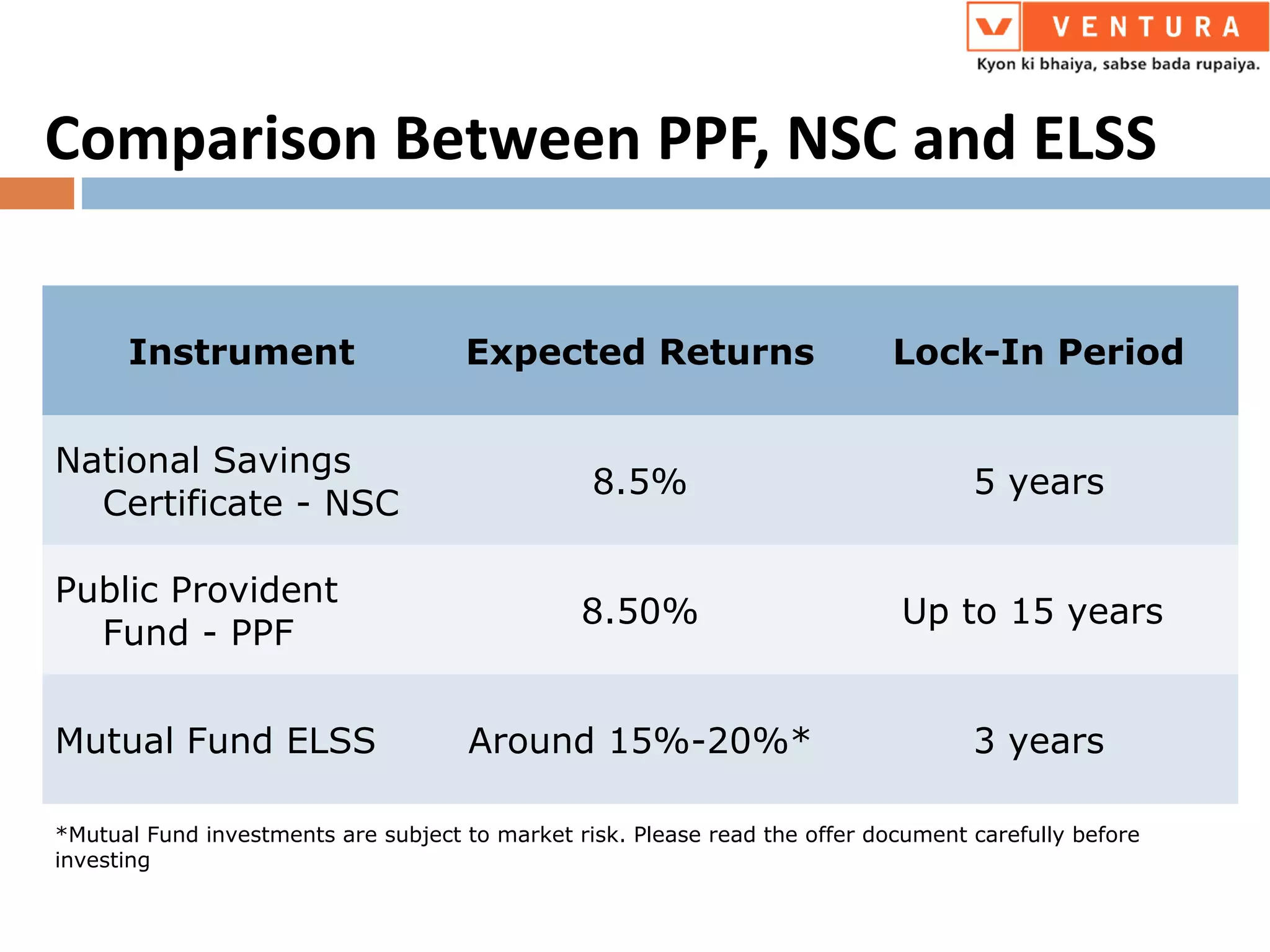

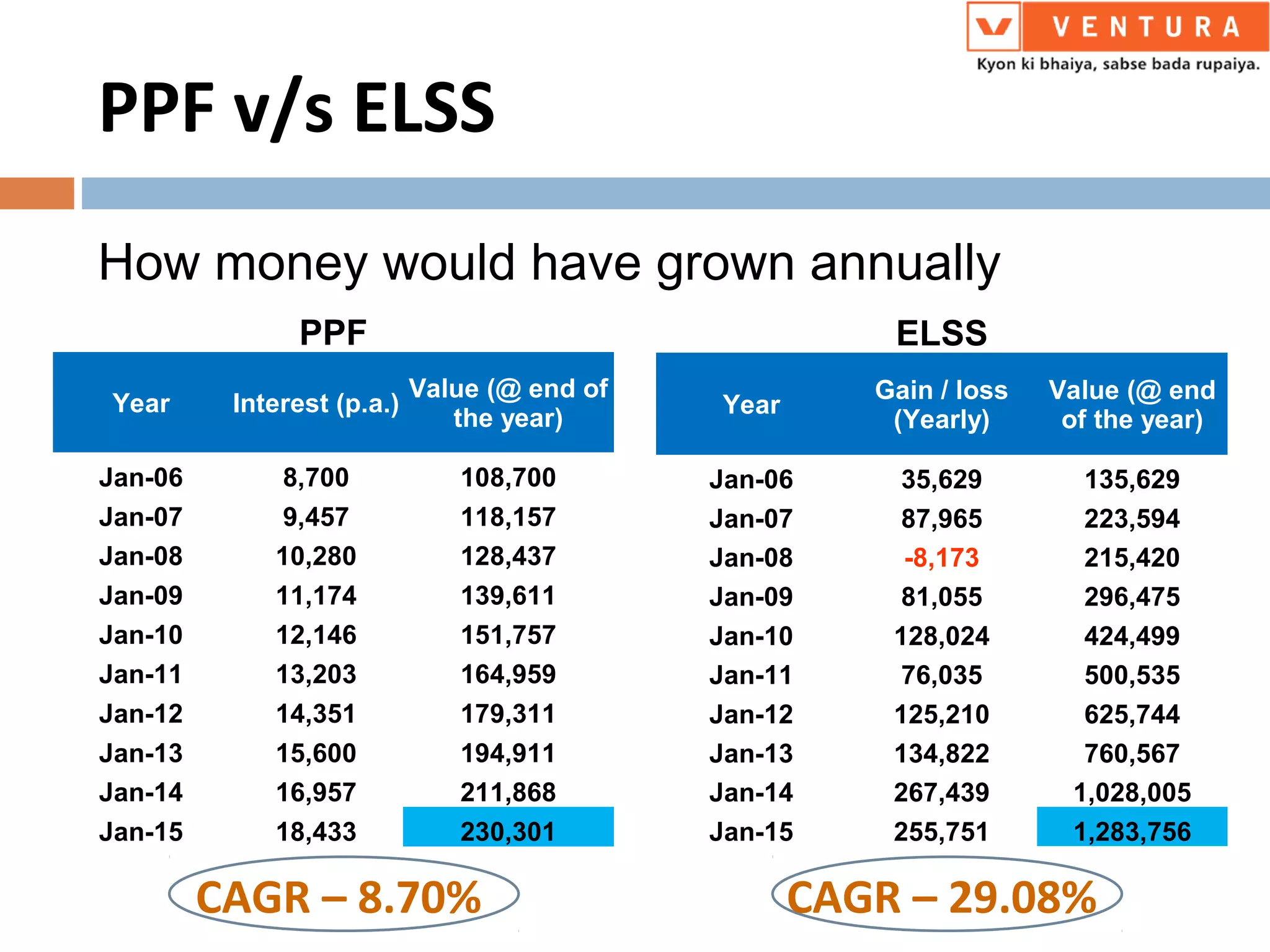

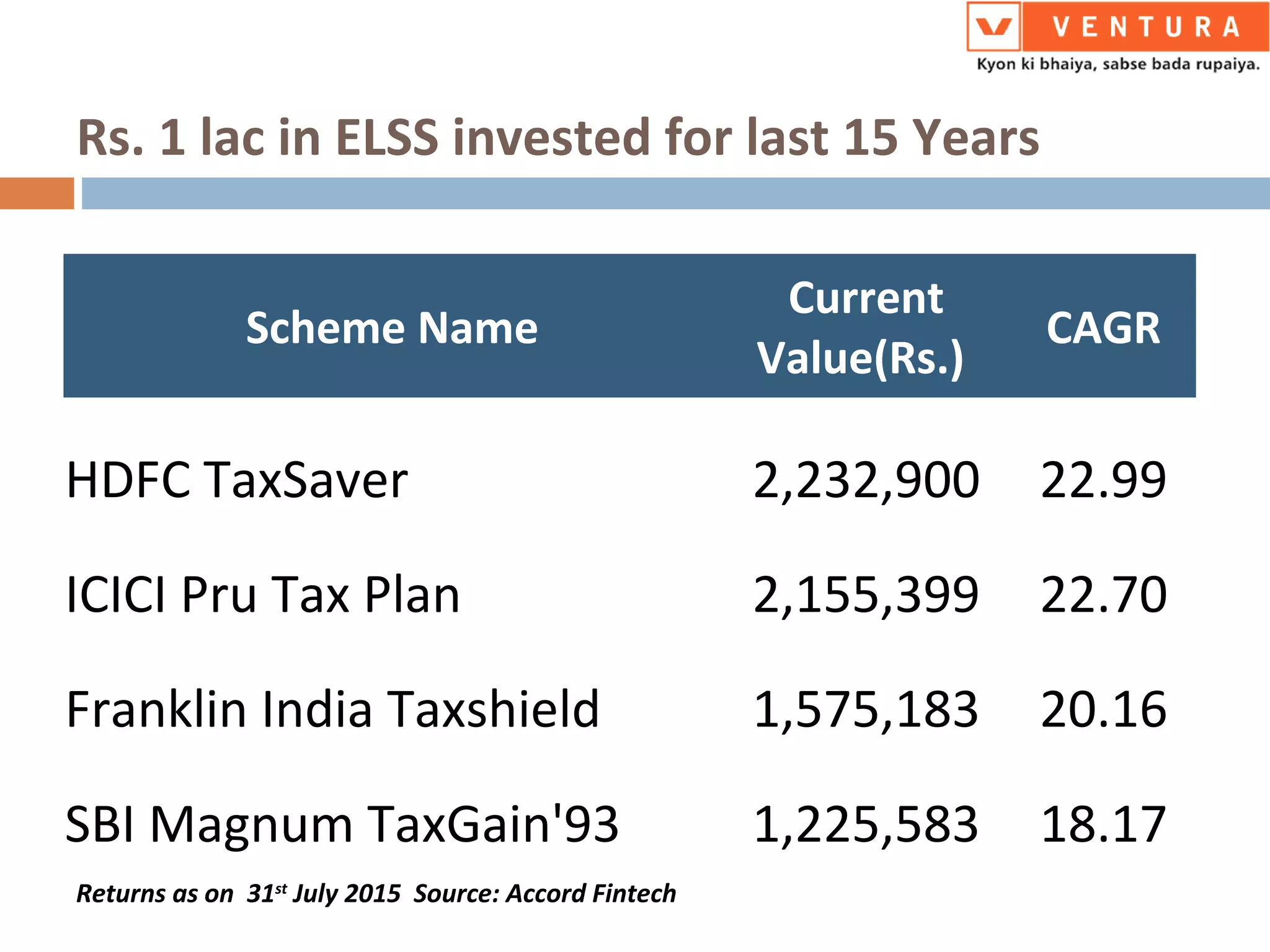

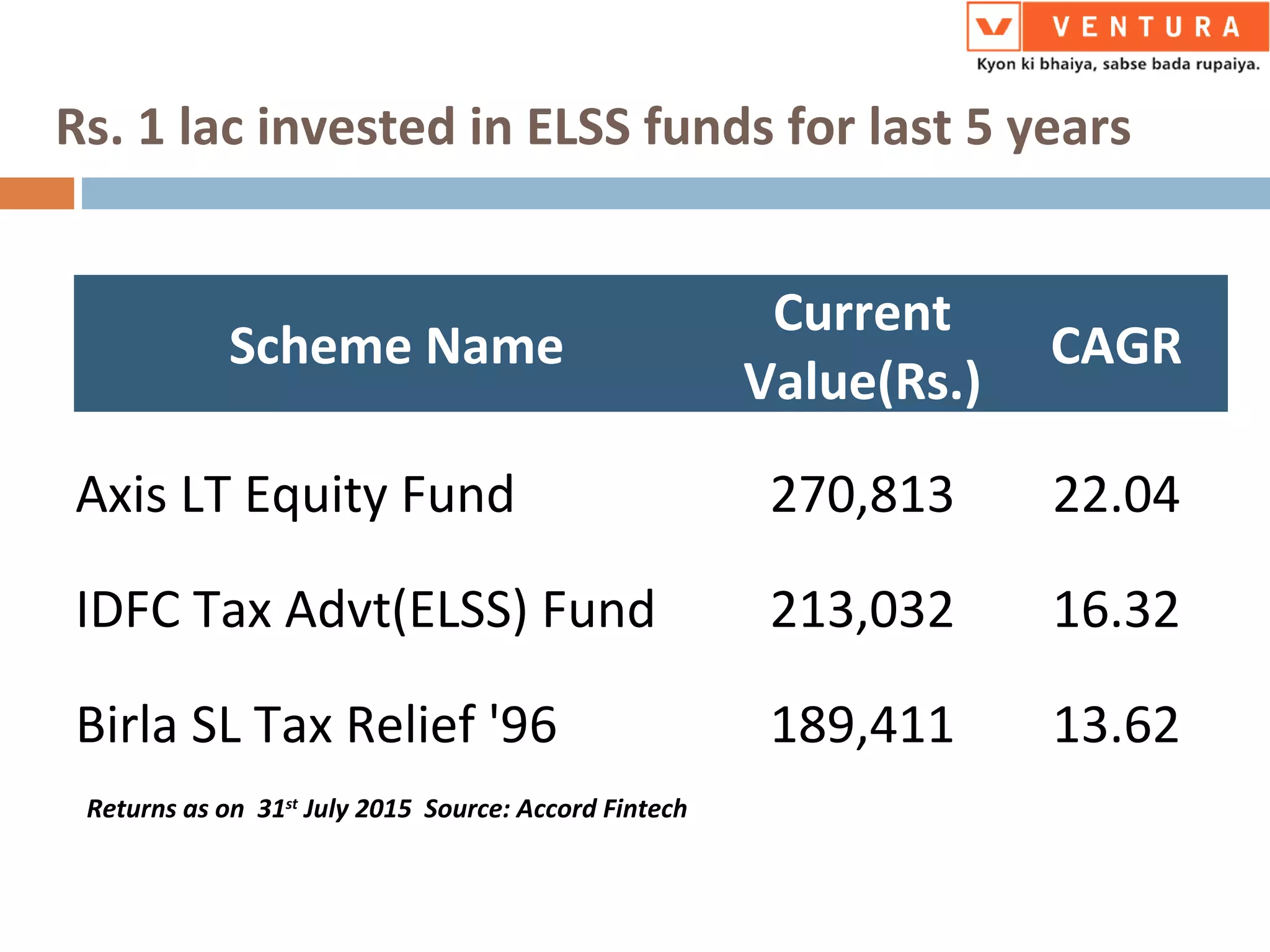

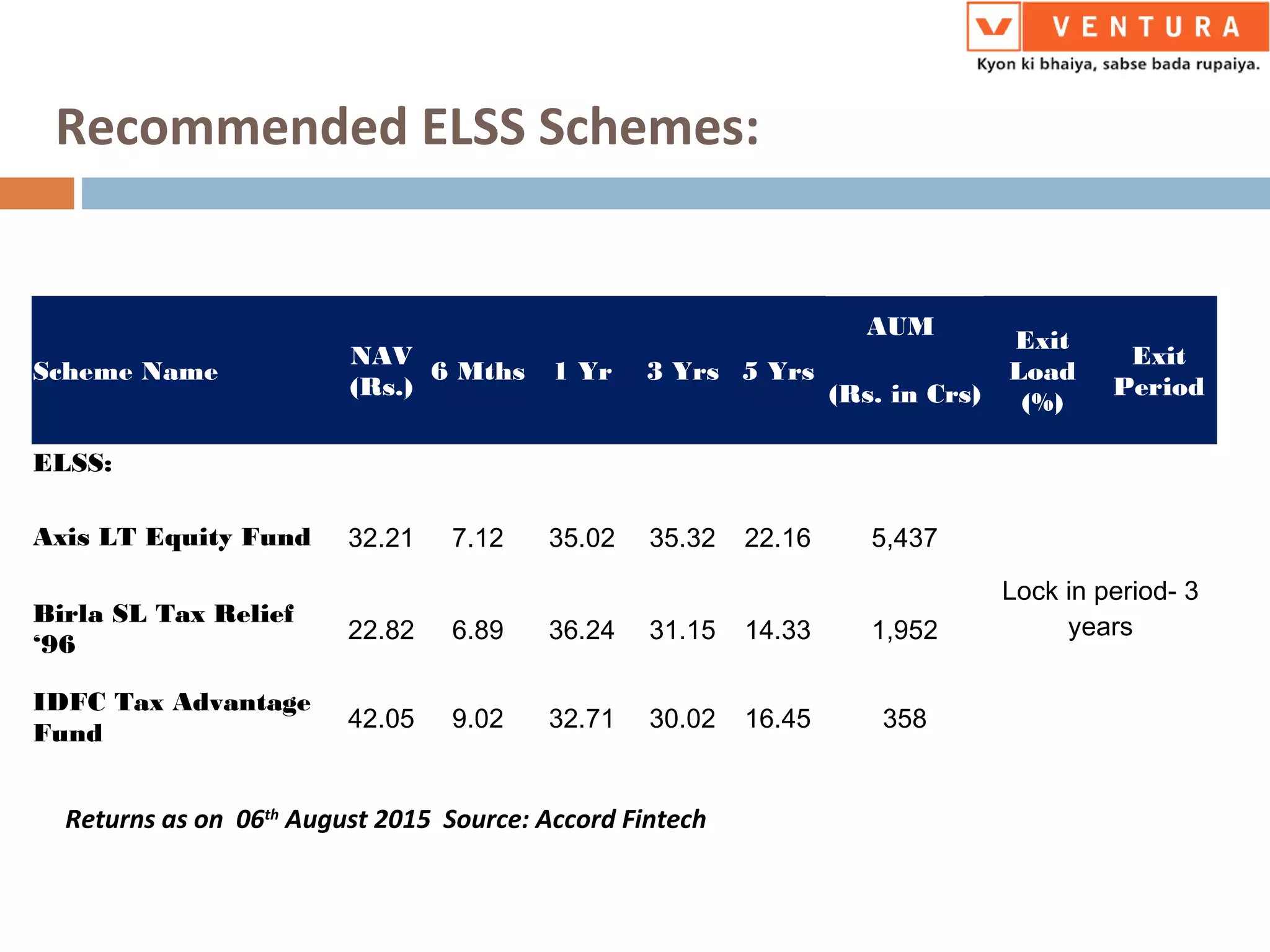

Equity Linked Savings Schemes (ELSS) are mutual funds that offer tax deductions under section 80C of the Income Tax Act, allowing investments up to Rs. 1.5 lakhs with a minimum investment of Rs. 1,000 and a lock-in period of three years. ELSS has the potential for higher returns, averaging around 15%-20%, compared to traditional savings schemes like PPF and NSC, which yield around 8.5%. Investors are encouraged to invest through Systematic Investment Plans (SIPs) for better growth while managing the required lock-in period.