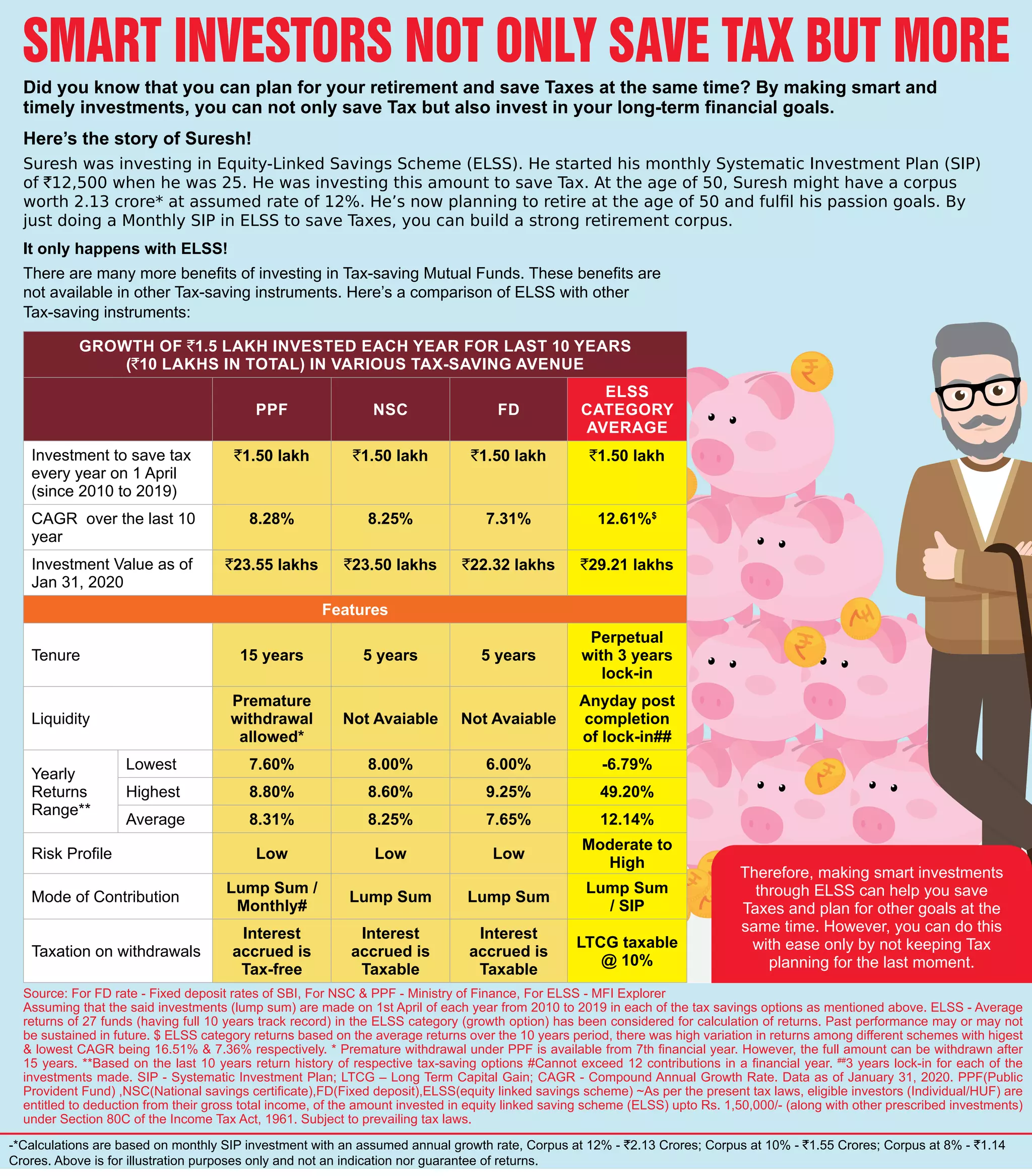

This document discusses how investing in an Equity Linked Savings Scheme (ELSS) can help save taxes while also building a retirement corpus. It shares the story of Suresh, who started an SIP of Rs. 12,500 per month in ELSS at age 25 and was able to accumulate over Rs. 2 crore by age 50. The document also compares the growth and returns of investing Rs. 1.5 lakh annually for 10 years in ELSS versus other tax saving instruments like PPF, NSC and FD, finding that ELSS provided the highest returns. It concludes that making smart long-term investments in ELSS can help save taxes while planning for financial goals, but tax planning should not be left for