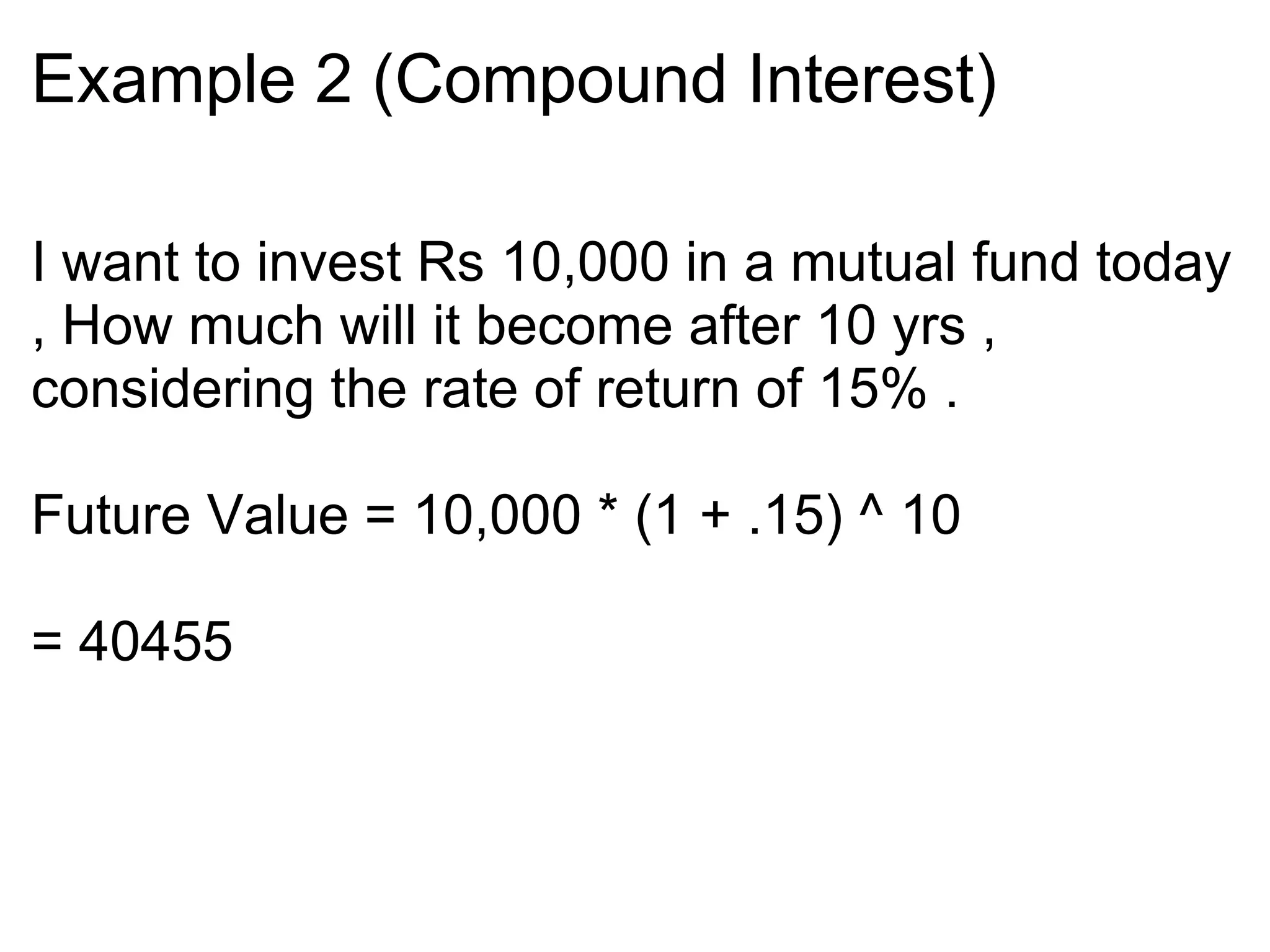

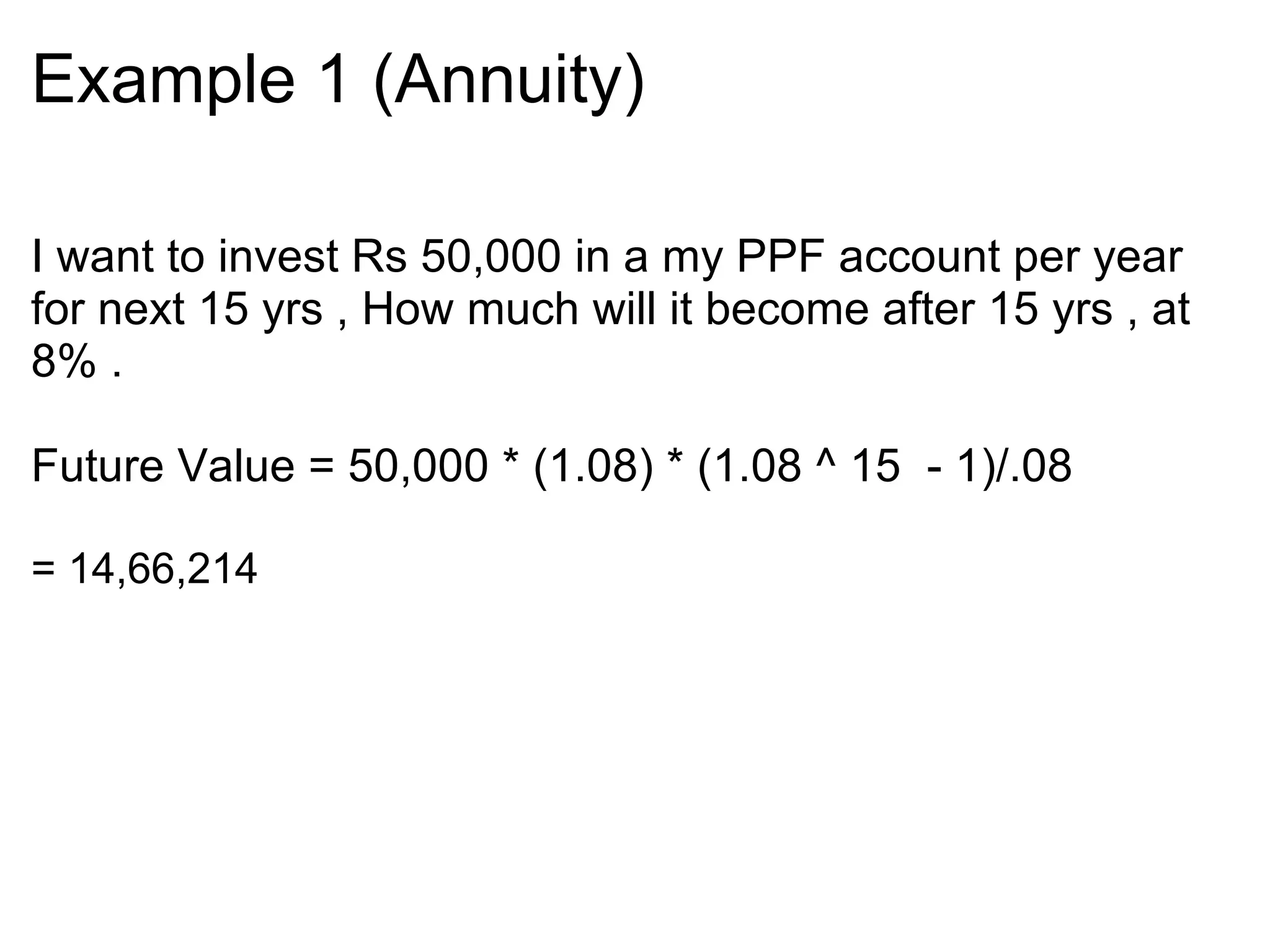

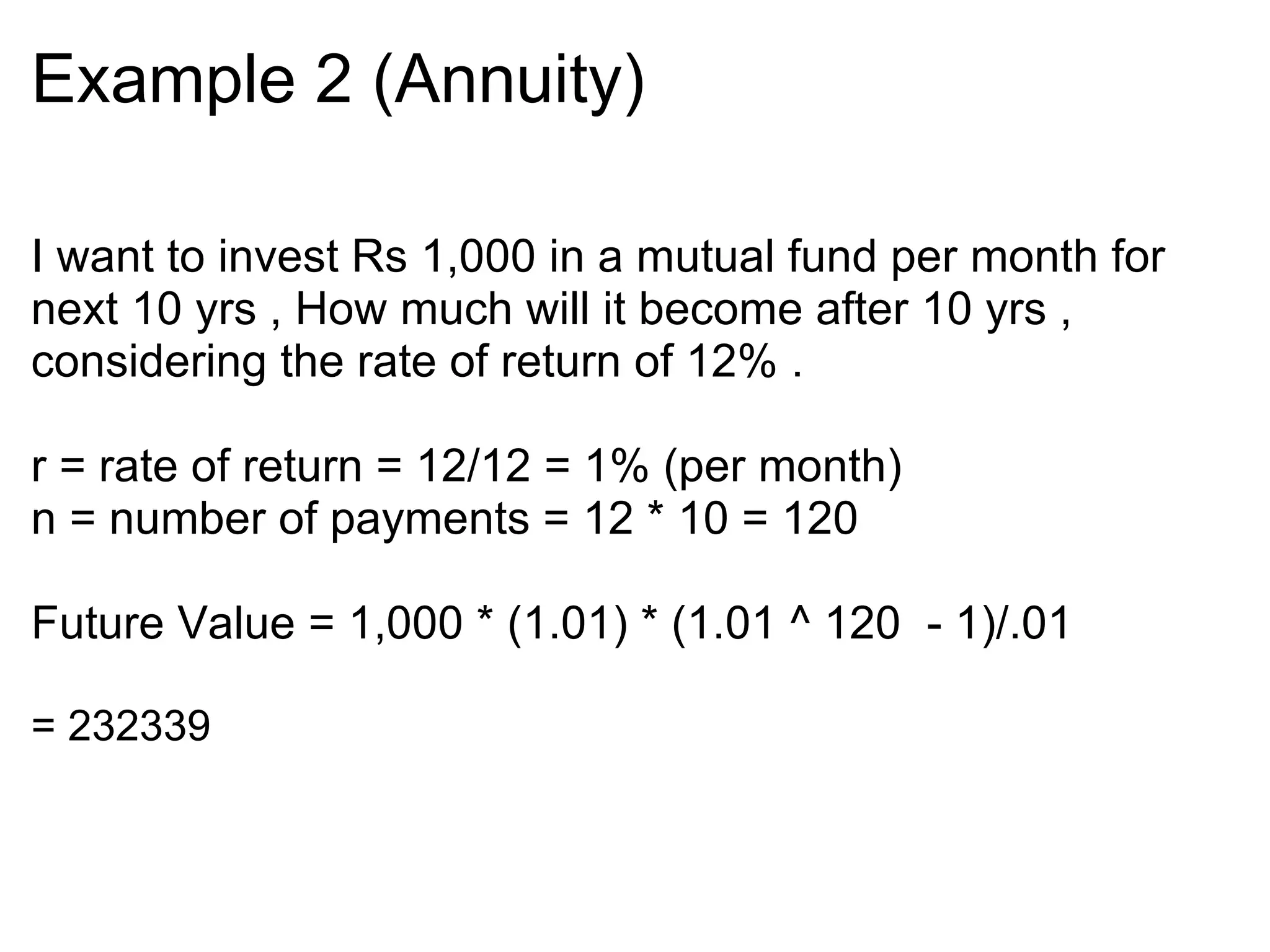

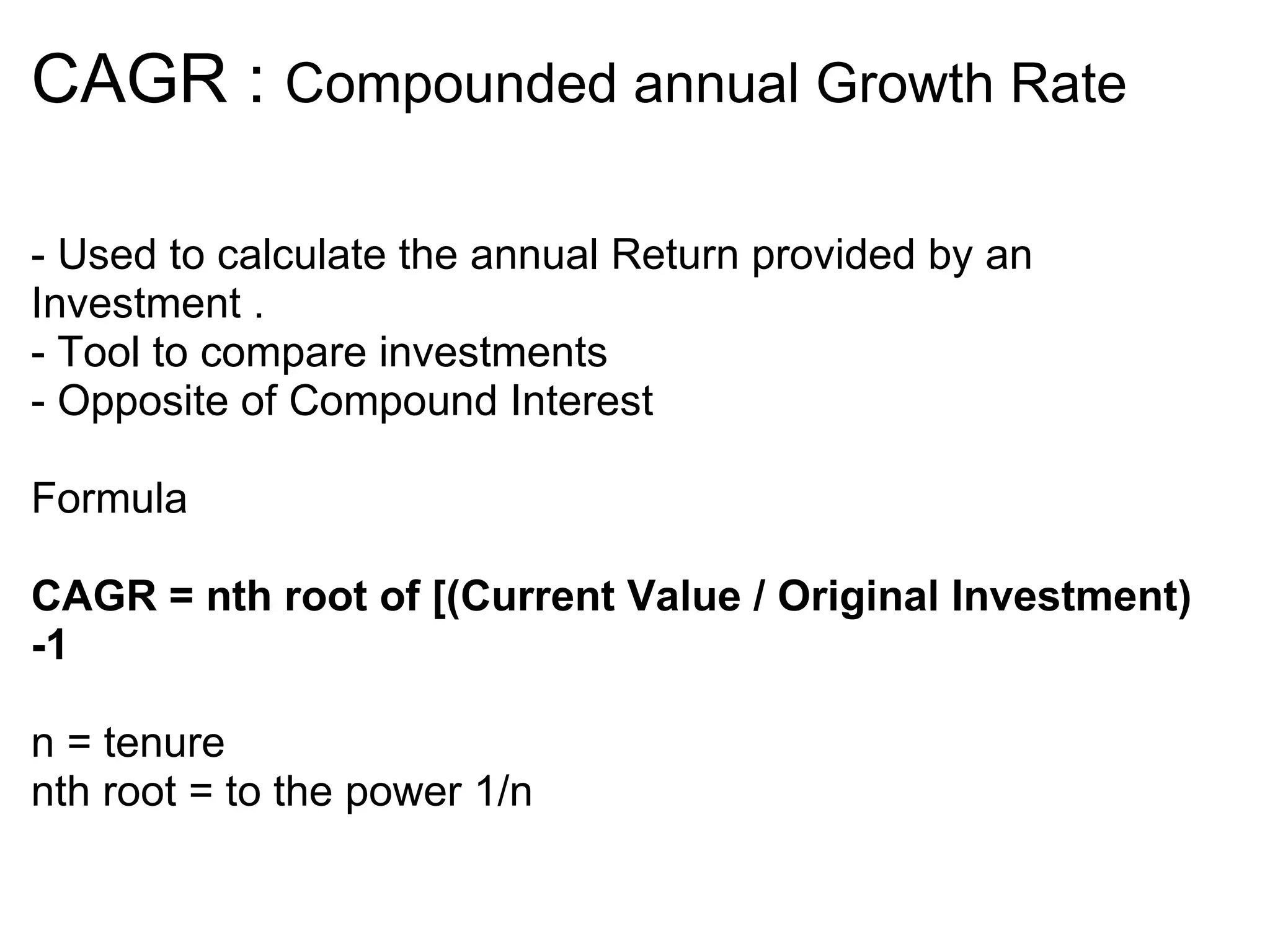

The document outlines key formulas in personal finance including compound interest, annuities, and compounded annual growth rate (CAGR). It provides examples for each formula, illustrating how to calculate future value based on different investment scenarios. The document serves as a practical guide for understanding investment growth over time.

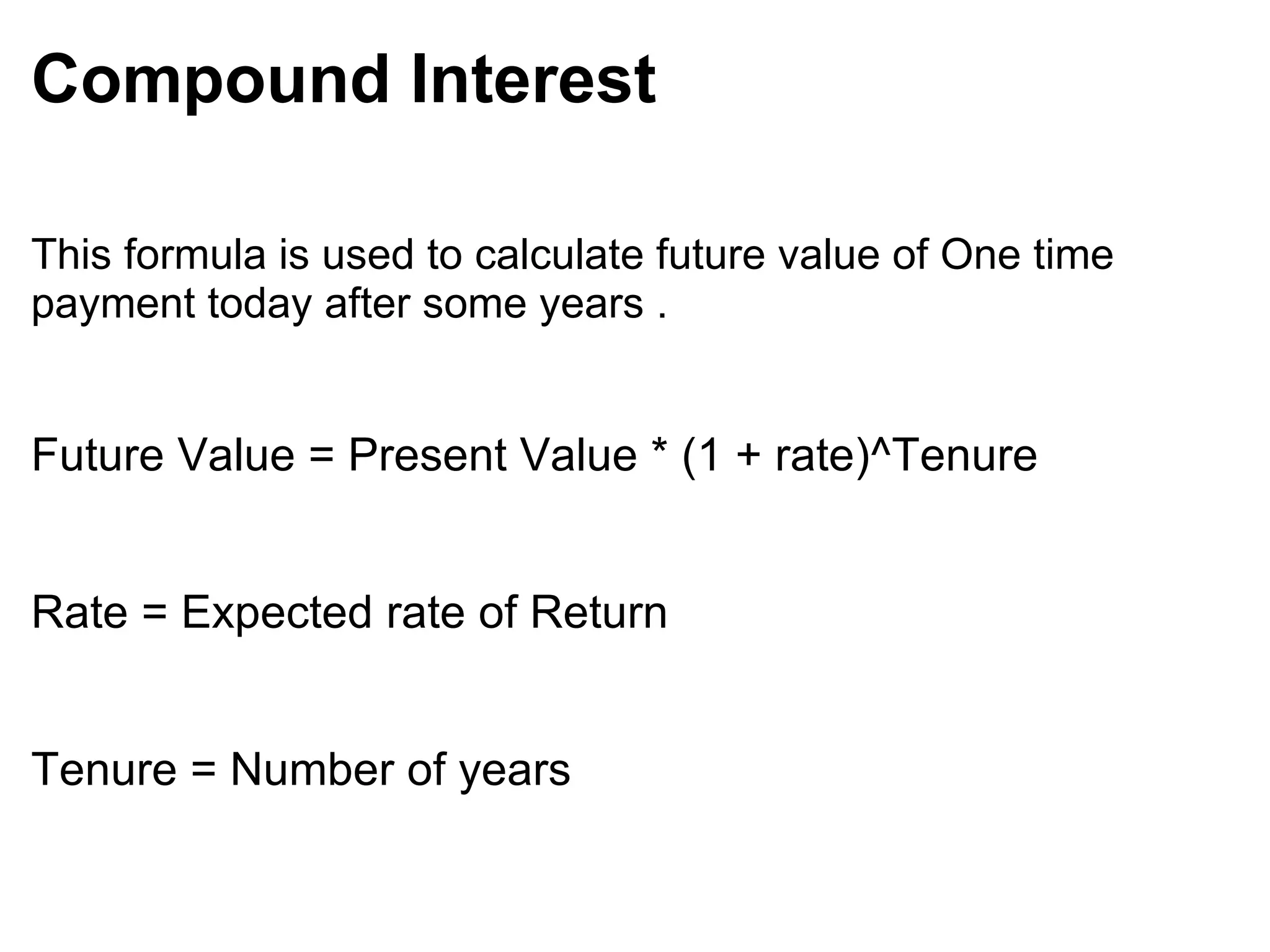

![Annuity This formula is used to calculate the future value when we do investment on a regular basis after a fixed interval . Example - when we invest in a mutual fund per month through SIP . - When we put money in our PPF account each year . Formula Future value = Amount per installment * (1+r) * [(1+r) ^n - 1]/ r](https://image.slidesharecdn.com/importantcalculationsinpersonalfinance-090518094317-phpapp02/75/Important-Calculations-In-Personal-Finance-5-2048.jpg)

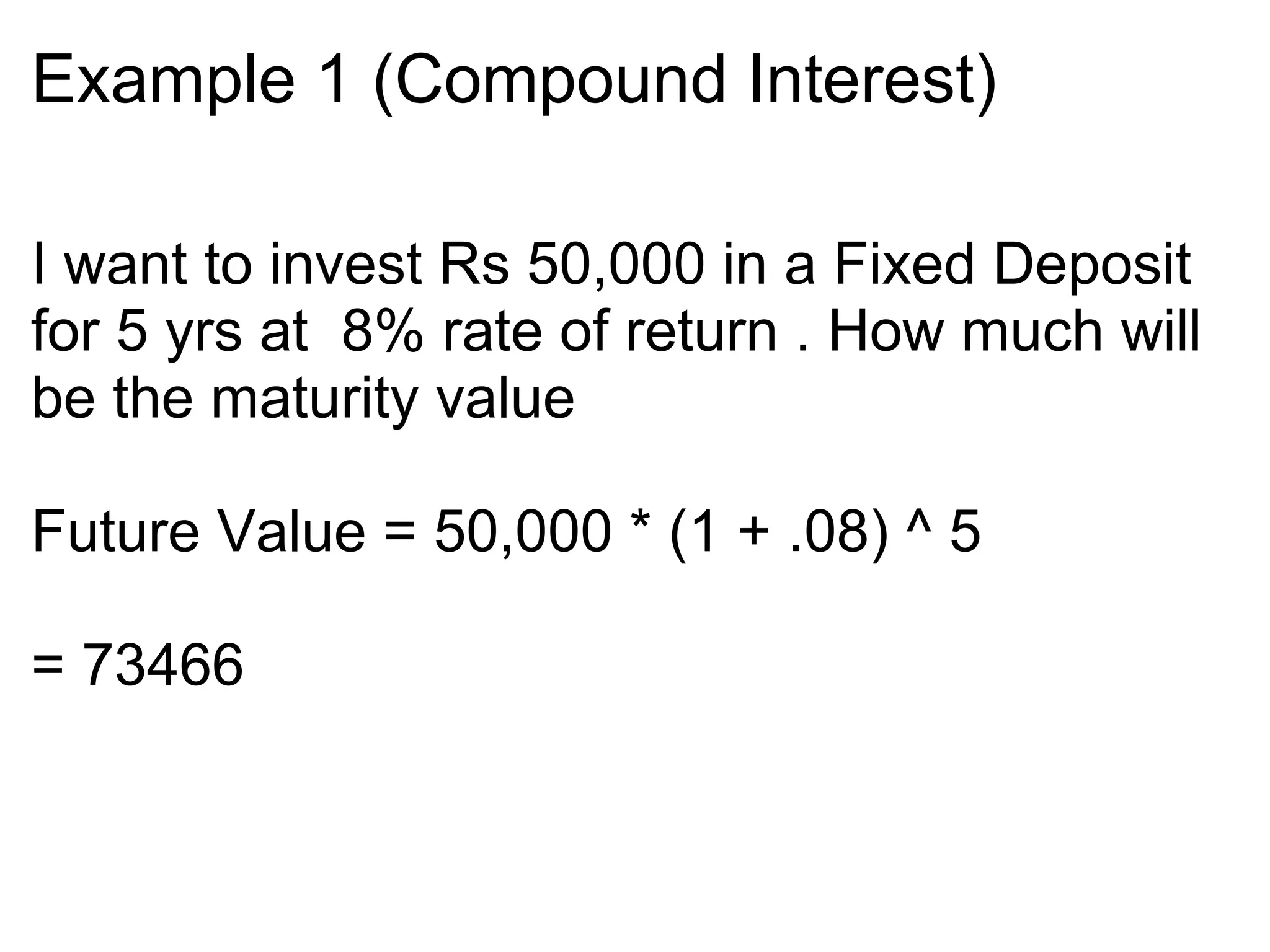

![Example 1 (CAGR) I Invested Rs 50,000 in a mutual fund on June 2005 , Its value after 4 yrs is Rs 1,00,000 . What is the annual returns it has provided to me ? CAGR = [(100000 /50000)^ (1/4) - 1 ] = 2 ^ .25 - 1 = .1892 = 18.92% Annual return](https://image.slidesharecdn.com/importantcalculationsinpersonalfinance-090518094317-phpapp02/75/Important-Calculations-In-Personal-Finance-9-2048.jpg)

![Example 2 (CAGR) Which investment is Better ? Investment 1 : 50,000 invested in 2000 became 2,00,000 in 2009 Investment 2 : 10,000 invested in 2004 became 25,000 in 2008 CAGR for Investment 1 = [200000/50000]^(1/9) - 1 = 16.65 % CAGR for Investment 2 = [25000/10000] ^ (1/4) - 1 = 25.74% Hence , Investment 2 is better than Investment 1 .](https://image.slidesharecdn.com/importantcalculationsinpersonalfinance-090518094317-phpapp02/75/Important-Calculations-In-Personal-Finance-10-2048.jpg)