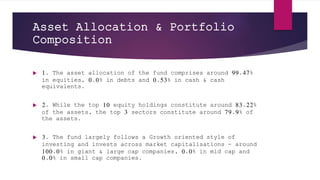

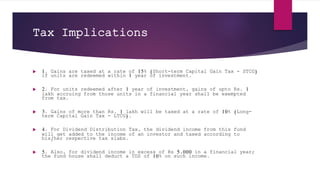

The document discusses whether Muslims can invest in the stock market and provides information about the Nippon India ETF Shariah BeES fund. It outlines the fund's objective to generate returns matching the Nifty Shariah Index, its asset allocation of over 99% in equities, and its top 10 equity holdings constituting 83% of assets. Tax implications for the fund include capital gains tax of 15% for holdings under 1 year and 10% for over 1 year.