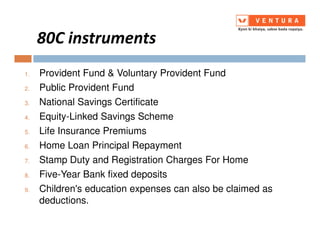

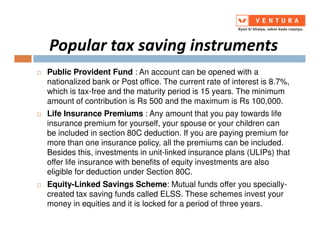

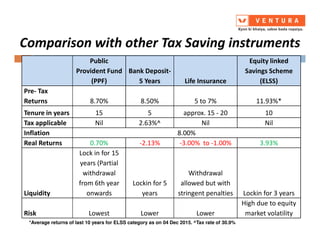

1) The document discusses various tax saving instruments available under Section 80C of the Indian Income Tax Act such as Public Provident Fund, life insurance premiums, equity-linked savings schemes (ELSS), and others.

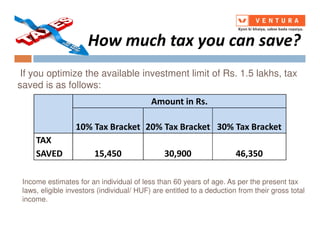

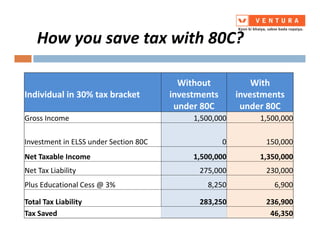

2) It provides details on the tax benefits of investing up to Rs. 1.5 lakhs annually via Section 80C, highlighting that those in the 30% tax bracket can save up to Rs. 46,350 in taxes.

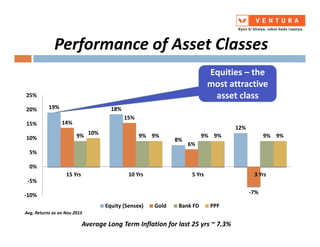

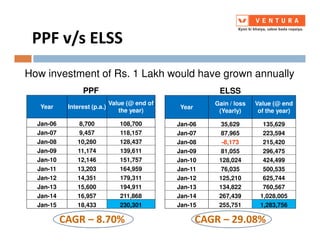

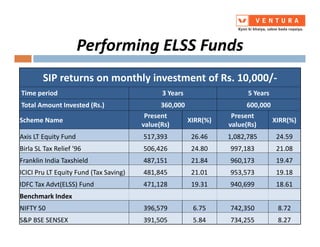

3) ELSS mutual funds are positioned as offering the highest potential returns compared to other 80C options like PPF and bank fixed deposits, while still providing tax benefits and a relatively low lock-in period of 3 years.