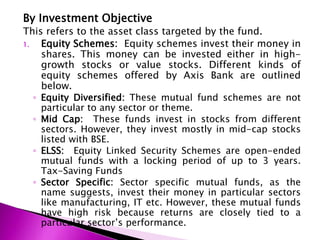

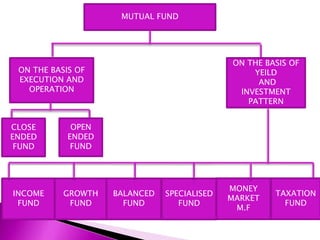

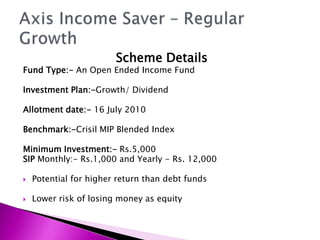

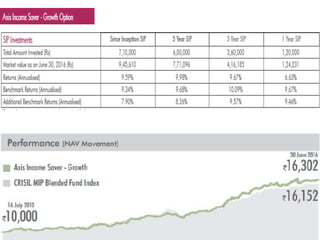

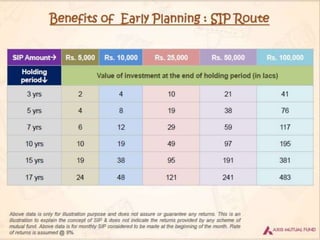

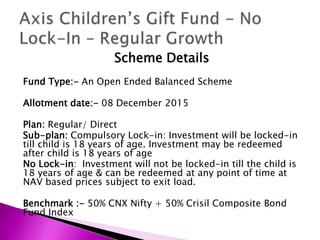

Axis Bank Limited is the third largest private sector bank in India, with approximately 43% of its shares owned by foreign investors and 34% owned by government entities. UTI Bank (which later became Axis Bank) was established in 1993 with its first branch opening in Ahmedabad. Axis Mutual Fund offers over 50 mutual fund schemes across different categories like equity, debt, hybrid, and more. Balanced or hybrid funds invest in both equities and fixed income securities to achieve a balance of growth and income. The Axis Triple Advantage Fund and Axis Income Saver Fund are examples of open-ended balanced mutual funds offered by Axis Mutual Fund.