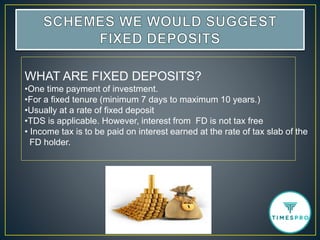

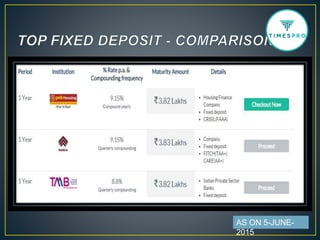

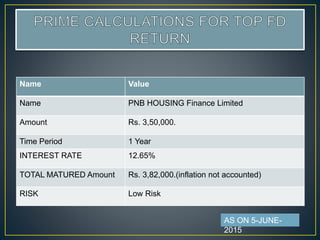

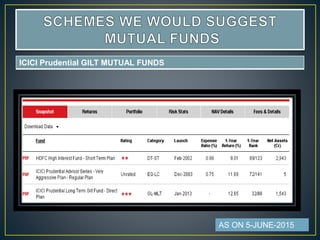

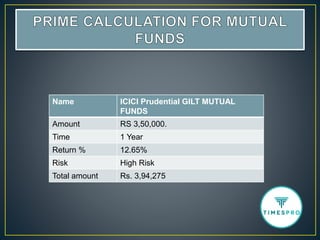

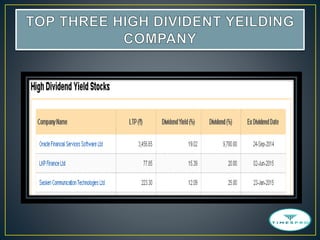

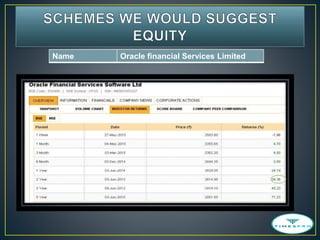

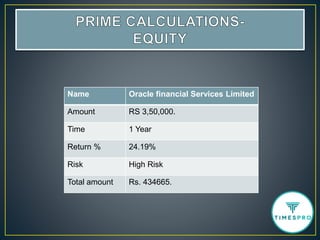

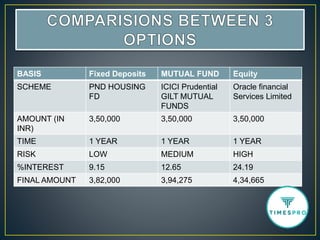

This document summarizes investment options for a client looking to invest Rs. 350,000 for one year with a high risk tolerance. It analyzes three potential investments: a fixed deposit, gilt mutual fund, and equity investment. It provides details on interest rates, risks, and projected returns for each option, with the equity investment in Oracle Financial Services Limited projecting the highest return of 24.19% despite also carrying the highest risk. The document recommends the equity investment option based on the client's risk profile and goal of seeking profit over safety of principal.