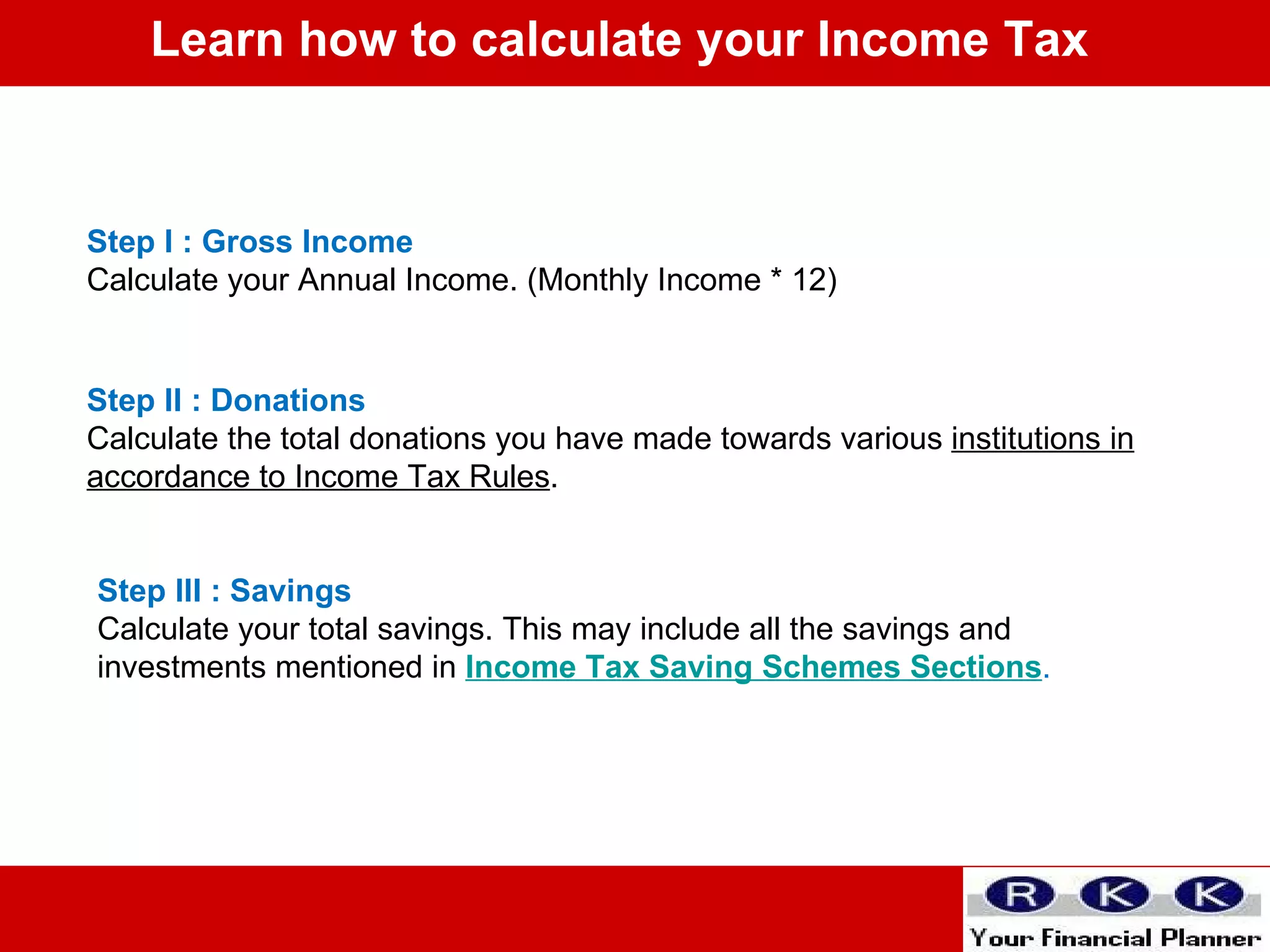

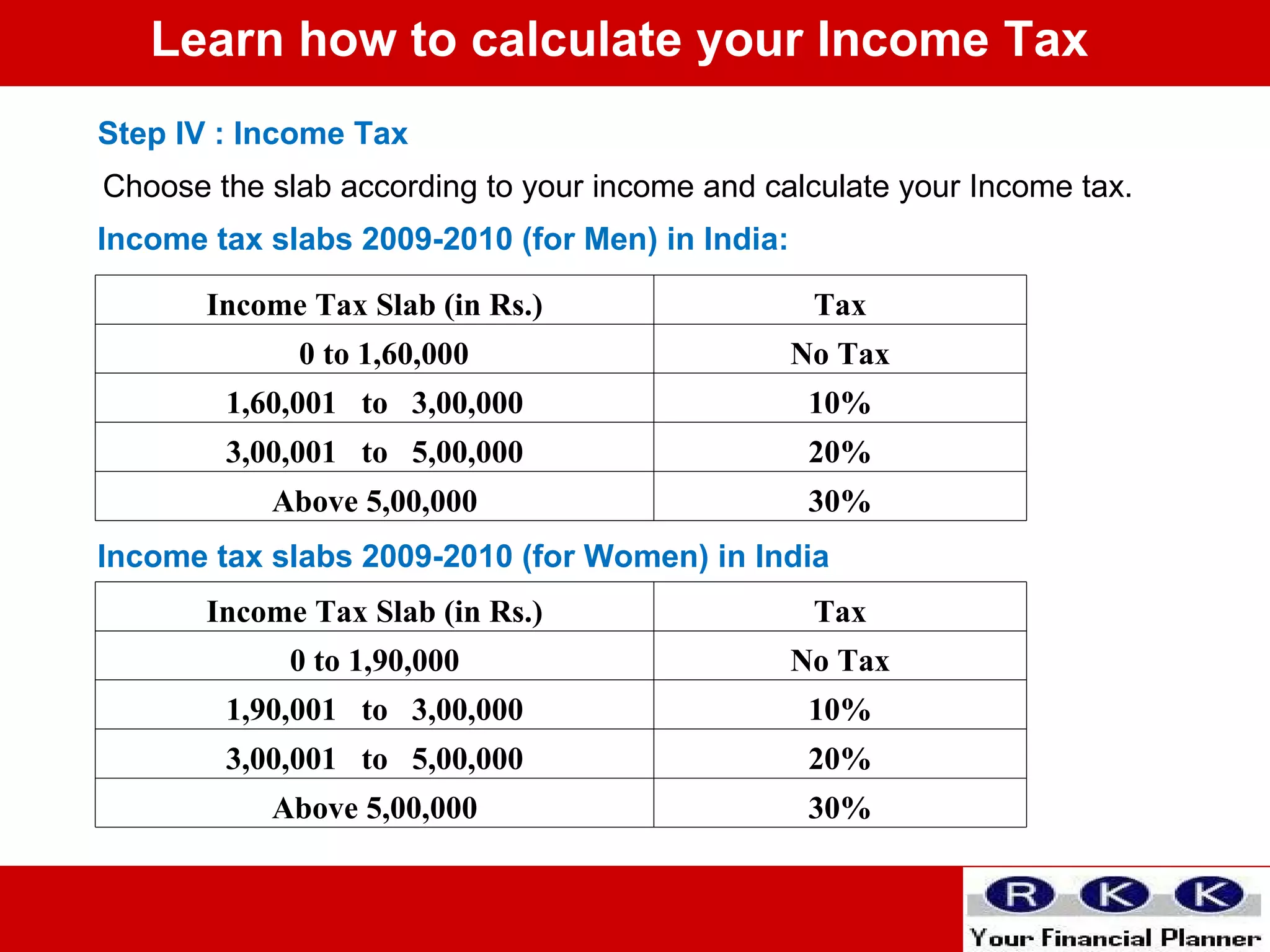

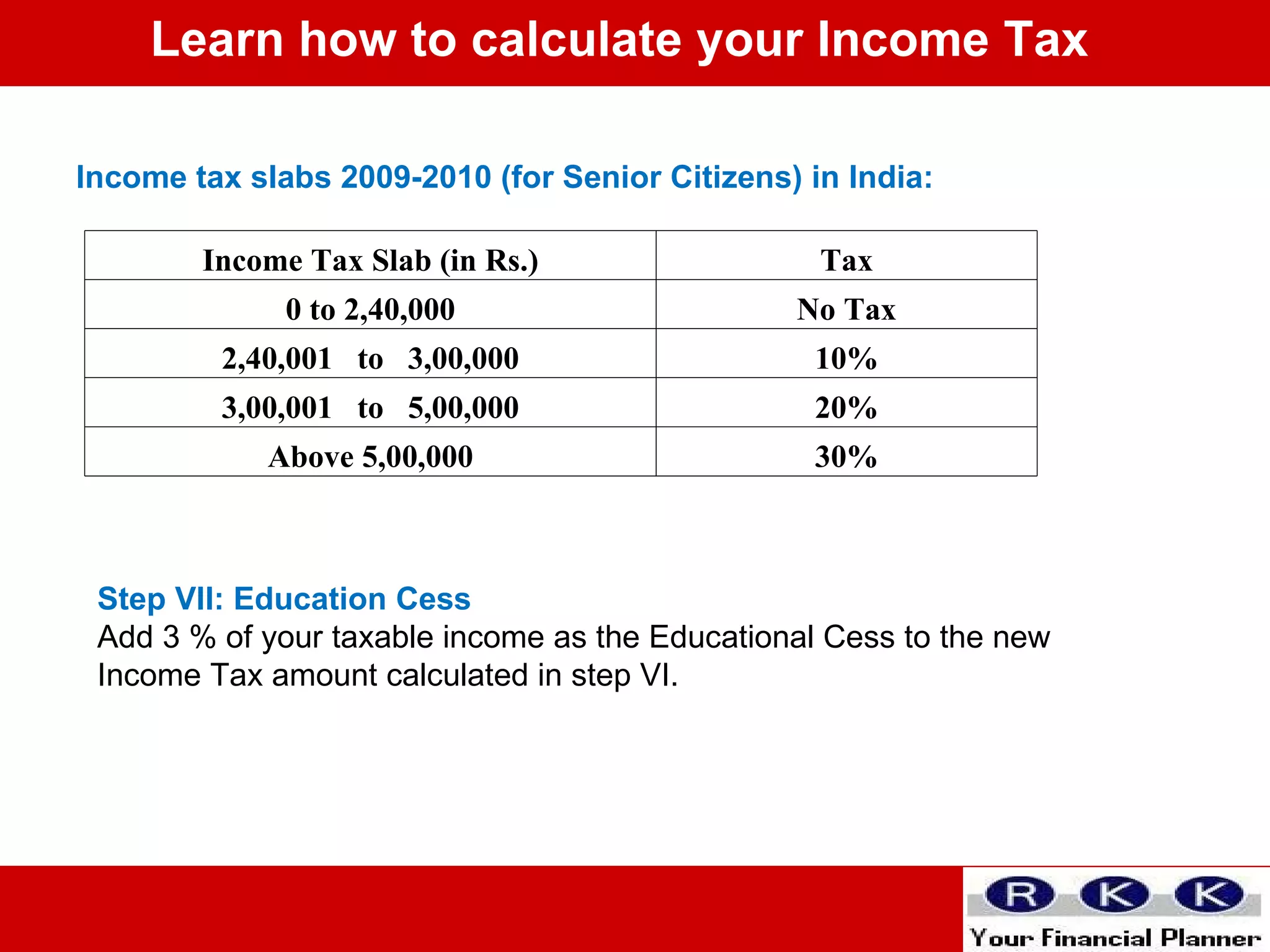

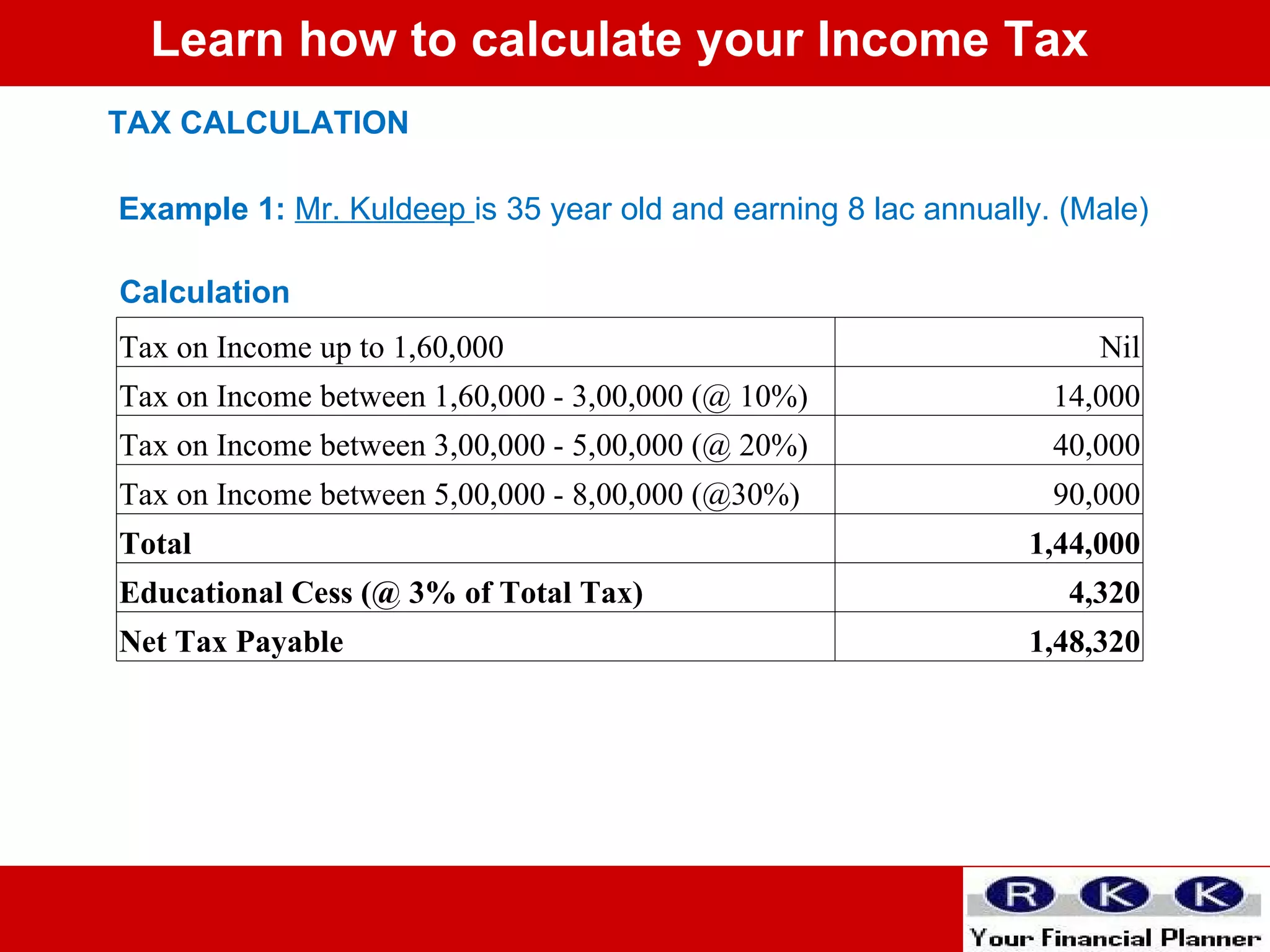

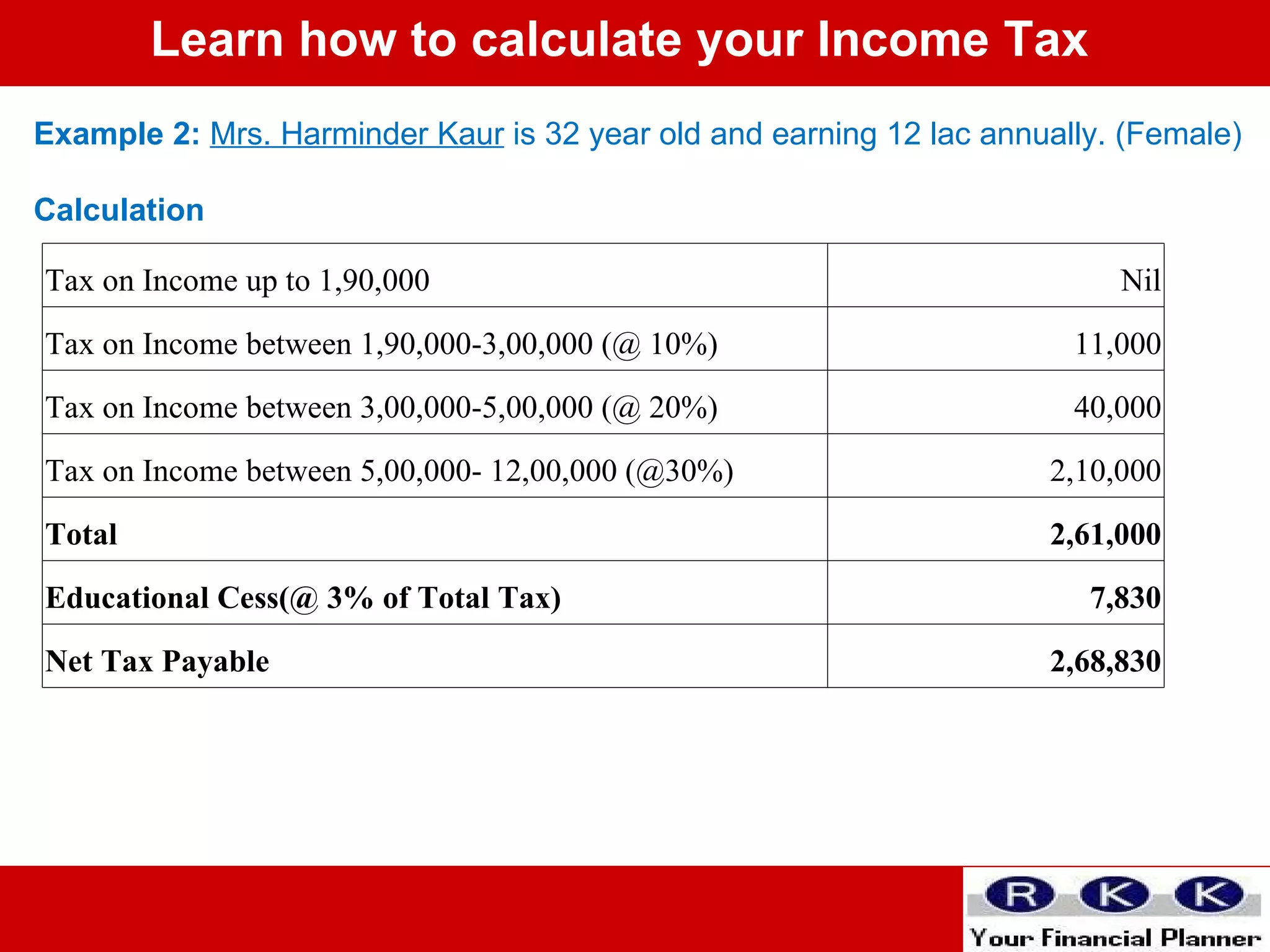

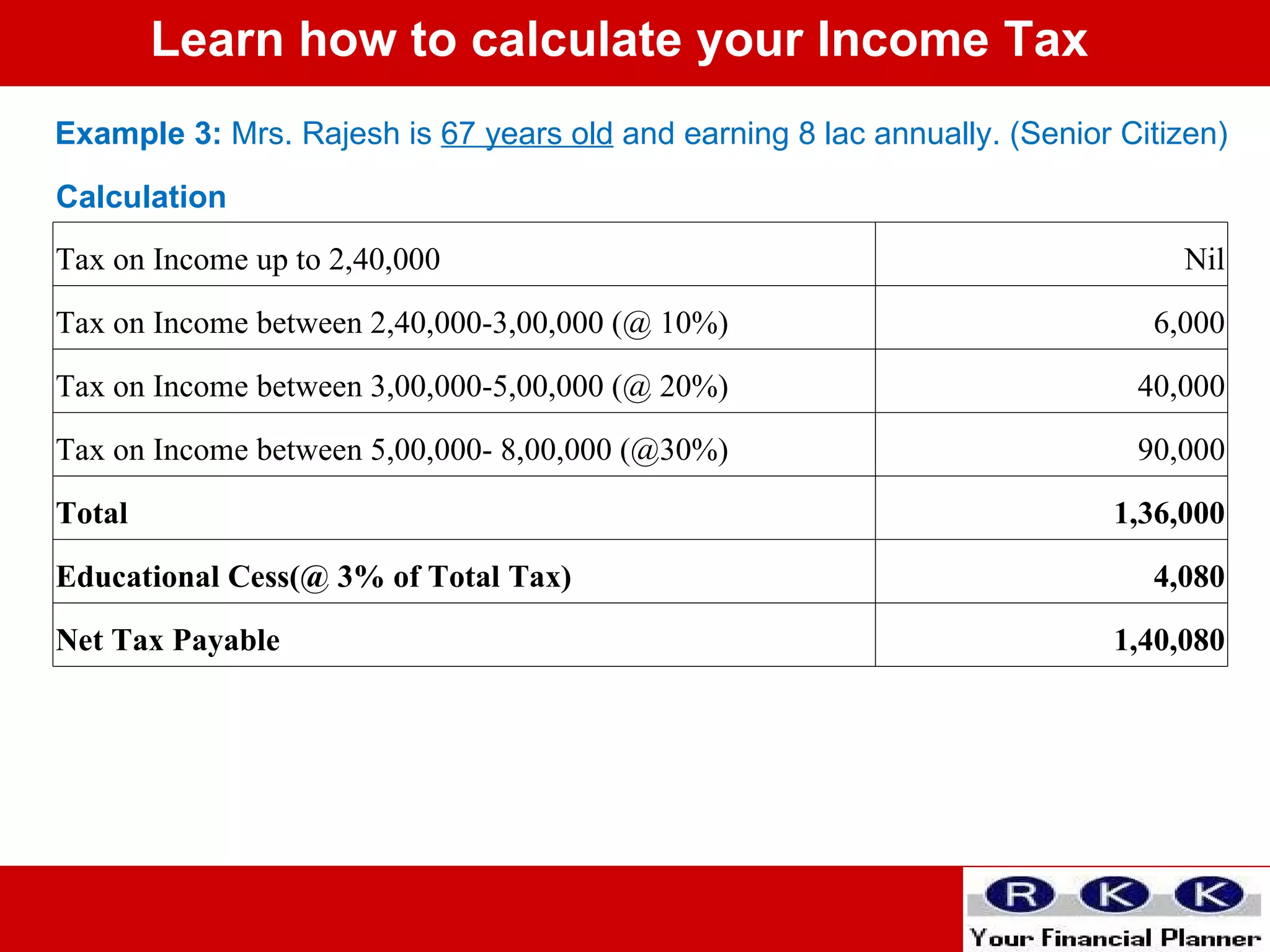

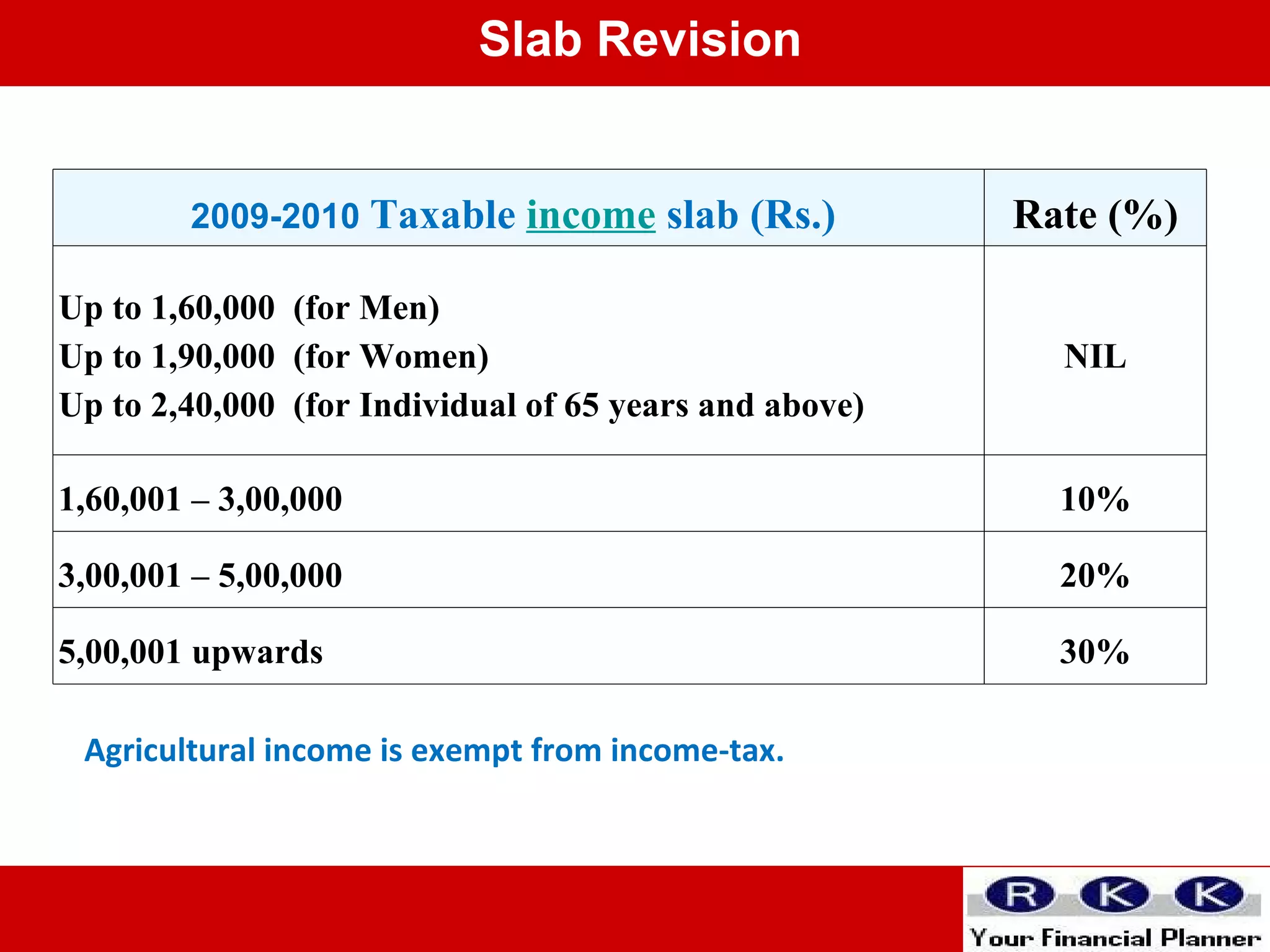

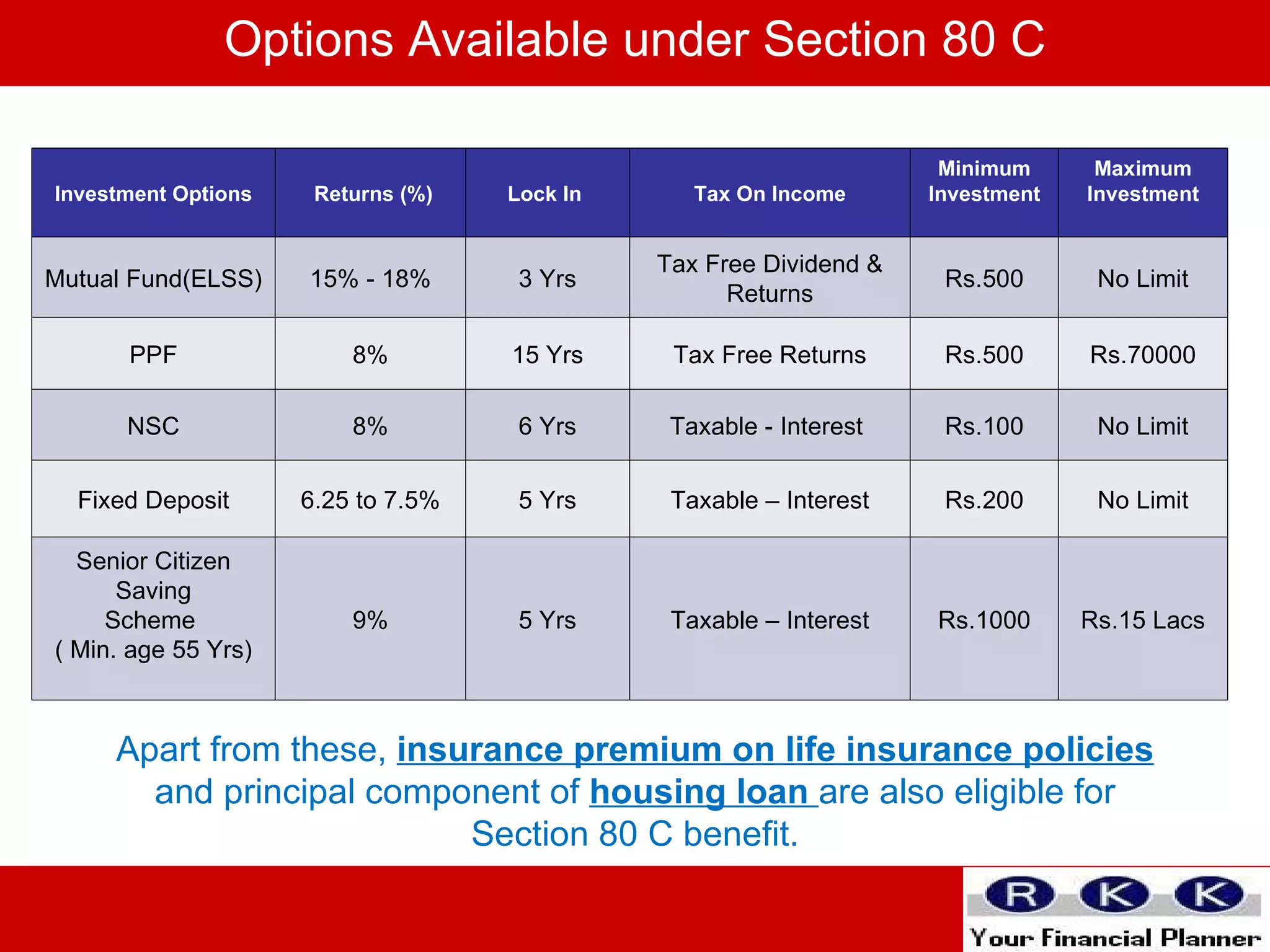

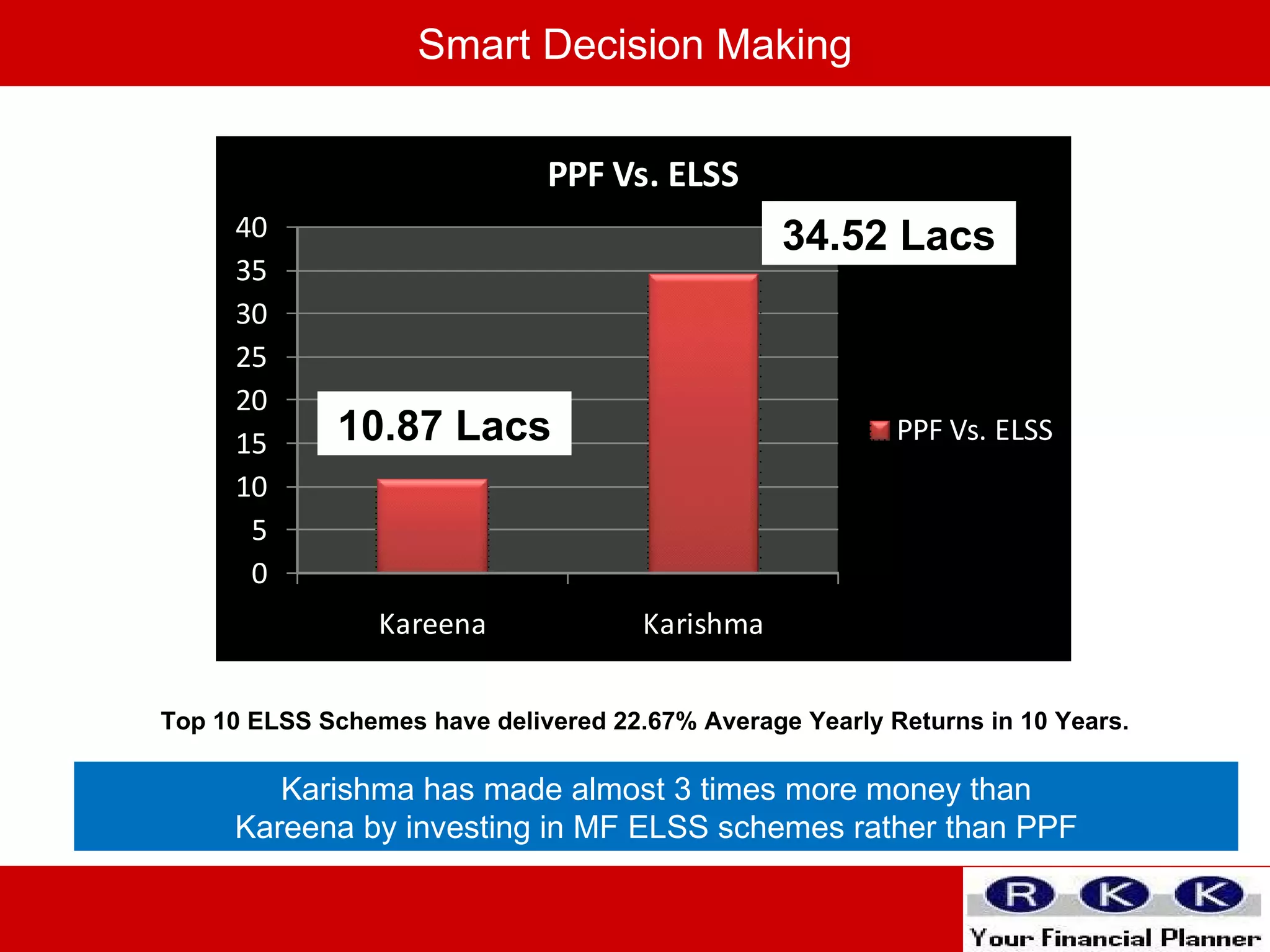

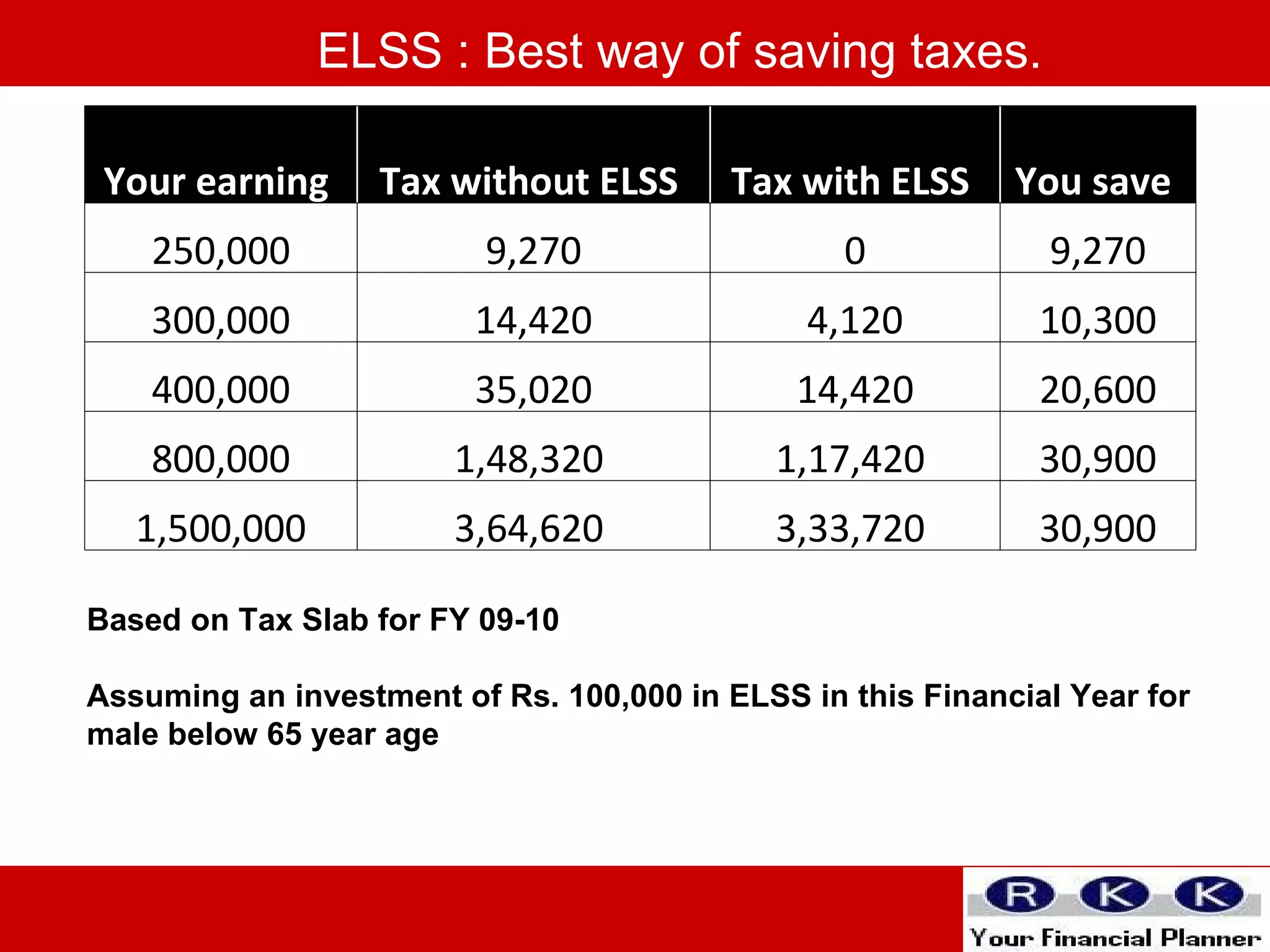

The document provides steps to calculate income tax in India. It explains how to calculate gross income, donations, savings, and tax amount based on income slabs. It provides examples of calculating tax for individuals with different incomes and age groups. It also discusses tax saving investment options under Section 80C like mutual funds, PPF, insurance etc. and their benefits over fixed returns.