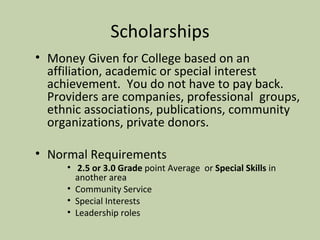

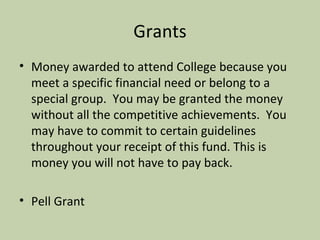

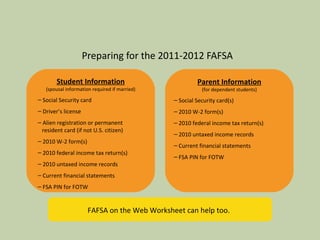

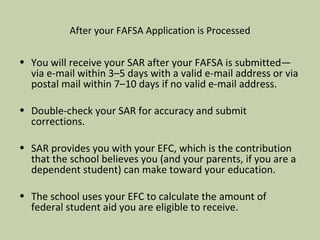

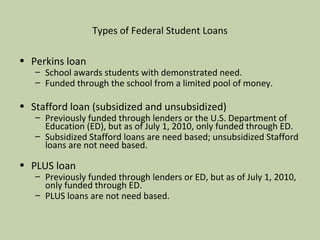

This document provides information on how to finance a college education, including through scholarships, grants, and loans. It discusses applying for scholarships based on academic merit, community service, or special skills/interests. It also describes grants that are awarded based on financial need or belonging to specific groups. Finally, it outlines the process for completing the FAFSA application to determine financial aid eligibility and explains the major types of federal student loans available.