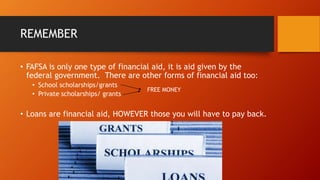

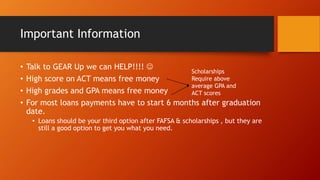

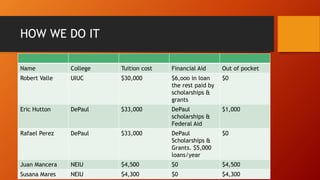

This document provides a 6-step guide to applying for financial aid through FAFSA. It emphasizes that FAFSA is the biggest source of financial aid and outlines the application process which includes getting a PIN, collecting tax documents, completing the application between January and June, reviewing the Student Aid Report, and comparing award letters from colleges. Additional information recommends applying for scholarships, speaking to the financial aid office with any questions, and explains that while loans must be repaid, they should be a third option for funding after grants and scholarships.