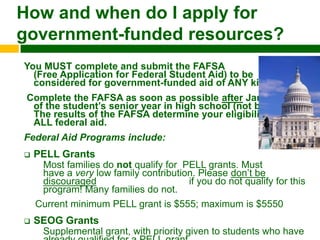

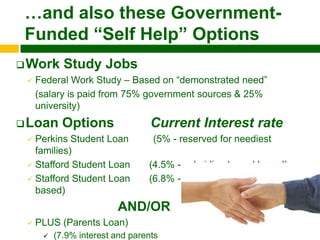

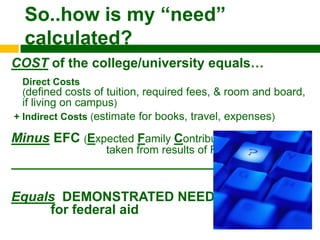

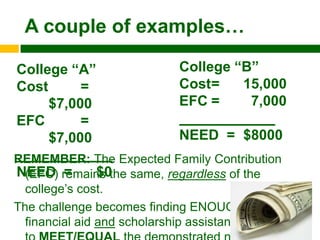

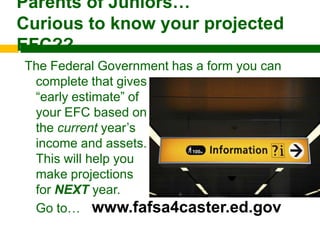

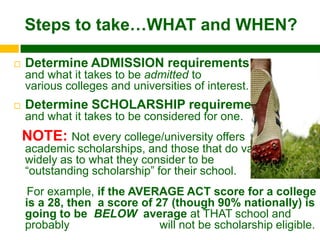

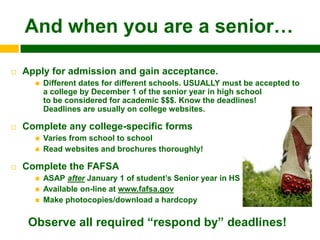

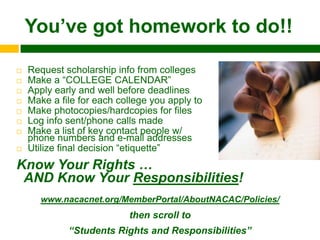

This document provides information to students on applying for financial aid and scholarships for college. It discusses timelines, acronyms, and expectations from colleges. Students learn about free online resources to search for scholarships and grants. The key steps are to complete the Free Application for Federal Student Aid (FAFSA) as early as possible after January 1st of senior year to be considered for federal aid, and to closely follow application deadlines and requirements for individual colleges and scholarships. Interviews and essays may also be required for competitive scholarships. Students are advised to stay organized and utilize available guidance resources and checklists.