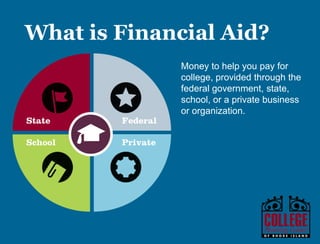

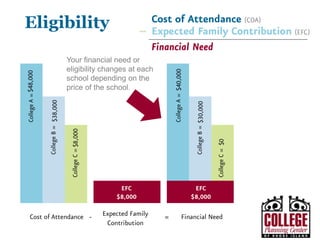

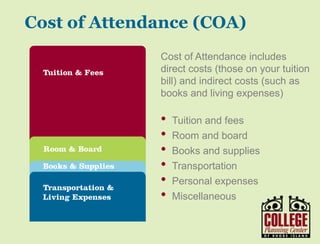

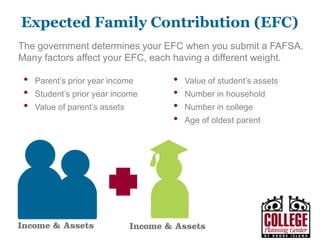

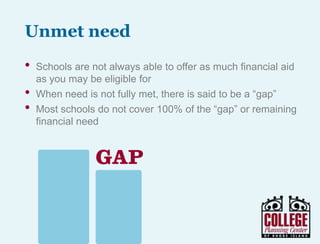

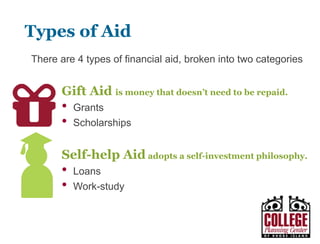

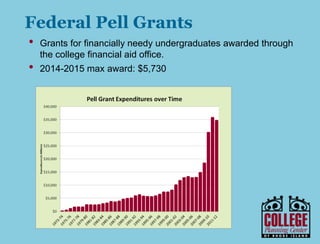

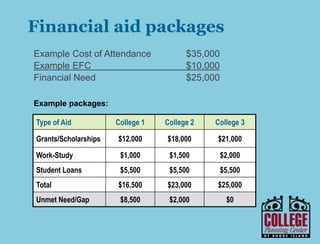

This document provides an overview of financial aid for college. It defines financial aid as assistance from the government, schools or private organizations to help pay for college costs. It explains that aid can be need-based, awarded based on financial need, or merit-based, awarded for talents or achievements. The document outlines the various types of financial aid available, including grants and scholarships that do not need to be repaid and loans that do require repayment. It provides details on applying for federal, state, institutional and private sources of financial aid.