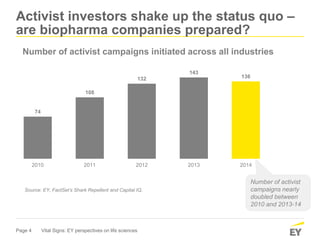

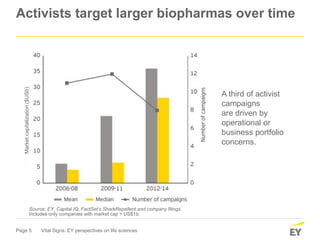

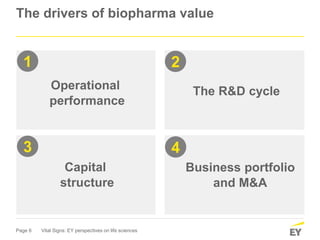

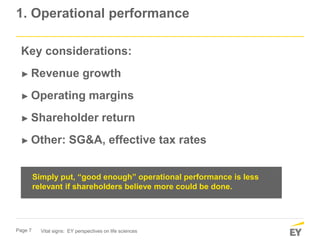

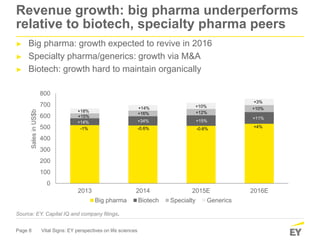

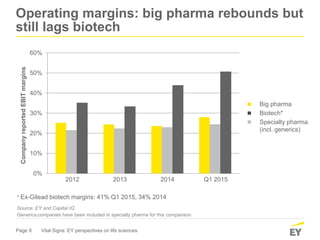

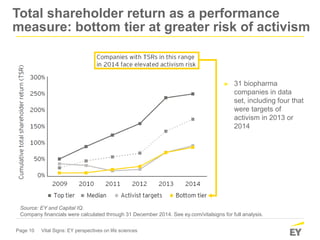

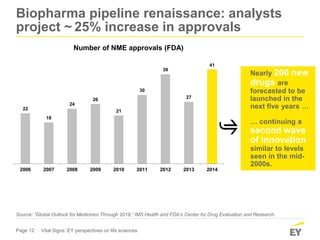

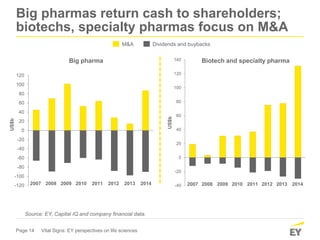

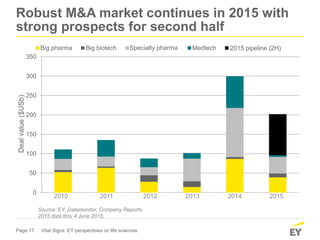

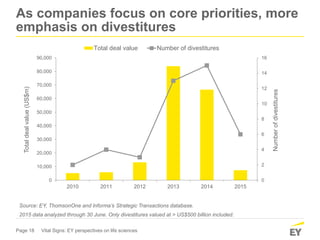

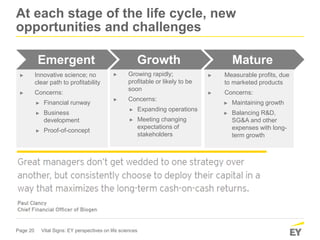

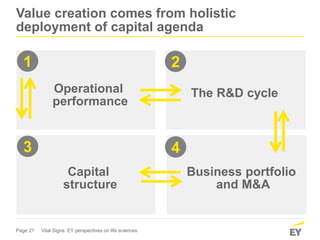

The document discusses the critical aspects of capital allocation strategies within the biopharma sector, emphasizing the importance of operational performance, R&D productivity, capital structure, and effective communication with investors. It highlights increasing activism among investors as a reaction to unsatisfactory performance, particularly in larger biopharma companies, and notes trends in mergers and acquisitions alongside the need for divestitures. The report suggests five strategic steps for firms to enhance their capital agendas and achieve long-term value creation.