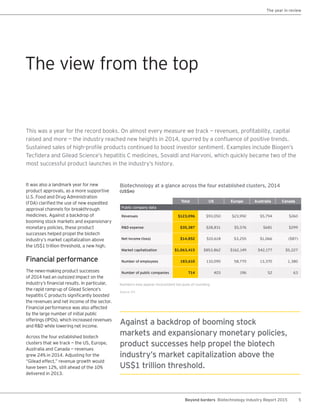

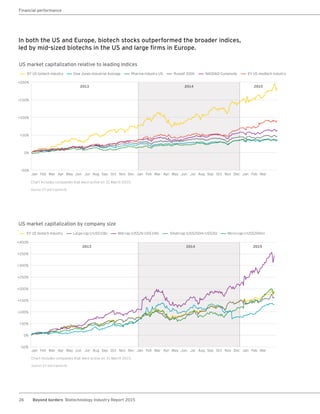

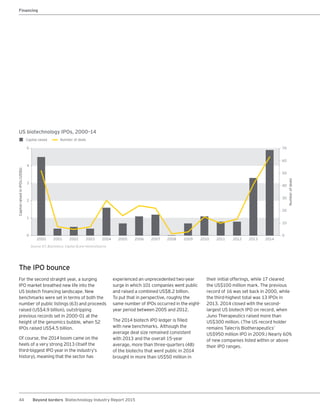

The biotechnology industry had an unprecedented year in 2014, reaching new highs in revenues, R&D spending, profits, financing amounts, and market capitalization. Strong product sales and approvals helped boost investor sentiment and company valuations. A surge in IPOs and follow-on financings provided the industry with historic levels of capital to fund innovation.