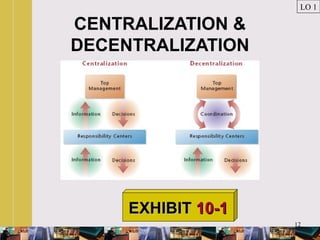

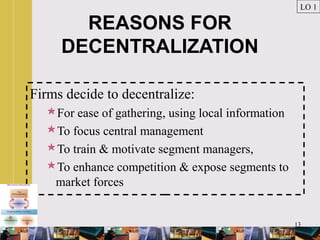

1. Firms choose to decentralize for several reasons, including ease of gathering local information, focusing central management, and motivating segment managers. This is achieved by creating divisions along lines such as type of goods, geography, or level of managerial responsibility.

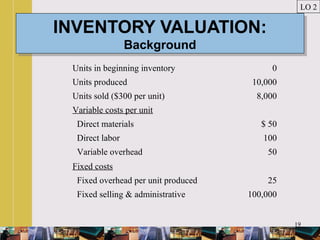

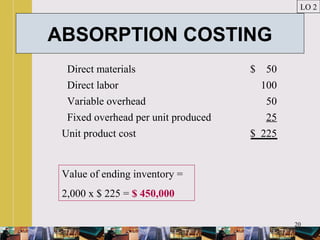

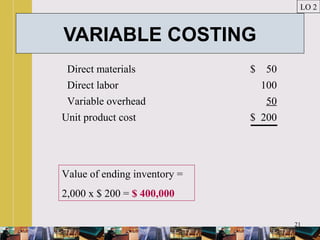

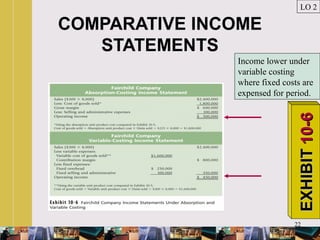

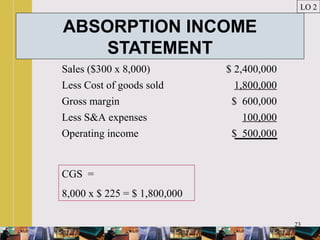

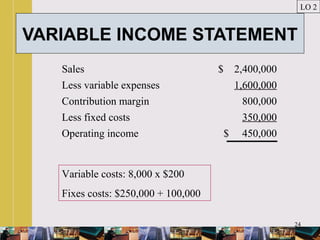

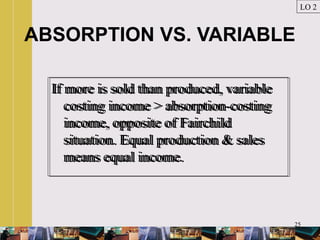

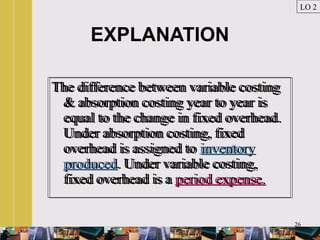

2. There are two main ways to calculate income - absorption costing and variable costing. Absorption costing assigns all costs including fixed overhead to inventory, while variable costing expenses fixed costs in the period. This affects performance evaluation as variable costing ensures a direct relationship between sales and income.

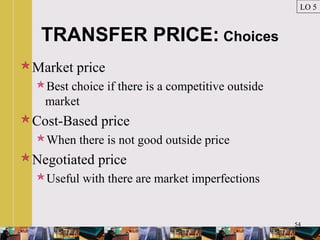

3. Transfer pricing is the price charged between divisions of the same company. It aims to set a price that is above the minimum to not disadvantage