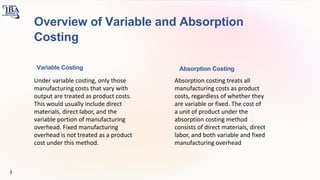

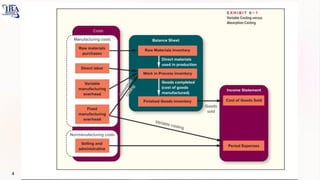

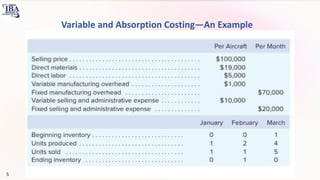

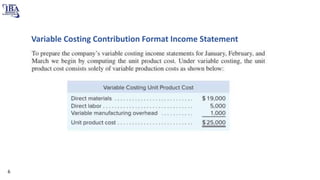

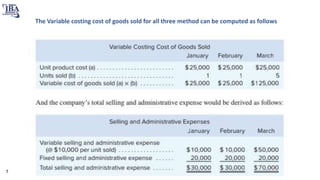

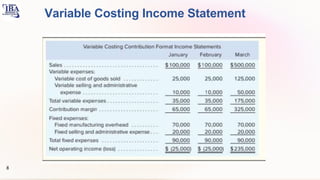

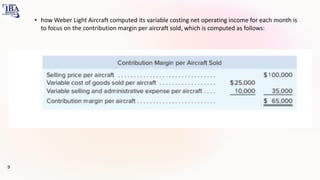

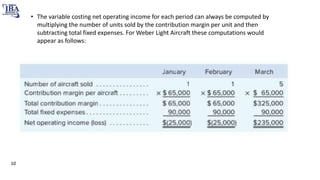

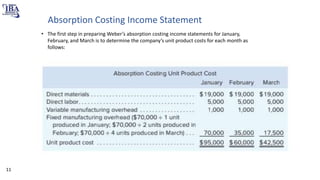

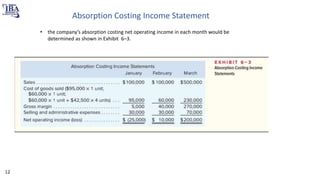

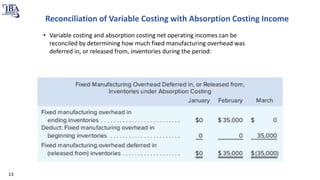

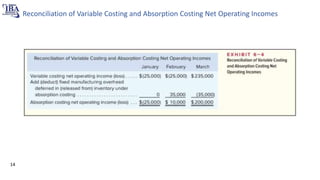

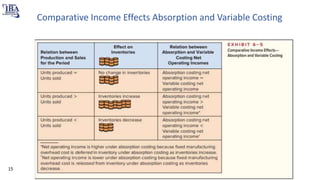

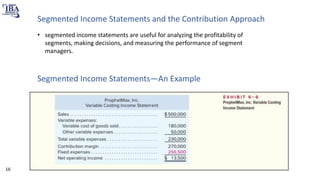

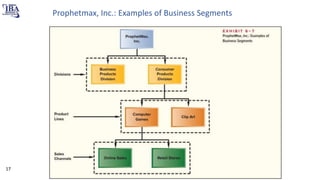

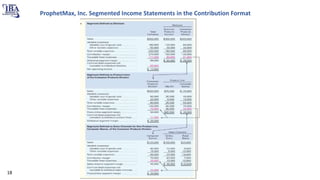

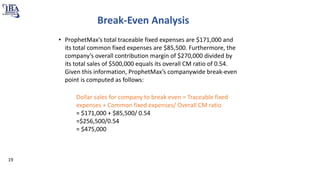

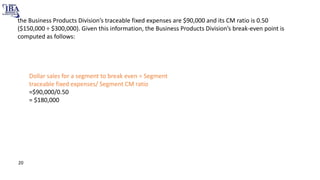

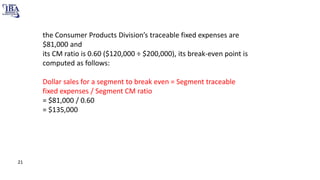

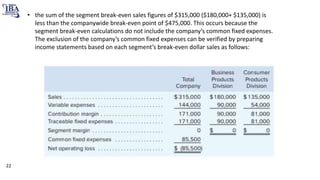

The document discusses variable and absorption costing methods in managerial accounting, highlighting key differences in handling costs and income statements. It includes topics like segmentation, contribution margins, and break-even analysis, illustrated through examples from a company named Prophetmax, Inc. Additionally, it provides insights on how to reconcile the two costing methods and prepare segmented income statements to assess profitability.