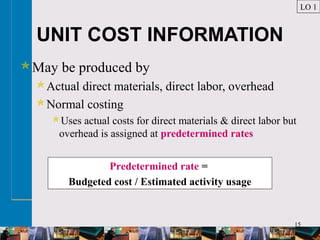

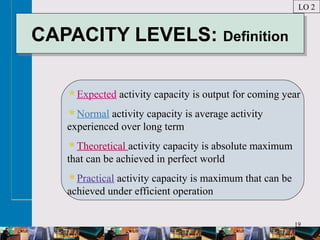

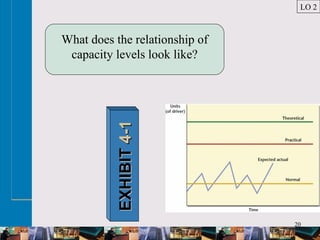

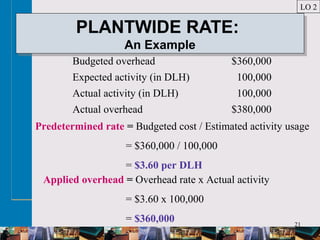

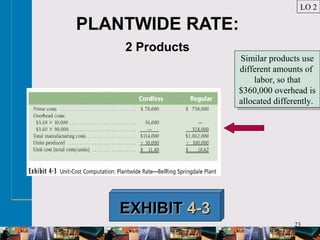

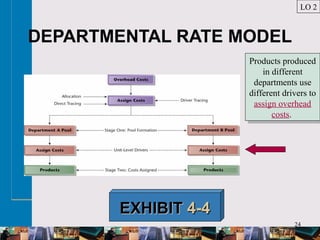

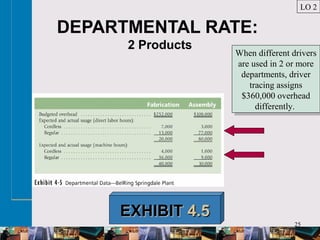

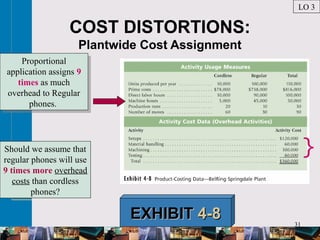

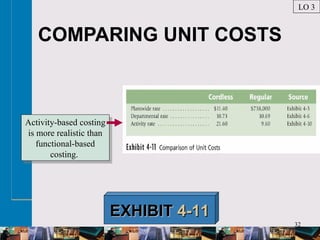

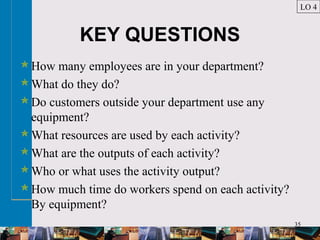

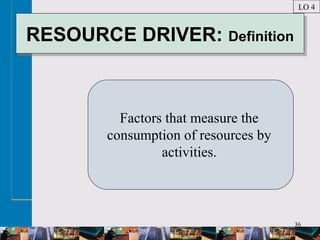

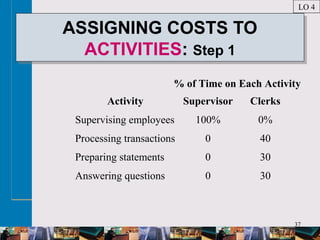

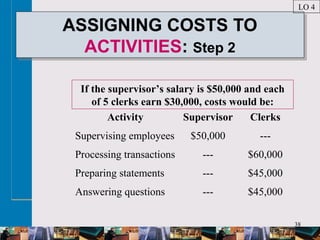

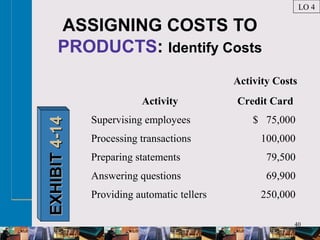

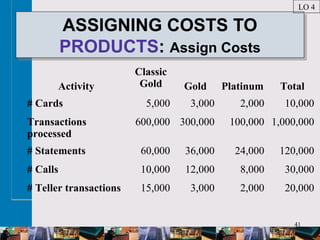

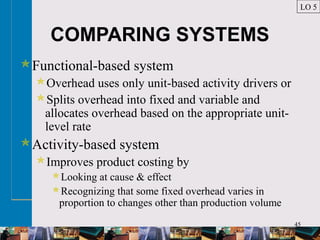

This document provides an overview of activity-based costing (ABC) systems for product costing. It begins by explaining the importance of calculating accurate unit costs and the limitations of traditional functional-based costing approaches. Specifically, functional-based costing can distort product costs when overhead is assigned proportionally, without considering different products' actual consumption of activities. The document then describes how ABC systems work to assign costs at the activity level before flowing them down to products based on each product's actual usage of activities. Finally, it notes that ABC systems can reduce complexity by using consumption ratios or approximating the full ABC method to reduce the number of activity rates.