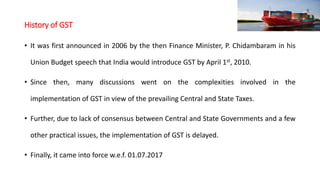

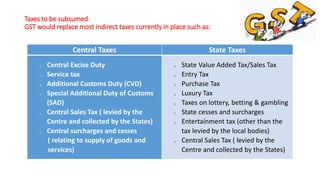

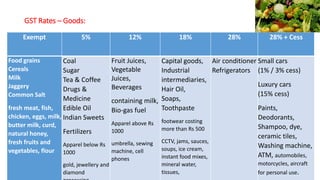

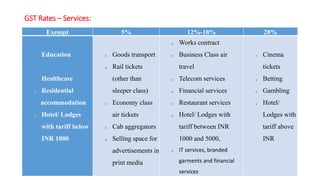

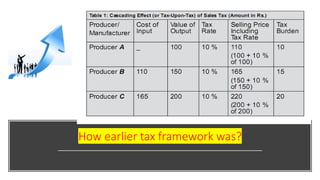

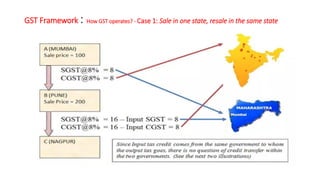

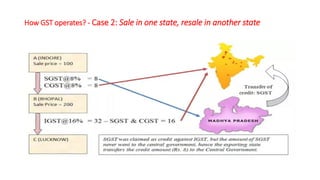

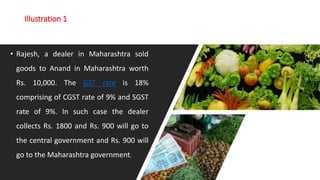

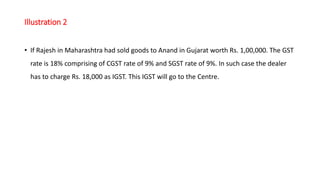

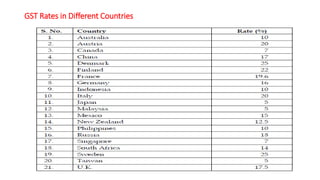

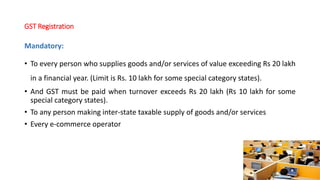

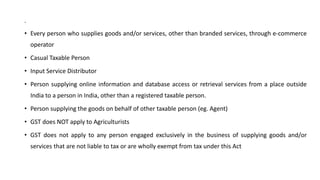

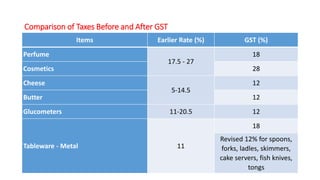

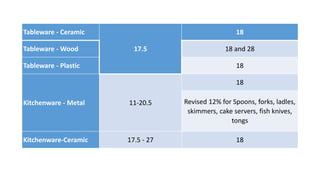

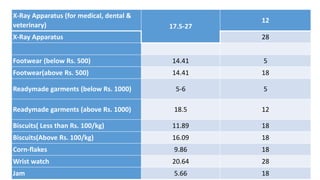

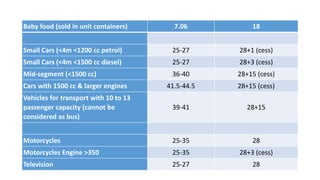

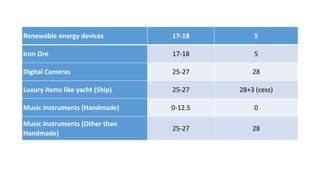

This document provides an overview of the Goods and Services Tax (GST) implemented in India in 2017. It discusses the history and objectives of GST, how it replaces previous indirect tax frameworks, applicable tax rates for goods and services, the registration process, and comparisons of taxes before and after GST. The impact on consumers is also addressed, noting some items may see reduced prices while the overall effect on monthly expenses depends on spending habits. Some challenges remain in fully implementing the new indirect tax system across India.