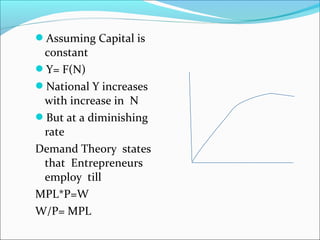

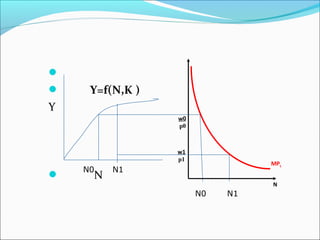

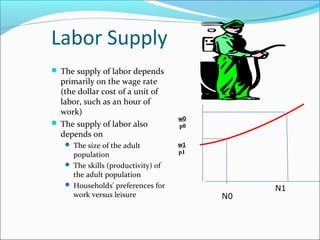

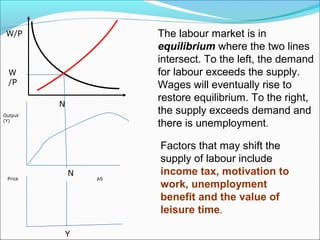

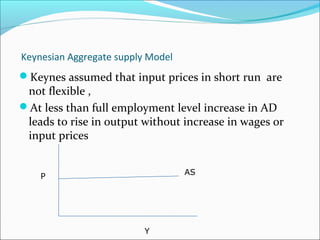

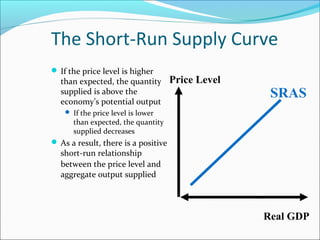

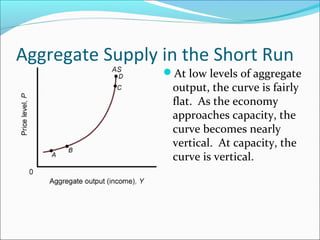

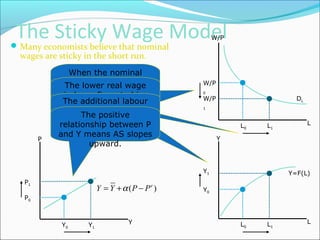

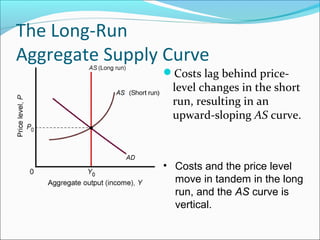

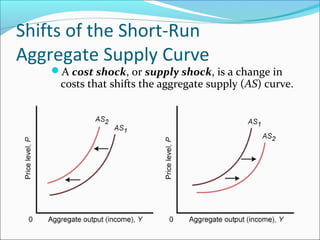

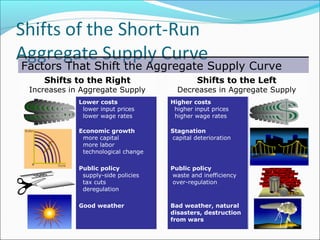

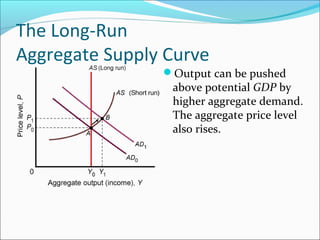

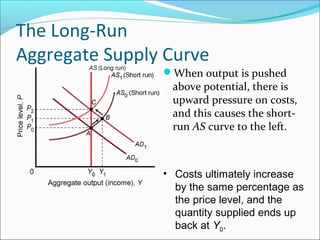

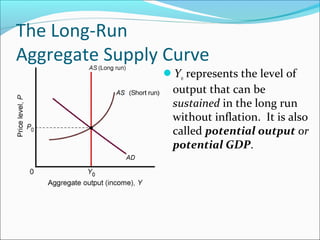

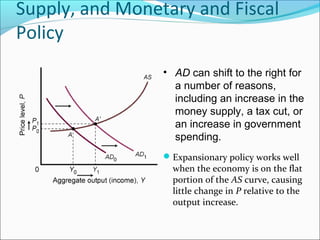

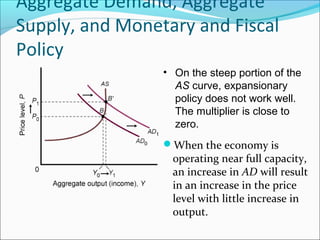

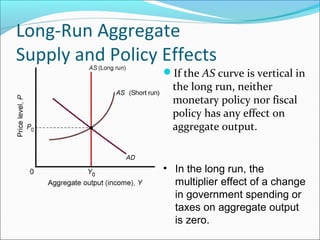

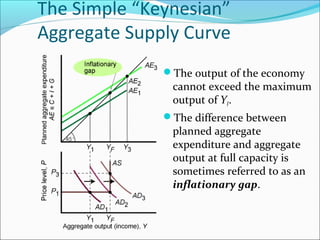

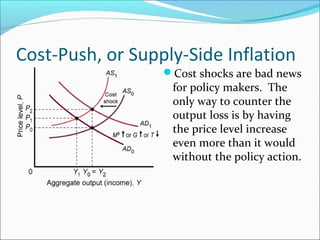

The document discusses aggregate supply, which is the relationship between the price level and the quantity of output firms are willing to supply. It examines aggregate supply from both short-run and long-run perspectives. In the short-run, aggregate supply is upward-sloping as input prices like wages are sticky. In the long-run, costs adjust fully to price level changes, making aggregate supply vertical. The aggregate supply curve can shift due to cost changes from factors like input prices, technology, or policies.