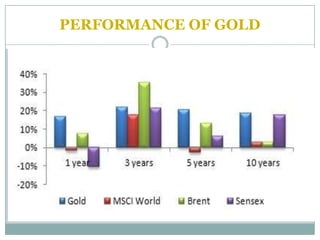

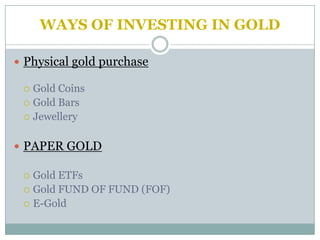

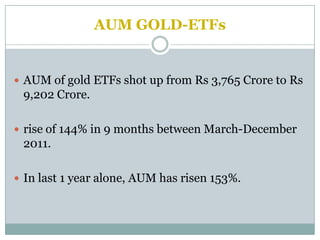

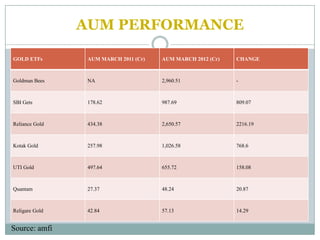

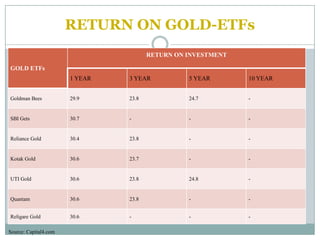

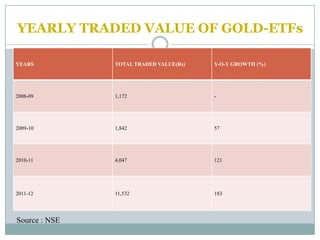

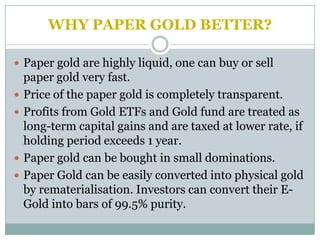

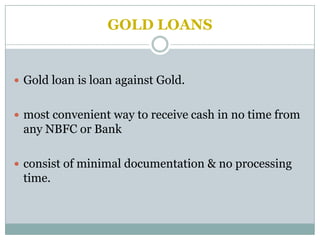

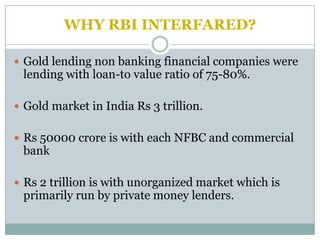

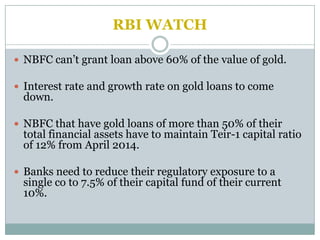

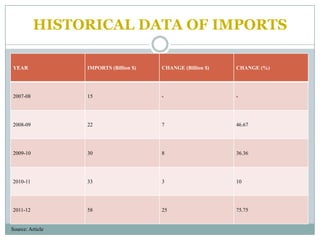

The document discusses gold as an investment in India. It states that gold is the most favored investment instrument in India as it provides steady returns, liquidity, and satisfaction to buyers. It also diversifies investment portfolios. The document then discusses various ways to invest in gold, including physical gold and paper gold like gold ETFs, funds, and e-gold. It provides details on the features and performance of these paper gold instruments. The document concludes by discussing historical gold import data in India and factors that could influence future gold prices.