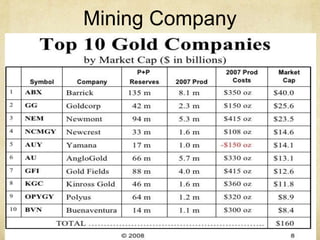

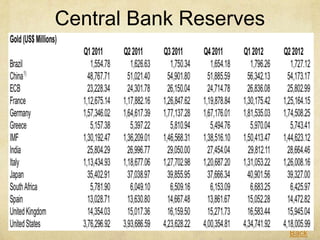

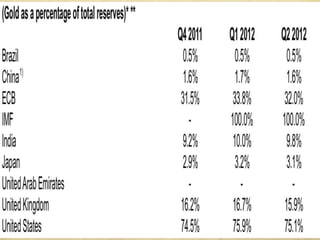

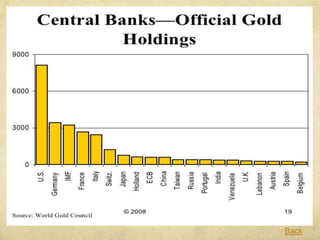

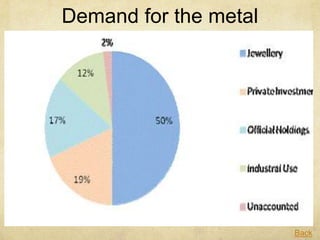

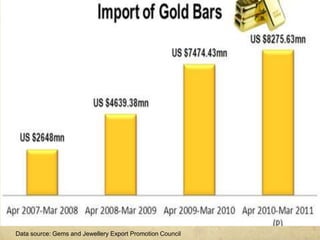

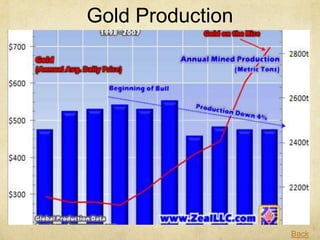

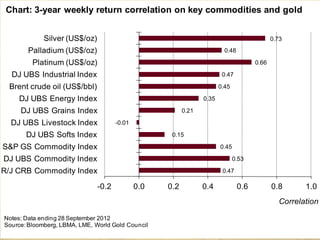

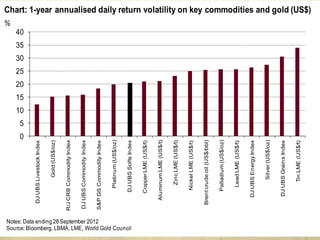

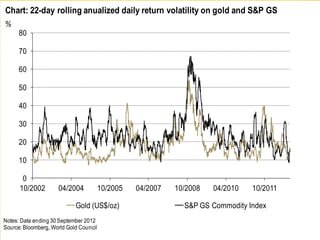

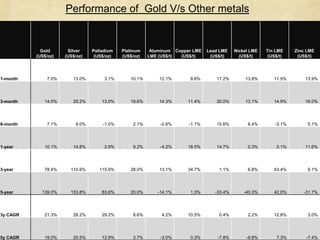

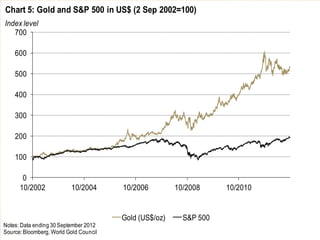

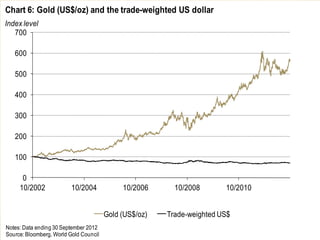

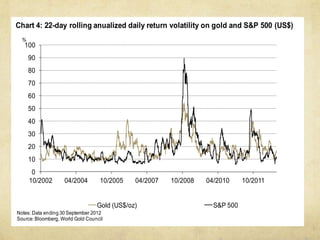

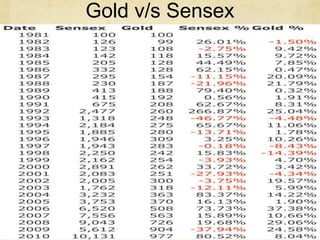

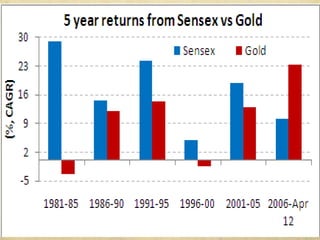

Gold can be invested in through various channels like bars, coins, accounts, exchange traded products, certificates, derivatives and mining companies. The price of gold is affected by factors like international prices, interest rates, dollar-rupee dynamics, central bank reserves and demand for the metal. Evaluating gold's performance over different time periods shows it has a low correlation with other commodities and assets like stocks, moving more independently based on its safe haven status.