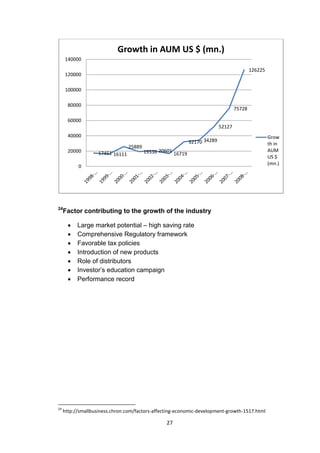

This document provides an overview of the mutual fund industry globally and in India. It discusses that mutual funds first originated in the United States in 1929 and have since grown to $12 trillion in assets globally by 2007, making them the largest financial investment vehicles. In India, the mutual fund industry was established in 1963 with the formation of Unit Trust of India. The industry has grown significantly since privatizing in 1993, and now has over 45 fund houses and approximately $20 billion in assets. The document outlines the key benefits of mutual funds for investors and discusses the continued growth potential of the industry in India.