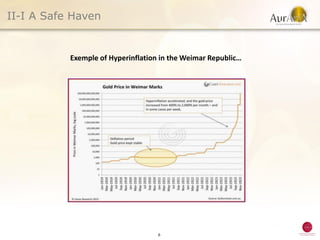

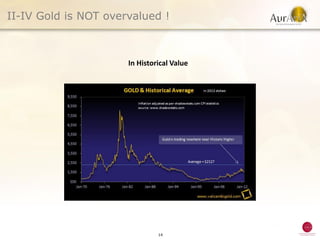

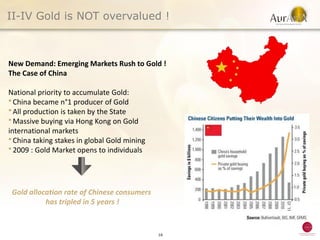

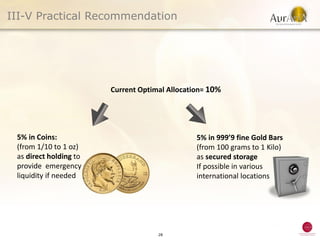

The document argues for gold as a safe and strategic investment, emphasizing its status as a tangible asset that provides protection against inflation, purchasing power loss, and various macroeconomic risks. Gold is presented as a low-correlation diversification asset with universal value that has historically proven its worth during financial crises. The author recommends an optimal allocation of 5-10% of one's total net worth in gold, particularly in physical forms, to enhance portfolio stability and guard against economic uncertainties.