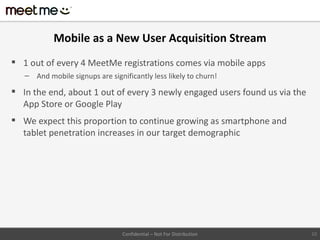

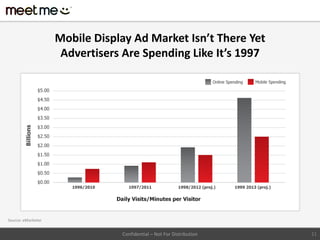

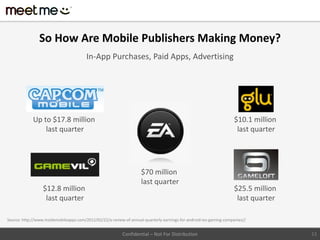

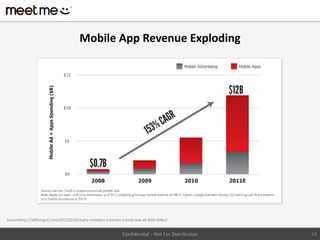

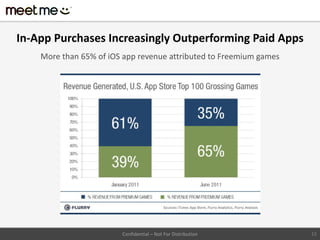

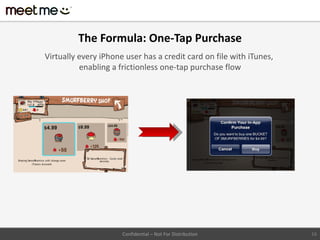

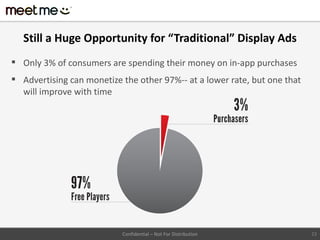

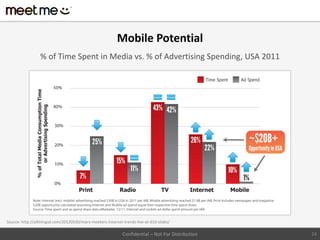

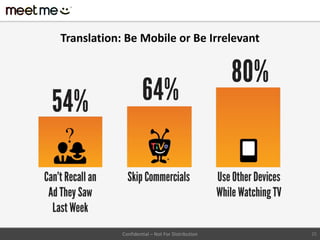

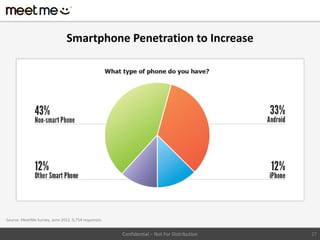

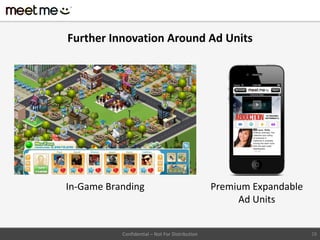

The document discusses opportunities and challenges around mobile monetization. It notes that while mobile usage is growing rapidly, mobile advertising revenues have not kept pace. It outlines how some mobile publishers are successfully monetizing through in-app purchases and incentivized video ads. It predicts that as smartphone penetration increases, payment options improve globally, and mobile advertising formats and targeting advance, the mobile monetization challenge will be solved.